7. Catalyst: The relationship between Apple Inc. (NASDAQ:AAPL) and mobile carriers still has plenty of room for improvement

For a long time, Apple did not need to establish strategic partnerships with mobile carriers in order to market its product successfully. The product was too good. That may not be the case with the iPhone 5. The upside is that Apple has never used this resource before, unlike Samsung, which sells devices through almost all of the world’s 800 carriers.

Here are the 2 big deals I am following:

– A deal with China Mobile Games & Entnmnt Grp Ltd (NASDAQ:CMGE), especially after news showed China Mobile is investing in 4G infrastructure. Remember that China Mobile is the biggest carrier in the world and that it is investing heavily in 4G network infrastructure this year. This deal could help Apple enormously!

– A deal with NTT Docomo in Japan.

8. Catalyst: Rumors of a budget iPhone are increasing.

Rumors are increasing in number! And I’m not only talking about Twitter sentiment here. Professional equity researchers from investment banks are also predicting a future budget device. First, JPMorgan. And now, Morgan Stanley. According to Appinsider:

On a recent trip to visit with tech suppliers in Asia, Morgan Stanley’s Katy Huberty received word that multiple new iPhone models will begin production the June-July timeframe.

Apple’s new handsets are likely to launch around September, the analyst believes, based on her meetings in Hong Kong and Taiwan. The information aligns with a separate report published on Tuesday that claimed Sharp would begin mass production of so-called “iPhone 5S” LCD displays in June.

We can’t be sure at this moment, but the probability of seeing a mini iPhone is going up. If somebody knows about this, that would probably be Foxconn or other component supplier.

9. There is no evidence that the absence of Steve Jobs has a negative effect on the stock price

Jobs was a genius: he had an amazing vision, as well as a strong business sense (the decision of releasing the iPhone before the iPad is worth billions). Without Jobs, Apple Inc. (NASDAQ:AAPL) could have lost much of its vision and innovation muscle.

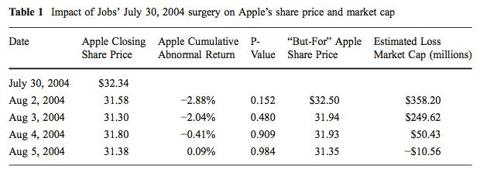

There is, however, an important paper written by James Koch et. al. about this point. In “Do Investors Care If Steve Jobs Is Healthy?”, the authors use conventional event study methods to test the magnitude of announcements regarding the health of Jobs on Apple’s share price and market cap. They use information from media observers, stock analysts and bloggers, between 2004 and 2009.

The result: and market capitalization, but that impact is not always negative and not nearly as large as many observers apparently believe. To confirm this, look at how close to 1 the p-values are in the next table of events concerning Job’s health in 2004:

Coming soon

– Apple Is not Another Computer Company: Part 3 – 1 Very Important Reason to be a Bear

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Apple. The Motley Fool owns shares of Apple.

The article Apple Is Not Another Computer Company: Part 2 originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.