It has been a rough 2013 for Apple investors. While the Dow Jones Industrial Average has climbed 12.60%, Apple Inc. (NASDAQ:AAPL) has declined -24.48%. The 2013 year has been marked with a disappointing earnings report, an apparent lack of innovation, and a flurry of analyst downgrades, all of which have contributed to the share price seen today. With the company trading at levels not seen since 2011, is it finally the right time for investors to take a bite out of Apple?

Core Business Fundamentals

What?

Apple Inc. (NASDAQ:AAPL) “designs, manufactures and markets mobile communication and media devices, personal computers, and portable digital music players, and sells a variety of related software, services, peripherals, networking solutions, and third-party digital content and applications.” The company’s product portfolio includes the iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings.

In 2012, the iPhone segment accounted for 51.41% of overall revenue, iPad segment represented 20.72% of overall inflow, the Mac segment translated into 14.84% of overall revenue, and the remaining 13.03% was allocated in the music related products and services, iPod, software, and peripheral segments.

How?

“Apple Inc. (NASDAQ:AAPL) sells and delivers digital content and applications through the iTunes Store, App Store, iBookstore, and Mac App Store. The company sells its products worldwide through its retail stores, online stores, and direct sales force, as well as through third-party cellular network carriers, wholesalers, retailers, and value-added resellers.”

Where?

The geographical breakdown of the company’s revenue in 2012 was split 38.95% United States, 14.56% China, and 46.49% other countries.

Profitability Metrics

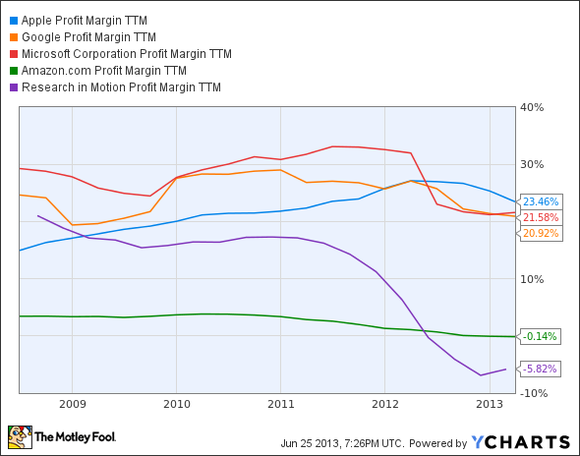

All of the company’s profitability metrics (TTM profit margin, return on equity, return on assets) are relatively strong and in the double digits, however these percentages have been sharply declining since the beginning of 2012 and are projected to continue to decline through 2017 as increased competition and rising costs tighten the company’s profit.

TTM profit margin “Measures how much out of every dollar of sales a company actually keeps in earnings” (Source: Investopedia).

With the largest profit margin in the industry, Apple Inc. (NASDAQ:AAPL) is able to retain more revenue as earnings, a crucial advantage. The company’s immense brand loyalty and pricing power has allowed the company to grow its profit margin over the past set of years, however projections display the margin faltering as competition mounts, which could lead to slight earnings deterioration by 2017.

Risk Assessment

The risk associated with Apple Inc. (NASDAQ:AAPL) as an investment can be classified as high, as they operate in an ever-evolving market for technological products in which consumer’s desires are constantly changing. The potential slowed pace of innovation stemming from the alteration in the company’s management after the death of the legendary founder, Steve Jobs, also contributes to this risk assessment.

Valuation

Presently, Apple possesses a price to earnings ratio of 9.65 and a price to book ratio of 2.80, both of which are five year lows for the company.

Considering that revenue is anticipated to grow at a high single-digit rate through 2017 and that earnings are projected to grow at a mid-single digit rate until 2015, and then reverse course and decline to the current levels by 2017, the valuation of Apple is severely depreciated. As the S&P 500 currently carries a price to earnings ratio of 16.15 and a price to book ratio of 2.27, and the estimated rate of growth of the S&P 500 is subpar in terms of revenue and in-line in terms of earnings compared to that projected for Apple, Apple’s valuation can only be classified as undervalued. If Apple was awarded the same price to earnings ratio as the S&P 500, the price of a share would rise to $676, representing approximately 69% upside from current levels.

| AAPL | GOOG | MSFT | AMZN | BBRY | S&P 500 | |

|---|---|---|---|---|---|---|

| Price/Earnings Ratio | 9.60 | 25.36 | 17.24 | 3430.72 | ~ | 16.15 |

| Price/Book Ratio | 2.78 | 3.80 | 3.66 | 14.69 | 0.80 | 2.27 |

Balance Sheet

As of the second quarter of 2013, Apple possessed $144.69 billion of cash and cash equivalents and $4.3 billion of total debt, resulting in a net cash position of $140.39 billion, or roughly $149.33 per share. The financial strength the company possesses allows the company to pay out its 3.03% dividend yield and allowed the company to initiate its $60 billion share repurchase program recently.

Expanding upon the dividend, with a payout ratio of only 29.12% Apple can retain the majority of its earnings to finance the products of tomorrow (TTM Research & Development Spending: $3.91 billion).

Industry & Competitors

The handset, tablet, computer, and media player markets (all of which Apple competes in) are constantly evolving, with persistent innovation required for companies to remain relevant and popular. The ability of Apple to control all aspects of its product has long distinguished the company’s products from others, however recent offerings have been criticized for falling behind the competition (example: offering the larger screen size on the iPhone after Samsung had). The industries Apple operates in are among the most competitive in the world, with many of the largest companies in the world being concentrated in these waters. Major competitors include Google Inc (NASDAQ:GOOG), Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN), and Research In Motion Ltd (NASDAQ:BBRY) BlackBerry.

Google’s Android operating system has long competed with Apple’ iOS for the spot as the premier smartphone operating system in the world. Additionally, many of the services Google Inc (NASDAQ:GOOG) offers rival those presented to Apple device users, as both companies attempt to lock consumers into their ecosystems.

Microsoft Corporation (NASDAQ:MSFT) competes most directly with Apple in the computer industry, as their Windows operating system rivals Apple’s OS X operating system. Additionally, Microsoft has recently partnered with Nokia Corporation (ADR) (NYSE:NOK) to begin producing smartphones, and the company recently entered the smartphone market.

Amazon’s Kindle Fire tablets have posed a serious threat to Apple’s iPad segment, and the success of the Kindle Fire prompted Apple to launch the iPad Mini. While Amazon.com, Inc. (NASDAQ:AMZN)’s core business is concentrated in the online retail sector, Amazon’s tablets, cloud services, and future products will compete with Apple.

Research In Motion Ltd (NASDAQ:BBRY) BlackBerry’s signature brand has been revived by the company, with the launch of the Z10; however, Blackberry has yet to make a sizable mark on the smartphone industry of today.

Looking Into the Future

After the passing of Steve Jobs, questions have been raised as to whether the company has lost its innovative touch, which has allowed Apple to revolutionize industry after industry. However, several opportunities are presented to the company to take advantage of in the future and products are rumored to be in the company’s pipeline. Apple recently released its radio streaming service, presenting a Pandora Media Inc (NYSE:P)-like alternative. Furthermore, an iWatch is slated to be released later this year, and while myself and many analysts do not expect this to be a major product, projections place this “smartwatch” as creating as much as $6 billion in revenue. The largest product in the company’s pipeline is the iTV, which is rumored to be a product that would revolutionize the television market. Television is one of the final industries Steve Jobs was attempting to revolutionize before his death, and expectations are sky-high for this particular product. Moreover, a cheaper version of the iPhone for emerging markets is anticipated, and would threaten Android’s dominant presence in emerging markets.

Analyst projections place revenue growth in the mid-single digit up to 2017, and earnings growth is projected to be in the low single digits until 2015, then reverse course and descend to current levels by 2017.

The Foolish Bottom Line

Apple’s decline from its $700 peak may have been warranted, however currently the stock sits at depressed levels. The culmination of the company’s depressed valuation, bulletproof balance sheet, strong pipeline, and leading market position should support the stock’s bottoming process at levels around $400, and fuel its climb higher as new products are released. All in all, at current prices Apple earnings five out of five stars, and is a screaming buy.

Ryan Guenette owns shares of Apple. The Motley Fool recommends Amazon.com, Apple, and Google. The Motley Fool owns shares of Amazon.com, Apple, Google, and Microsoft.

The article Is it Finally the Right Time to Take a Bite out of This Tech Titan? originally appeared on Fool.com and is written by Ryan Guenette.

Ryan is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.