Toronto-based Trapeze Asset Management says Apple Inc. (NASDAQ:AAPL) is 14% overvalued according to its proprietary valuation models. Pfizer Inc. (NYSE:PFE) and Procter & Gamble Co (NYSE:PG) are also overvalued stocks according to the Canadian firm, whereas Microsoft Corporation (NASDAD:MSFT) and JP Morgan Chase (NYSE:JPM) are among the cheapest blue chip stocks. Overall, the S&P 500 index is 16% overvalued.

We have recently seen a copy of $25 billion activist hedge fund Elliott Management’s investor letter and billionaire Paul Singer also seems extremely concerned about the stock market in general.

“Global stock prices at current levels cannot possibly reflect the best analysis of millions of investors regarding the prospects of private-sector corporate profits. Similarly, current prices of long-term bonds are reductio ad absurdum and beyondum, since they did not provide potential of a fair return on fixed income obligations of long duration after almost any expected (or unexpected) inflation is taken into account. Rather, today’s trading levels of stocks and bonds reflect “thumb on the scale” valuations driven by continued and massive government asset purchases and zero percent (or lower!) short-term policy rates, as well as an essentially unlimited tolerance for risk on the part of large segments of the international investing community, including risks that they do not even know exist,” Paul Singer said in the investor letter, dated January 30th.

The biggest uncertainty in Singer’s eyes is the potential impact that a loss of confidence in other safe-haven commodities would have on stock prices.

“Profit margins in the U.S. are at the top end of their historical range, and equity market valuations are generally high. But if confidence in paper money or in the currently-viewed “safe havens” of the U.S. dollar and/or government bonds of the developed world disappears, it is anyone’s guess whether the expression of that loss of confidence would be a run-up in stock prices (if they are viewed as the “most real” liquid financial asset) or a rout (if the competition in yields from crashing bond prices caused a commensurate fall in stock prices),” the letter read.

Trapeze Asset Management’s Randall Abramson shares Paul Singer’s pessimism regarding both bonds and stocks.

“We may be at important inflection points for markets. The Dow and S&P 500 at record highs and not cheap. Interest rates at record lows, so bonds are not cheap. Energy and other commodity prices at multi-year lows and likely not to decline much further. And, other than the U.S. dollar, currencies generally are at unsustainable lows. Time for caution and time for opportunity. Value investors tend to be contrary. Often though, as now, it’s tough to be contrary in the face of such long trends. It’s been said about markets that the trend is your friend, but when it’s as extended as today, it’s likely not,” said Abramson last November in an investor letter.

Abramson also shared his latest views about the markets in a short letter.

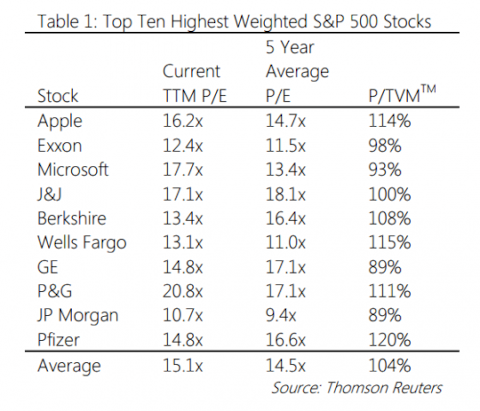

“Finding compelling undervalued large cap names in the U.S. is currently a tough task. With a trailing 12 month P/E ratio of 19x, the S&P 500 is hardly a bargain. Large cap U.S. stocks also appear to be expensive through the lens of our proprietary valuation model, TVM . The average price-to-TVM for the constituents that comprise the S&P 500 now stands at 116%. Mega caps are less expensive but still close to fair value. For example, Table 1 lists the current trailing 12-month P/E ratios and P/TVMTM values for the ten highest weighted stocks in the S&P 500. As a group they are cheaper than the overall S&P 500 but still not attractive,” Abramson said.

Here is a copy of Table 1:

Trapeze Asset Management is having a hard time finding any attractive investments.

“The few names that do appear on our radar screen are either in sectors experiencing considerable headwinds (e.g., Energy, Materials and Financials) or have negative analyst earnings estimate revisions (e.g., McDonald’s, Owens-Illinois), which our research has shown to be the best value trap predictor” said Abramson.

We should note that no valuation model is 100% accurate; however, it is also clear that value investors have been dumping their Apple Inc. holdings over the last few months. Earlier this month we shared why value investor Jim Roumell sold his long-time Apple holdings. Apple is still the most popular stock among hedge funds, but there is a significant decline in its popularity. Overall, Apple is an under-owned stock by hedge funds, which collectively own just 3.2% of Apple’s outstanding shares.

Disclosure: None