One of the hottest topics for discussion in the stock markets is the sudden change in the fortunes of Apple Inc. (NASDAQ:AAPL). Since September 2012, the stock has been on a decline, and is currently precariously poised near its 52-week low of around $419.

Its near-term future will depend on the Q2’13 results, where investors would be looking forward to the margins and management guidance. In the smartphone and tablet space, which is the main segment of Apple Inc. (NASDAQ:AAPL)’s revenue (around 63%), it is mainly competing with the power of Google Inc (NASDAQ:GOOG) and the resurgence of Research In Motion Ltd (NASDAQ:BBRY) BlackBerry.

Apple Inc. (NASDAQ:AAPL) is as financially strong as a company can get in a competitive environment. With zero debt and a huge pile of cash, the current market price gives a P/E (ttm) multiple of less than 10. The forward P/E is 8.53, and the PEG is 0.51, indicating that at current levels, the valuations are not very high. The book value per share is $135.62 (P/B of 3.15).

Even if the annual trend is seen, revenue has grown from $42.9 billion in 2009 to $156.5 billion in 2012 (265% growth). Net income has grown 407% during the same period, from $8.23 billion to $41.73 billion. The net profit margin has, consequently, increased from 19% in 2009 to 27% in 2012.

However, if the trend of the last few quarters is seen, it is clear that the performance of the company has been on the decline. Though there has been some sequential growth in the last quarter, year over year performance indicates significant decline in net profit margins from 28.20% to 23.99% (Table I).

This is just one of the reasons which have adversely affected the sentiment. In fact, it is a symptom rather than a disease. Investors are circumspect about the future of Apple Inc. (NASDAQ:AAPL) mainly because they have started doubting its ability to innovate.

Over the years, the company has always built competitive advantage through innovation, and its pricing power is directly dependent on differentiation. Expected inability to bring out some amazing product immediately has led big investors to cut their stakes in the stock.

Table I

13 Weeks Ending

| $ millions | 12/29/12 | 09/29/12 | 06/30/12 | 03/31/12 | 12/31/12 |

|---|---|---|---|---|---|

| Revenue | $54,512 | $35,966 | $35,023 | $39,186 | $46,333 |

| Net Income | $13,078 | $8,223 | $8,824 | $11,622 | $13,064 |

| NPM | 23.99% | 22.86% | 25.19% | 29.66% | 28.20% |

Google Inc (NASDAQ:GOOG) is not selling devices for the sake of selling devices. It sells tablets and smartphones so that more and more people use Android-based applications to surf and access services on the net. Samsung has, so far, been a great partner in its endeavor. This increases its capacity to “understand” customer behavior, preferences etc., and place relevant advertisements more appropriately.

This makes the advertisements more valuable. 92% of its revenue comes from advertising, hence, increasing advertisement revenue is the main purpose behind all its creations or acquisitions.

Google Inc (NASDAQ:GOOG) is getting aggressive on improving hardware sales, and recently acquired Motorola primarily for this purpose. With Motorola in its bag, it is planning to go big with the X-Phone & the X-Tablet in the near future. It is also likely to bring out some innovative products like the Google Glass, which is expected to be launched this year.

Financially, it has $48 billion cash on books and debt is $7.21 billion. It is trading at a P/E (ttm) of around 24, and the forward P/E is 14. The significant difference indicates investor confidence in the growth prospects. The expected PEG is 1.2 and book value is $217.33 (P/B of 3.66).

The annual trends for Google Inc (NASDAQ:GOOG) indicate that revenue has grown 112%, from $23.65 billion in 2009 to $50.18 billion in 2012, and the net income has grown 65%, from $6.52 billion in 2009 to $10.74 billion in 2012.

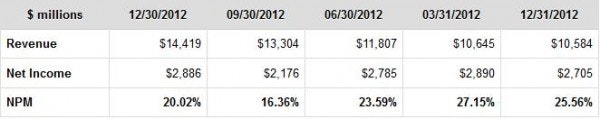

The annual net profit margin has, however, declined from 27.6% in 2009 to 21.4% in 2012. Compared with 2011, revenue increased 32% and net income increased 10.27%. The quarterly trends indicate that the revenue has increased 36% YoY and 8% sequentially. The net profit margin has decreased on a YoY basis from 25.56% (Table II).

Table II

13 Weeks Ending

The annual revenue trends of Research In Motion Ltd (NASDAQ:BBRY) BlackBerry indicate how it lost out to the fresher, more innovative operating systems and applications from Apple Inc. (NASDAQ:AAPL) and Google Inc (NASDAQ:GOOG). While the market for smartphones has grown exponentially, its revenue has declined from about $14.95 billion in 2009-10 to $11.07 billion in 2012-13 (a decline of 26%). Its recently launched Z10 has received very good response and has brought some pride to the die-hard BlackBerry fans.

Importantly, most of the 1 million Z10 devices shipped (55%) were converts from other operating systems. Worldwide, Android accounts for around 70% of the smartphone market. BlackBerry can provide an alternative to this growing market and attempt to regain lost glory.

BlackBerry, meanwhile, is making a resurgence of sorts. It was wiped out of the market due to the phenomenal success of iOS and Android over the last few years. Now that Apple is looking a little jaded, it has smelt blood and is attempting to dent its market share.

In 2011-12, the revenue was $18.42 billion, indicating that the revenue declined nearly 40% in 2012-13. It had a net income of $2.45 billion in 2009-10 but reported a net loss of $646 million in 2012-13. The quarterly trends indicate that while revenue has declined significantly YoY, the margins have started to turn positive over the last two quarters (Table III).

Years of erosion in market share has made the company significantly weak. However, it still has no debt on books and has cash of $2.65 billion. It is trading at a discount to its book value per share of $18.36.

Table III

Conclusion

While history of outstanding performance is definitely in favor of Apple, the effect of last few quarters has cast a serious doubt in the minds of investors about its ability to continuously innovate and maintain its pricing power. There are suggestions and reports that it may change its stance as a niche market player to compete in other cost-sensitive markets with lower price products (lower margins).

However, such a change in stance is fraught with dangers of brand image dilution, which may leave it in a confused state of positioning. These changes in marketing have to be done extremely carefully, otherwise they may benefit competitors more than the company itself.

So, the best course for Apple would be to come out with classy, nearly disruptive technology products which can invigorate the growth story for another historical leg. In the last one year, nothing new has come up, and nothing remarkable is expected in the near future. Investors may have to wait for the management commentary with the Q2’13 results before making any substantial investment.

About Google, its advertising revenue motives are clear. It has or is developing the ammunition to take on Apple and others. The new Nexus, X-Phone/Tablets and, of course, the upcoming Google Glass “digital eyewear” are all created and programmed to enhance its revenue.

Though its margins have fallen, it has innovative, high margin products in the pipeline. However, there is some talk about its falling apart with Samsung as it (Samsung) is coming out with its own operating system, Tizen. Still, considering the overall picture, Google has the most balanced risk-reward ratio.

BlackBerry, is buoyant with its new operating system, and is geared up to take on the weakening might of the competition. However, one or two quarters cannot make investors “consider it done.” Its products have to perform, and it has to continuously iterate its innovation. BlackBerry is, therefore, a high risk-high reward bet right now.

All said and done, one can not write off Apple. It has the might and the immediate need to come out with that one spectacular product, which can turn the tables again. It has to do it soon, otherwise this fight may go out of hand. It all boils down to innovation.

(Source: All data and charts have been sourced from Google finance, Yahoo finance & websites of the respective companies.)

The article Big Tech Boys: Even Innovation Needs Iterations originally appeared on Fool.com is written by Naomi Warmate-Igwe.