No other sector has experienced the rate of churn in dominant companies as the technology sector. Compaq reaped enormous profits in the 1980s due to its superior product and rapid innovation. But competition caught up with it in the 1990s as up-starts like Dell Inc. (NASDAQ:DELL) offered the same product for less. But even Dell succumbed to rapid changes in the industry, as consumers moved from PCs to tablets and smartphones like those made by Apple Inc. (NASDAQ:AAPL).

Although we do not know what the industry will look like five years from now, we can be sure that it will be much different than it is today. Getting on top for a short-time is achievable for the most determined companies, but staying on top is a virtually impossible task.

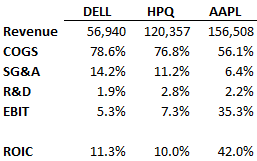

Just take a look at three companies’ financials in 2003:

Back in 2003, Dell Inc. (NASDAQ:DELL)’s just-in-time inventory and direct-to-consumer sales model allowed it to earn high returns on invested capital despite selling its products at a lower price point than its competitors.

Hewlett-Packard Company (NYSE:HPQ), which acquired the once-dominant Compaq, was still earning low operating margins as it tried to become a more efficient producer in an industry with no durable competitive advantages.

Meanwhile, Apple Inc. (NASDAQ:AAPL) was still struggling to turn itself around after Steve Jobs saved the company from bankruptcy just a few years prior. However, the technological landscape changed dramatically in favor of Apple due to its incredible innovations.

By 2012, each company had changed drastically:

During this time, Apple Inc. (NASDAQ:AAPL) made an important shift away from personal computers and toward consumer electronics in general. iPods, iPads, iPhones, and iEverthingElse have taken over the tech industry, while Dell Inc. (NASDAQ:DELL) and Hewlett-Packard are dependent on the declining PC market.

Although it has diversified away from PCs more than Dell, printers and PCs still account for the bulk of Hewlett-Packard Company (NYSE:HPQ)’s revenue. Unfortunately, both Dell and Hewlett-Packard have to enter new markets — like tablets — if they want to remain relevant in the changing technological landscape.

Change is scary for investors, but it is necessary in the technology sector. Luckily, both Dell and HP produce ample amounts of free cash flow despite declining incremental ROIC, so both companies have time to become low-cost producers in new markets before PC sales decline even further.

Takeaways

The most important thing to understand about the technology sector is that the next decade will be unrecognizable to those who operated in the last.

Who in the 1980s could have imagined that competition would eventually get the best of Compaq in the 1990s? And who in the 1990s could have imagined a world that did not necessarily need Dell’s PCs, but preferred Apple Inc. (NASDAQ:AAPL)’s phones and tablets? And who today can imagine a world in which Apple is not at the forefront of consumer electronics?

In 2003, Dell Inc. (NASDAQ:DELL) earned a 43% return on invested capital (ROIC) while Apple turned out a measly 1.6% ROIC. Last year, the tables were switched — with Apple earning a 42% ROIC and Dell an 11% ROIC.

Since 2003, demand for Dell’s products has declined dramatically — and only its innovative business model has enabled it to earn a satisfactory ROIC, though much lower than it had in the past. Is it so difficult to imagine that Apple Inc. (NASDAQ:AAPL) will one day go the way of all innovative tech companies — down into oblivion?

The article All Tech Companies Go to Hades originally appeared on Fool.com and is written by Ted Cooper.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.