Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze American Eagle Outfitters Inc. (NYSE:AEO) from the perspective of those elite funds.

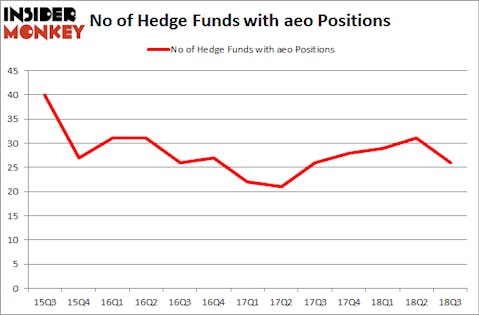

American Eagle Outfitters Inc. (NYSE:AEO) was in 26 hedge funds’ portfolios at the end of September. AEO investors should pay attention to a decrease in activity from the world’s largest hedge funds of late. There were 31 hedge funds in our database with AEO positions at the end of the previous quarter. Our calculations also showed that aeo isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

Let’s view the recent hedge fund action encompassing American Eagle Outfitters Inc. (NYSE:AEO).

How have hedgies been trading American Eagle Outfitters Inc. (NYSE:AEO)?

Heading into the fourth quarter of 2018, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of -16% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AEO over the last 13 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in American Eagle Outfitters Inc. (NYSE:AEO) was held by Arrowstreet Capital, which reported holding $35.6 million worth of stock at the end of September. It was followed by AQR Capital Management with a $32.7 million position. Other investors bullish on the company included Two Sigma Advisors, Rima Senvest Management, and Shellback Capital.

Due to the fact that American Eagle Outfitters Inc. (NYSE:AEO) has experienced bearish sentiment from the smart money, we can see that there is a sect of fund managers that decided to sell off their full holdings last quarter. It’s worth mentioning that Louis Bacon’s Moore Global Investments dumped the largest investment of the 700 funds monitored by Insider Monkey, comprising close to $16.9 million in stock, and Lee Ainslie’s Maverick Capital was right behind this move, as the fund cut about $16.6 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 5 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as American Eagle Outfitters Inc. (NYSE:AEO) but similarly valued. We will take a look at MKS Instruments, Inc. (NASDAQ:MKSI), Rayonier Inc. (NYSE:RYN), Emcor Group Inc (NYSE:EME), and Proto Labs Inc (NYSE:PRLB). All of these stocks’ market caps are similar to AEO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MKSI | 25 | 447755 | -3 |

| RYN | 17 | 303151 | 1 |

| EME | 20 | 231394 | 3 |

| PRLB | 5 | 11266 | -3 |

| Average | 16.75 | 248392 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $248 million. That figure was $326 million in AEO’s case. MKS Instruments, Inc. (NASDAQ:MKSI) is the most popular stock in this table. On the other hand Proto Labs Inc (NYSE:PRLB) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks American Eagle Outfitters Inc. (NYSE:AEO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.