Amazon.com, Inc. (NASDAQ:AMZN) reported its fourth quarter results earlier this week, with revenue growing by 22% and gross margins higher than expected. Net income for the quarter was $97 million, or $0.21 per share. These results put the full year revenue at just over $61 billion, 27% growth from $48 billion in 2011.

Of the three quantities mentioned above – revenue, gross margin, and net income – analysts seem to only care about two of them when it comes to Amazon. They point to the relentless revenue growth and to the surprise jump in gross margin while casting off net income as a non-issue. Investors apparently agreed, sending Amazon shares soaring the next day.

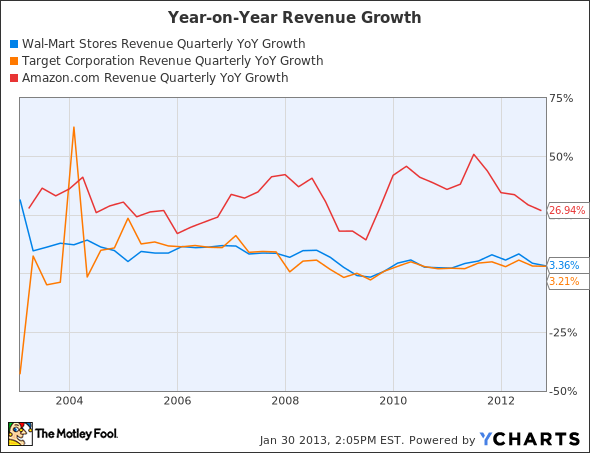

Revenue Growth

Amazon has been growing revenue at an astounding rate for the last decade while Wal-Mart and Target have settled between 3-5% growth.

WMT Revenue Quarterly YoY Growth data by YCharts

Amazon and Target now have similar annual revenues, with Amazon around $60 billion and TGT around $70 billion. Wal-Mart is much larger with annual revenue around $460 billion.

Gross Margin

Amazon has had a gross margin between 22-23% for the last decade. This compares to Wal-Mart’s 25% and Target’s 30%.

AMZN Gross Profit Margin TTM data by YCharts

This means that Amazon makes less money on each product sold than both Wal-Mart and Target. This makes sense given Amazon’s drive to offer the lowest prices.

Operating Margin

This is where things turn sour for Amazon. While Wal-Mart maintains an operating margin of about 6% and Target about 7.5%, Amazon’s operating margin dropped to just 1.8% in 2011 and to 0.9% in the TTM period.

WMT Operating Margin TTM data by YCharts

Amazon is sacrificing profitability for revenue growth. There can never be 20+% revenue growth AND high margins at the same time for Amazon, especially now that the company is much larger than it was a decade ago. It’s one or the other. An interesting article on Seeking Alpha proposes that Amazon’s sales growth in states where the company was forced to start charging sales tax was reduced substantially. This makes sense, since a lack of sales tax gave Amazon an automatic price advantage of 6-9% over traditional retailers. Further evidence of this trend is seen in this article from Reuters claiming that Best Buy Co., Inc. (NYSE:BBY) saw an above-average increase in online sales in states where Amazon recently started charging sales tax.

Amazon is set to lose a major part of its price advantage with the addition of sales tax. This means that, since margins can’t really be suppressed further, Amazon’s prices will in general go up. This will cause revenue growth to slow. The question which remains is, when this happens, what useless metric will analysts cling to in order to justify their ridiculous price targets?

Pure Madness

The reason why Amazon’s valuation is so insane is because it assumes that both revenue will continue to grow extremely quickly and that margins will improve. Let’s imagine a scenario where Amazon is able to grow revenue at, say, 25% for the next 10 years. At the same time, Amazon achieves Wal-Mart level operating margins of 6%. Clearly, both of these things cannot happen at the same time, but let’s try to value Amazon as if they could. EBIT would be about $3.6 billion this year, which would drop to about $2.5 billion after interest and taxes. If margins remain flat then this net income would rise by 25% annually with revenue.

Doing a simple discounted cash flow calculation using net income as the cash flow, a discount rate of 12%, and an after-ten-year growth rate of 3%, the hypothetical value of the company comes out to $133 billion. This is about 10% higher than the current market cap of $118 billion.

But this calculation assumes two conditions that are not compatible. If we assume high revenue growth then we cannot assume high margins, and vice versa. If we do the same calculation with, say, 10% revenue growth instead, the value of the company is just $46.5 billion. If instead we adjust the operating margin to 3% then the value of the company is $67.5 billion.

The Bottom Line

Amazon is a ridiculous stock. The numbers which matter for every other stock are, at least in the minds of analysts and some investors, irrelevant for Amazon. One of my favorite Warren Buffet quotes is:

“An investor needs to do very few things right as long as he or she avoids big mistakes.”

Amazon today is the mother of all big mistakes. It’s madness, plain and simple, which is driving the stock price up and up regardless of sensibility. Investors are basing their investment on two very big assumptions which, while on their own are quite a reach, together are utterly impossible. There is no reasonable justification for buying Amazon at today’s prices.

The article Amazon: When Will The Madness End? originally appeared on Fool.com and is written by Timothy Green.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.