The global leader in the online retail industry, Amazon.com, Inc. (NASDAQ:AMZN) has only risen 7.31% so far in 2013, not even half of the return provided by the Dow Jones Industrial Average so far this year.

Amazon.com, Inc. (NASDAQ:AMZN) is a leading online retailer offering a broad array of items, with a prominent presence both domestically and internationally. Based on market capitalization, Amazon is valued at $122.55 billion. However, the profitability of the company’s business model has been brought into question, as the TTM profit margin is currently -0.14%.

With the stock trading within $15 of all time highs, at current prices is Amazon.com, Inc. (NASDAQ:AMZN) a solid investment in the world of tomorrow, or should investors wait for a more reasonable valuation to be stapled to this innovative giant?

Strengths:

Institutional Vote of Confidence:

67% of shares outstanding are held by institutional investors, representing over $80 billion in investment, displaying the confidence some of largest investors in the world have in the company and its future.

Explosive Revenue Growth:

In 2003 Amazon reported revenue of $5.26 billion; in 2012, the company announced revenue of $61.09 billion, representing year over year annual growth of 31.32%, an explosive trend which is anticipated to sustain into the future, with projections placing 2017 revenue at $162.69 billion. This growth has been a result of the rapid adoption of the Amazon.com, Inc. (NASDAQ:AMZN) platform and the growing popularity of online retail both internationally and in the US.

Leading Market Position:

Amazon is the leader in the online retail industry both domestically and internationally, possessing top market share positions, and with this comes a greater level of dominance and control over its industry.

Brand Value & Loyalty:

Amazon’s brand value is estimated to be $28.66 billion, and the level of brand loyalty most customers display is

valuable.

Innovative Business Model:

The company possesses virtually unlimited online shelf space, and can offer customers a vast and diverse selection of products through an effective search and retrieval interface, and the shopping experience is personalized by Amazon recommending products based on past purchases and a wide array of reviews that are offered on the site, giving the company a distinct advantage over traditional brick and mortar retail stores.

Free Cash Flow: In 2013, Amazon.com, Inc. (NASDAQ:AMZN) is projected to generate $4.9 billion in free cash flow, representing the financial strength and security the company possesses.

Net Cash Position: Amazon’s $10 billion debt load is outweighed by its $11 billion position of cash and cash equivalents, resulting in a net cash position of $1.1 billion, or $2.40 per share, a minor financial strength of the company.

Weaknesses:

Lack of Dividend:

At no time in the company’s history has Amazon paid out a dividend, and the company has expressed no plans of doing so in the future, a major downside for long-term investors.

High Valuation: At the moment, Amazon carries a price to book ratio of 14.53, a price to sales ratio of 2.01, and a price to earnings ratio that is currently negative, all of which indicate a company trading with an extremely high valuation.

Opportunities:

Continuation of Shift to Online Retail Platforms: In 2011, only roughly 7% of total US retail sales were estimated to be e-commerce transactions, totaling $202 billion; however, Forrester Research projects this figure rising to 9% by 2016, totaling $327 billion. Internationally, as of the end of 2011, the use of the Internet as a purchasing tool only possessed a penetration rate of 33%, compared to the 78% penetration rate in the United States, demonstrating incredible potential for e-commerce platforms.

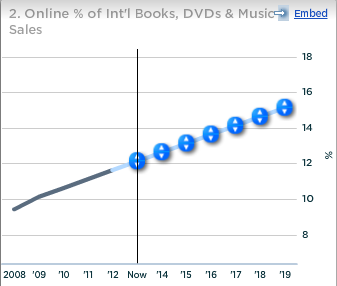

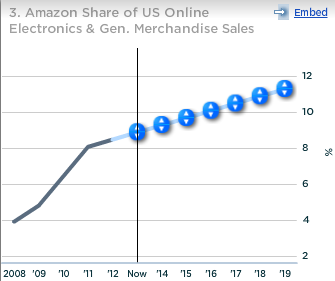

Increase in Market Share:

Amazon.com, Inc. (NASDAQ:AMZN)’s market share of both the international and United States online retail markets has increased substantially over the past years, and is anticipated to continue to gain ground into the future, presenting opportunity for the company to fuel revenue growth.

Kindle Products:

Total Kindle products sold have increased from 0.36 million in 2008 to 43.9 million projected for 2013, with projections placing 2019 total Kindle products sold just shy of 100 million, indicating a segment of incredible possible growth.

Cloud Services:

Cloud and other web services accounts for 8.34% of overall business, with revenues derived from the segment increasing from $0.54 billion in 2008 to $3.55 billion projected for 2013, with projections placing 2019 revenue derived from the segment at $17.6 billion. The explosive trend of cloud services presents the opportunity to Amazon.com, Inc. (NASDAQ:AMZN) to capitalize and derived growth from the segment.

Acquisitions:

Amazon has a long history of successful acquisitions which have allowed the company to add innovative and distinguished services to its portfolio of offerings, and further acquisitions could allow the company to further innovate and capture new customers.

Threats:

Implementation of Sales Tax Program:

One of the main advantages of buying on Amazon.com opposed to purchasing the same item at a brick-and-mortar location is the lack of sales tax, but over the past years a strong push by state governments has occurred which has resulted in many states instating a law implementing a sales tax on items sold on Amazon, threatening business

advantage.

Competitors:

Major publicly traded competitors of Amazon include eBay Inc (NASDAQ:EBAY), Mercadolibre Inc (NASDAQ:MELI), and Best Buy Co., Inc. (NYSE:BBY).

eBay Inc (NASDAQ:EBAY) is valued at $70.21 billion, does not pay out a dividend, and carries a price to earnings ratio of 26.19. eBay Inc (NASDAQ:EBAY) competes with Amazon on the internet platform and poses a major threat to Amazon’s business, but fundamentally their platforms differ. The company’s business appears strong with a TTM profit margin of 18.68%.

Mercadolibre Inc (NASDAQ:MELI) is valued at $5.06 billion, pays out a dividend yielding 0.50%, and carries a price to earnings ratio of 50.65. Mercadolibre poses a threat to Amazon.com, Inc. (NASDAQ:AMZN) in Latin American markets, but does not infringe on its core North American market. Fundamentally, the company is solid with a TTM profit margin of 25.24%.

Best Buy Co., Inc. (NYSE:BBY) is valued at $9.32 billion, pays out a dividend yielding 2.47%, and carries a negative price to earnings ratio. Best Buy’s core business is focused on traditional brick and mortar stores, thus not posing a paramount threat to Amazon’s core business. Fundamentally, Best Buy Co., Inc. (NYSE:BBY)’s business model is flawed with a -0.50% TTM profit margin.

The Foolish Bottom Line

Financially, Amazon could not be stronger. The company possesses explosive revenue growth, a leading market position, and a strong free cash flow position. The major weaknesses of the company include its lack of dividend and premium valuation. Looking forward, the company will experience sustained accelerated growth stemming from the fundamental shift of retail sales to Internet platforms and gains in market share. All in all, Amazon is an incredibly strong company financially that will experience

substantial growth into the future, however shares come at a premium. Amazon earns four out of five stars, and is a buy on any substantial pullback.

The article The Trailblazer at the Head of the Online Retail Revolution originally appeared on Fool.com and is written by Ryan Guenette.

Ryan Guenette has no position in any stocks mentioned. The Motley Fool recommends Amazon.com, eBay, and MercadoLibre. The Motley Fool owns shares of Amazon.com, eBay, and MercadoLibre. Ryan is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.