The owners of Hulu, the online television streaming service, are reportedly shopping the website around to potential buyers in order to gauge interest. While a sale might not be imminent, we appear to be inching closer as the two major stakeholders with a voting interest – The Walt Disney Company (NYSE:DIS) and News Corp (NASDAQ:NWSA)– can’t agree on a proper strategy for the service going forward. With a bevy of buyers expressing interest in the company, the owners have a lot of potential suitors for when they do decide to sell.

Why sell now?

Hulu is showing excellent signs of health. Last year, revenue grew 65% to $695 million as the company more than doubled its subscriber number to 3 million. CEO Jason Kilar reported earlier this month that the company set records for both subscriber additions and revenue in the first quarter of 2013. With all this fantastic news about the company’s growth, why would the owners want to sell?

The main driving point toward a Hulu sale is Newscorp and Disney’s inability to agree on what the future of the website should look like. Newscorp would like to see Hulu transition away from ad-supported free streaming, and create a subscription-only service. Disney prefers to leave things as is.

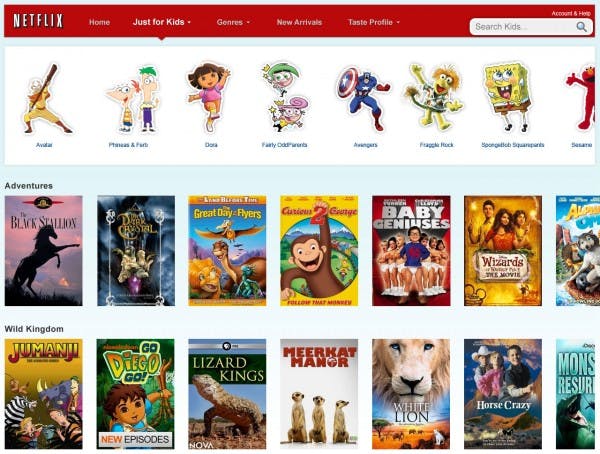

From Newscorp’s perspective, offering its shows for free on Hulu diminishes the value of its content, which makes licensing deals with companies like Netflix, Inc. (NASDAQ:NFLX) or Amazon.com, Inc. (NASDAQ:AMZN) less profitable.

From Disney’s perspective, providing a free service prevents viewers from turning to the services provided by Netflix, Inc. (NASDAQ:NFLX) and Amazon.com, Inc. (NASDAQ:AMZN). A sale of Hulu would alleviate the owners from this conflict of interest, and allow the value of the content they produce to rise faster.

How much?

Last year, Providence Equity Partners sold its 10% stake back to Hulu for $200 million valuing the company at $2 billion. Earlier this year, CEO Jason Kilar announced his impending departure after cashing out a portion of his stake for roughly the same valuation. The problem is the website is much more valuable in the hands of Disney, Newscorp, and Comcast than it is in almost anyone else’s.

With these three companies stake in Hulu, the service pays less for content. That’s why when the owners shopped Hulu around previously, they didn’t sell to the high bidder, DISH Network Corp. (NASDAQ:DISH), because it wanted the content rights included. These content licenses give Hulu the majority of its value; so while the company might be worth $2 billion to the current owners, it’s unlikely to garner much of a premium unless it packages a content licensing agreement.