Is Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

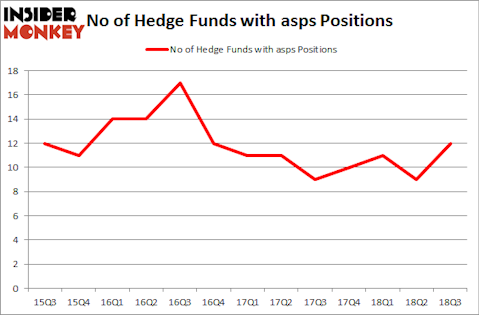

Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) has seen an increase in hedge fund sentiment lately. ASPS was in 12 hedge funds’ portfolios at the end of September. There were 9 hedge funds in our database with ASPS holdings at the end of the previous quarter. Our calculations also showed that asps isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are numerous methods investors have at their disposal to appraise stocks. A pair of the best methods are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the top fund managers can outclass their index-focused peers by a very impressive margin (see the details here).

Let’s review the recent hedge fund action surrounding Altisource Portfolio Solutions S.A. (NASDAQ:ASPS).

How have hedgies been trading Altisource Portfolio Solutions S.A. (NASDAQ:ASPS)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in ASPS at the beginning of this year. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

The largest stake in Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) was held by Omega Advisors, which reported holding $31.5 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $18 million position. Other investors bullish on the company included GLG Partners, Citadel Investment Group, and CQS Cayman LP.

Consequently, some big names have jumped into Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) headfirst. Citadel Investment Group, managed by Ken Griffin, assembled the most outsized position in Altisource Portfolio Solutions S.A. (NASDAQ:ASPS). Citadel Investment Group had $3.9 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $0.6 million position during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) but similarly valued. We will take a look at Western Asset High Income Fund II Inc. (NYSE:HIX), American Vanguard Corp. (NYSE:AVD), Wells Fargo Advantage Funds – Wells Fargo Income Opportunities Fund (NYSE:EAD), and Adamas Pharmaceuticals Inc (NASDAQ:ADMS). All of these stocks’ market caps resemble ASPS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HIX | 2 | 40181 | -1 |

| AVD | 7 | 29762 | -3 |

| EAD | 3 | 52989 | -1 |

| ADMS | 17 | 157846 | -2 |

| Average | 7.25 | 70195 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $70 million. That figure was $72 million in ASPS’s case. Adamas Pharmaceuticals Inc (NASDAQ:ADMS) is the most popular stock in this table. On the other hand Western Asset High Income Fund II Inc. (NYSE:HIX) is the least popular one with only 2 bullish hedge fund positions. Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ADMS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.