Alphabet Inc (NASDAQ:GOOGL) has long been a favorite of option traders due to its high share price and juicy option premiums. With the stock trading at $804, it has basically gone nowhere since late-2015.

With a massive technological revolution currently taking place, Alphabet is well placed to take advantage of potential boom industries in self-driving cars and virtual reality.

Amigobulls recently reported that “self-driving cars could actually come sooner than many people think”, due to recent regulations introduced by the National Highway Transportation Safety Administration.

turtix / Shutterstock.com

On December 14, Alphabet Inc (NASDAQ:GOOGL)’s self-driving technology efforts became an official company called Waymo, which stands for a new way forward in mobility.

Competition in the self-driving car space is already pretty fierce, with Tesla Motors Inc (NASDAQ:TSLA) leading the charge, but Alphabet and Waymo still have potential to grab a significant share of the market.

Waymo plans to focus on working with auto manufacturers to provide the tech, rather than building their own cars. This seems sensible given tech is their area of expertise rather than car making.

In addition to self-driving cards, the virtual reality market is set to heat up over the next few years. Forbes recently listed Alphabet as one of 11 stocks to watch in this $80 billion market.

The article reported that Alphabet is “already building a new version of Glass and has secretly distributed the product to health care, manufacturing and energy companies.”

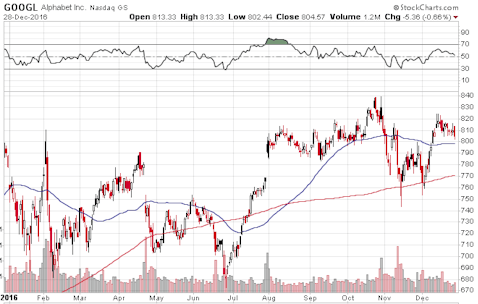

Looking at the charts, while Alphabet Inc (NASDAQ:GOOGL) is basically at the same level it was a year ago, it has had a nice run up since July. After consolidating since August, the stock could look to push above the 52 week high at $840 sometime in early 2017.

Options traders can take advantage of a bullish stance in Alphabet by trading bull put spreads.

If trader were willing to bet that GOOGL will stay above $800 between now and March they could sell a March 17th, 2017 $800-$790 spread.

For selling that spread, they would receive $410 in option premium. The maximum loss would occur if GOOGL traded below $790 on the expiry date. The maximum loss would be $590.

Therefore, traders will to bet on a table to higher GOOGL share price between now and March could receive a juicy 69% return on their investment.

Follow Alphabet Inc. (NASDAQ:GOOGL)

Follow Alphabet Inc. (NASDAQ:GOOGL)

Receive real-time insider trading and news alerts

Options trading involves risk and is not suitable for some investors. Check with your financial advisor before making any investment decisions.

Disclosure: I do not have any positions in GOOGL

Note: Gavin has a Masters in Applied Finance and Investment. He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. He likes to focus on short volatility strategies. Gavin has written 5 books on options trading, 3 of which were bestsellers. You can read more from Gavin at Options Trading IQ.