The world’s leading aluminum producer Alcoa Inc. (NYSE:AA) posted its results for the quarter ending December 2012. The company swung to a quarterly net profit of $242 million from a loss of $191 million a year ago. Excluding one-off items, such as gains from the sale of the Tapoco hydroelectric dam complex in Tennessee, which caused an after tax gain of $161 million, Alcoa generated a profit of $64 million, a significant change from the loss of $34 million in the same quarter last year. The positive results come on the back of a drop in oil prices in Q2, a rise in aluminum prices, better performance in the aerospace sector and the business’s ongoing cost cutting drive, which includes closure of inefficient smelters and a reduction of 23%, or 531,000 metric tons, of production capacity.

It is now increasing its focus on the aerospace industry. The unit pulled off the most impressive performance of all the company’s divisions by netting a 12% increase in quarterly operating profit over last year to $137 million.

Since the beginning of 2013, Alcoa’s shares have been up 2.7%. Overall, however, it has been struggling due to volatile metal prices, the global economic slowdown in 2012 and oversupply in the industry.

Global aluminum prices have continued to rise slowly following the massive dip after the financial crisis of 2008. In the last calendar year, aluminum prices averaged at $2,022.80 per metric ton, which is significantly lower than 2010 or 2011 levels. This also represents a 23% drop from the pre financial crisis average price of $2,639.86 in 2007. In 2013, the average commodity price is expected to be $2,125 per metric ton, which would represent a 5% increase from 2012. So much of that will come from a reflation of the world’s credit markets currently being engineered by the Federal Reserve and the other major central banks. China is engaging in infrastructure stimulus, classic Keynesian counter-cyclical policy, which will be supportive of base metals prices. Japan’s aggressive monetary debasement should spur a domestic rebuilding that will put a bid under metal prices as well.

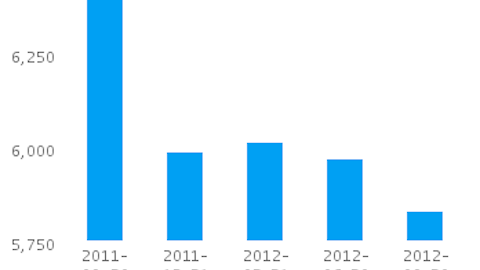

However, despite the rise in aluminum prices in the final quarter, Alcoa has still failed to increase its quarterly sales, which registered a drop of 1.5% to $5.9 billion.

Like steel manufacturers, such as ArcelorMittal (NYSE:MT) or US Steel , the performance of Alcoa is also closely tied to the increase or decrease of fuel prices.

The link between Alcoa’s performance and oil prices is shown in the table below. I have used both United States Brent Oil Fund, LP (NYSEARCA:BNO) and the United States Oil Fund LP (NYSEARCA:USO), which represents WTI, to present my point. Since the industry is hedged out six months, I have compared Alcoa’s current results (Q4 2012) with average oil prices of Q2 2012 and so on. The correlation between operating margins and oil prices is represented by the Pearson Statistic, which measures direction correlation. Negative correlations mean rising oil prices have a depressing effect on operating margins.

| Alcoa | Q4 2011 | Q1 2012 | Q2 2012 | Q3 2012 | Q4 2012 |

| Revenue | 5,989.00 | 6,006.00 | 5,963.00 | 5,833.00 | 5,898.00 |

| GP | 761 | 908 | 809 | 567 | 930 |

| Margin | 12.71% | 15.12% | 13.57% | 9.72% | 15.77% |

| Amex BNO | $78.67 | $74.04 | $75.36 | $83.14 | $75.11 |

| Amex USO | $40.96 | $34.14 | $37.54 | $39.32 | $34.71 |

| Pearson Stat (BNO) | -0.9503 | ||||

| Pearson Stat (USO) | -0.7728 |

Based on these calculations, it is pretty obvious that Alcoa’s gross profit margin is inversely proportional to oil prices (i.e. the higher the oil prices, the lower the margin is going to be in the coming quarters). With Brent Crude and WTI moving higher in Q1 so far and a likely breakout from the current trading range with rising inflation and economic activity, I expect Alcoa’s margins to erode starting with its next earnings report.

Alcoa’s cost cutting initiative is going according to plan. Shipments from the $10 billion Saudi Arabian facility, the business’s most cost efficient plant, began in Q4. 2013 is expected to be better on a rise in demand from China by 11% due to better performance from the local heavy vehicles construction segment. Moreover, the rise of the commercial building and construction industries in the US could increase aluminum’s demand by 7%. The demand in the aerospace segment, the strongest performing unit of the company, is also expected to increase by 10%. Pushing out overhead will help offset rising energy prices, but I still expect margins to be squeezed in 2013 as end users will be reluctant to bid prices higher.

The article Alcoa’s Solid Earnings to Be Short-lived originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.