The Russell 2000 ETF (IWM) has shot up by 38% since hitting a 52-week low on February 11, easily outdistancing the S&P 500 ETF (SPY)’s 19% gains during that time. Nor is the small-cap rally likely to be over. History shows that after periods of 15% or greater declines in the Russell 2000 ETF, it has responded with average gains of nearly 100%. In fact, only once did the rebound run come in below 60% gains. It’s no wonder then that hedge funds appear to be aggressively putting their money back into small-cap stocks. In this article, we’ll look at their Q3 trading habits in regards to Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP).

Is Ctrip a good investment now? The smart money is betting on the stock. The number of long hedge fund positions rose by 7 lately. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Equifax Inc. (NYSE:EFX), Ulta Salon, Cosmetics & Fragrance, Inc. (NASDAQ:ULTA), and Genuine Parts Company (NYSE:GPC) to gather more data points.

Follow Trip.com Group Limited (NASDAQ:TCOM)

Follow Trip.com Group Limited (NASDAQ:TCOM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Iakov Filimonov/Shutterstock.com

How are hedge funds trading Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP)?

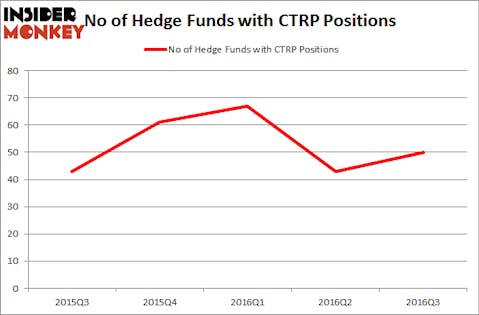

At the end of the third quarter, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a 16% jump from the second quarter of 2016. That followed a steep decline in Q2, as many Chinese stocks lost hedge fund support over fears surrounding the country’s economic growth and stability. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Fisher Asset Management, managed by Ken Fisher, holds the largest position in Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP). Fisher Asset Management has a $460 million position in the stock. The second largest stake is held by Discovery Capital Management, led by Rob Citrone, holding a $229.3 million position. Other members of the smart money that are bullish comprise Jason Karp’s Tourbillon Capital Partners, Lei Zhang’s Hillhouse Capital Management, and Daniel S. Och’s OZ Management.