Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost around 20%. Facebook, which was the second most popular stock, lost 14% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

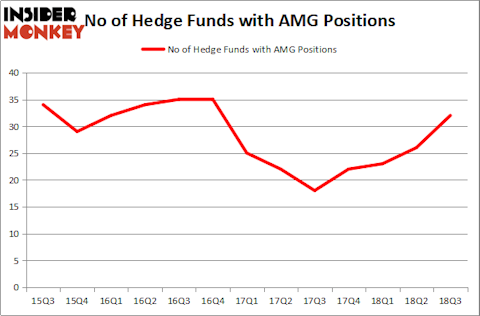

Affiliated Managers Group, Inc. (NYSE:AMG) was in 32 hedge funds’ portfolios at the end of the third quarter of 2018. AMG has seen an increase in activity from the world’s largest hedge funds lately. There were 26 hedge funds in our database with AMG positions at the end of the previous quarter. Our calculations also showed that AMG isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are a multitude of tools shareholders can use to value publicly traded companies. A couple of the most underrated tools are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the top hedge fund managers can trounce the S&P 500 by a solid amount (see the details here).

We’re going to review the key hedge fund action regarding Affiliated Managers Group, Inc. (NYSE:AMG).

What have hedge funds been doing with Affiliated Managers Group, Inc. (NYSE:AMG)?

Heading into the fourth quarter of 2018, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 23% from the previous quarter. On the other hand, there were a total of 22 hedge funds with a bullish position in AMG at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Affiliated Managers Group, Inc. (NYSE:AMG), which was worth $179.4 million at the end of the third quarter. On the second spot was Southeastern Asset Management which amassed $160.6 million worth of shares. Moreover, Sirios Capital Management, Renaissance Technologies, and D E Shaw were also bullish on Affiliated Managers Group, Inc. (NYSE:AMG), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Southeastern Asset Management, managed by Mason Hawkins, assembled the biggest position in Affiliated Managers Group, Inc. (NYSE:AMG). Southeastern Asset Management had $160.6 million invested in the company at the end of the quarter. John W. Rogers’s Ariel Investments also made a $36.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Steve Cohen’s Point72 Asset Management, Matthew Hulsizer’s PEAK6 Capital Management, and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s check out hedge fund activity in other stocks similar to Affiliated Managers Group, Inc. (NYSE:AMG). These stocks are Ubiquiti Networks Inc (NASDAQ:UBNT), Enable Midstream Partners LP (NYSE:ENBL), Carlisle Companies, Inc. (NYSE:CSL), and KT Corporation (NYSE:KT). This group of stocks’ market caps are closest to AMG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBNT | 16 | 336685 | 1 |

| ENBL | 4 | 12258 | 1 |

| CSL | 22 | 460444 | 6 |

| KT | 9 | 184882 | 0 |

| Average | 12.75 | 248567 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $248.57 billion. That figure was $733 million in AMG’s case. Carlisle Companies, Inc. (NYSE:CSL) is the most popular stock in this table. On the other hand Enable Midstream Partners LP (NYSE:ENBL) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Affiliated Managers Group, Inc. (NYSE:AMG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.