And if you look back, it’s been 20 years now, but everything that drove the test business in the early 2000s was consumer. Consumer, consumer, consumer. I remember that was all, everything that mattered was always consumer. And now consumer is not what’s driving the test requirements. Consumer’s sort of left for dead. All of the applications in data, AI, processing, automotive, et cetera, are driving all the test requirements and that definitely is a case for burn-in. So for memories it’s the data centers, okay, memories are stacking together and then they’re putting them together. I definitely remember and can talk to in great detail about how many die are being stacked into an SSD and where do you want to burn them in? You should burn them in before you put them into that application.

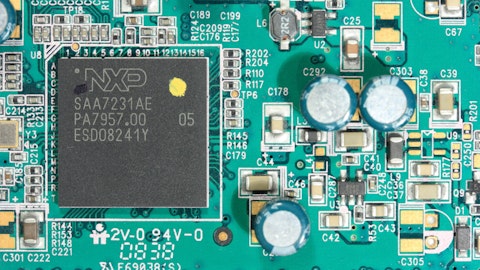

And then now what we’re seeing with the likes of the A100, B200 type things, these modules [indiscernible] packaging that actually puts a processor, a big old stack of DRAM, a chipset on there, future would be an optical IO chipset or something along those lines, those devices often need to be burnt in. Are you going to burn them in at the module level? The answer is, yes. Why? Because it’s the only place to do it. Well, that’s ridiculously expensive. So there are initiatives to say how do we burn those devices in at the die level. And I can tell you sort of just front and center of my whole career at this thing. When you start with, I need to do it, there are testability, DFT, and other things that you can do to implement it. And we believe we have a solution that can partner with them to actually implement wafer level burden.

So the applications that will be driving our business today are very different than I think they will be in a couple years. I mean, I still think silicon carbide is going to be a really good business for us, but it won’t be the only one.

Jed Dorsheimer: So, Gayn, sorry, the move to multi-chip modules from an economic perspective is the driver then in terms of…

Gayn Erickson: It’s the catalyst that makes them relook at their test strategy and say, I’m going to need to do more wafer level, correct.

Jed Dorsheimer: Got it. And the reason they’re not doing that with your system today is they’re selling for a price where they can eat the yield loss or…

Gayn Erickson: That’s a good question, but it’s not crazy. Sorry, [indiscernible] you’re crazy, Jed. But if you’re able to get 97% margin and you eat 50% yield loss, who cares, I guess? I’m not implying I know that answer and if I did, I’m not telling it. But that would be logical. But as things become more important, or you don’t have capacity, or that money matters, yes, you would drive it. And so I think that’s what makes sense, why we’re feeling these sort of tops down initiatives for shifting things towards wafer level.

Jed Dorsheimer: Got it. That’s helpful. I’ll jump back in the queue. Thank you.

Gayn Erickson: Okay. Thanks, Jed.

Operator: Thank you. [Operator Instructions] Up next we have Larry Chlebina with Chlebina Capital. Please proceed.

Larry Chlebina: Hi, Gayn. How you doing? Corning’s CEO on his last quarter earnings report, he was really optimistic on what he called the second optical network that’s going to be deployed hooking up GPUs and AI data centers. And since you were pushed to ship your optical IO production system to get it out as soon as possible, do you have a sense of when this may show up in the marketplace?

Gayn Erickson: Yes. And I — okay. So it’s one of the most — I feel like it’s one of the most tightly guarded secrets, okay? And I don’t believe that we’re even being told everything correctly. That sounds probably, you don’t want to hear that, but I think we — I know more than I can say and I still do we have everything. What I have mentioned I think you’ve heard me in the past and what I sort of struggled with is, if you go out and you look at someone like a [YOL] (ph) who’s really smart and understands this optical space very well, okay. And they look at the optical IO, they’re like, well, I’m not sure how big that market’s going to be, et cetera, et cetera. It’s like, oh, what does NVIDIA or AMD tell you? Oh, they won’t tell me anything.

Like, you got your own figure, right? Of course they’re not telling us. The reality in my mind is what AMD, Intel, NVIDIA, pick your other processor [indiscernible], what their plans are, that’s what’s going to drive it. And those are very closed environments. They are not — I don’t believe for a minute that NVIDIA and AMD are talking together about how they can get their processors to talk to each other, okay? So you kind of have to watch on the edges. You watch where the investments are made, you watch what’s going on, you see the technology, you watch patents, you watch tech. But my belief is, and I kind of shared this even about a year ago, it feels like we’re a couple years out to volume production, and the question is, how big is it and could it be much sooner than that?

You know, we’re enabling that with our solutions and capabilities and there was a big pull for it. And keep in mind, we also have the same capability on our NP systems installed at customers. So you don’t have to see all of the front edge of this simply with new systems, but we would see it with wafer packs. So there’s a lot of design activities that are going on right now that seem pretty interesting to me, but I’m a believer. It makes sense, it is a critical bandwidth, it’s going to be a pinch point, I think it’s going to be a differentiator with all the AI guys and it also may have the byproduct of then expanding the need for more optical even within the data centers.