Strike gold with the golden years…

The U.S. population of 85-plus is growing at a much faster rate than the rest of the country’s population, according to the U.S. Census Bureau. By 2025, the population of 85-plus is projected to reach 25% compared to 15% for those under 85. And although the current growth rate of seniors who are 85-plus sits right at 5%, it could double in just four years.

These undeniable demographic trends and the stock’s consistent performance, make Senior Housing a great addition to any retirement portfolio. It’s already a core holding in many of my client’s portfolios. Carla Pasternak, director of income research for StreetAuthority’s High-Yield Investing , also has recommended it as a key Retirement Savings Stock.

The company has been expanding quickly. This year alone, Senior Housing raised more than $650 million in capital market transactions and has access to a $750 million unsecured credit facility. Despite this fast growth, it’s been able to keep a lowly-levered balance sheet compared to most REITS, with a debt-to-capital ratio of just 30%.

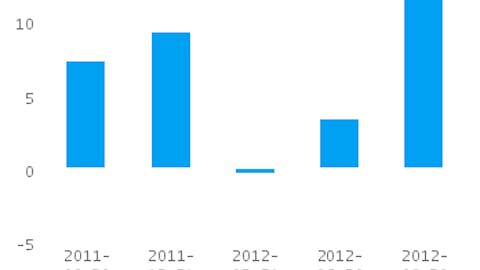

In addition, the company has performed consistently through the years. Besides a growing stock price, Senior Housing has steadily raised the dividend from $1.20 a share in 2000 to a recent $1.56 a share, which brings the yield to roughly 7%. Add that to capital appreciation and you have a compounded annual return of 55% during the past 12 years. Not bad for a “lost decade” of investing…

The fact that REITs are required by law to pay 90% of their income as dividends to shareholders — regardless of whether their share price goes up or down — makes this an even sweeter deal.

Risks to Consider: Although the lion’s share of Senior Housing is private pay — which implies relatively affluent tenants — tougher economic conditions or external circumstances such as inflation, could affect the company’s pool of qualified prospects in the senior lifestyle and assisted-living segment. In addition, as part as their different tax structure, REITs don’t pay income taxes. This means their dividends are usually fully taxable.

Action to Take –> I see Senior Housing as a long-term holding, especially if you are building a retirement, income-focused portfolio. This doesn’t mean the stock can’t perform well in the short term. Based on favorable long-term demographics and the company’s historic consistency, a 12-month price target of $29 is completely reasonable. Factoring in dividend income, this translates into a 33% total return.

This article was originally written by Adam Fischbaum, and posted on StreetAuthority.