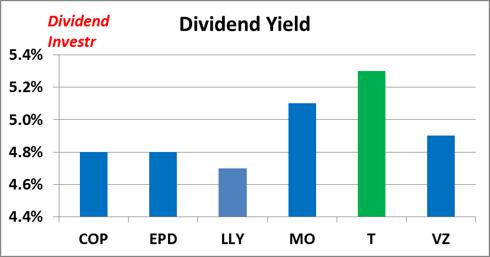

Dividend stocks offer a way for investors to earn a return regularly before realizing any gains from the sale of the stock. Large companies, like those with market caps over $40 billion (mega-cap) tend to be fairly consistent in paying dividends. Below we complied a list of 6 mega-cap stocks that have a market cap of over $40 billion and dividend yields higher than 4%. We obtained market data from Finviz and MSN Money.

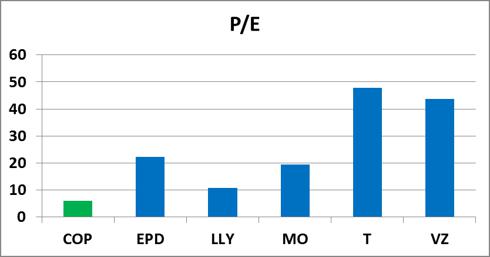

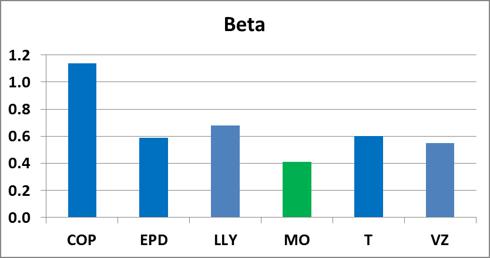

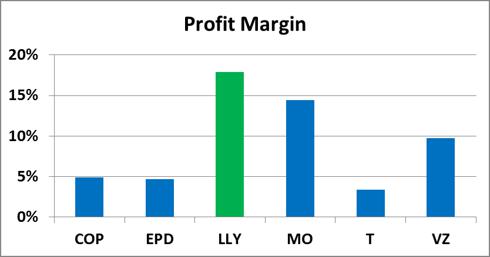

| Stock | Market Cap (Billion $) | Sector | Dividend Yield | P/E | Beta | Profit Margin |

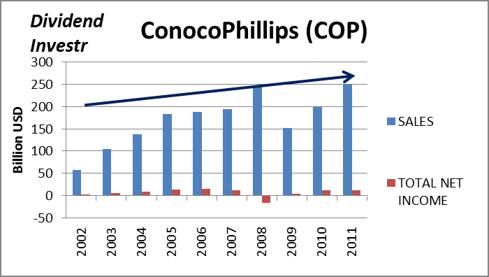

| ConocoPhillips (COP) | 69.5 | Basic Materials | 4.8% | 6.0 | 1.14 | 4.9% |

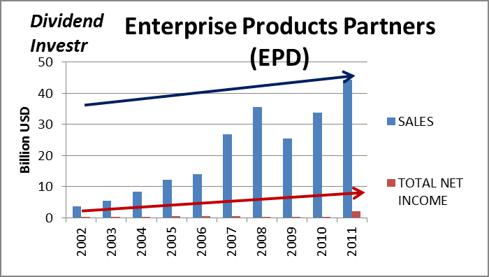

| Enterprise Products Partners (EPD) | 46.7 | Basic Materials | 4.8% | 22.2 | 0.59 | 4.7% |

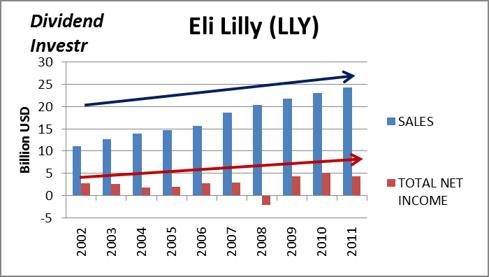

| Eli Lilly (LLY) | 48.1 | Healthcare | 4.7% | 10.8 | 0.68 | 17.9% |

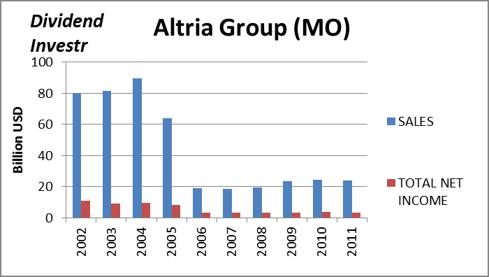

| Altria Group (MO) | 65.9 | Consumer Goods | 5.1% | 19.4 | 0.41 | 14.4% |

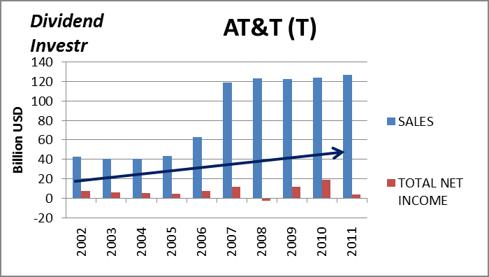

| AT&T (T) | 194.1 | Technology | 5.3% | 47.9 | 0.6 | 3.4% |

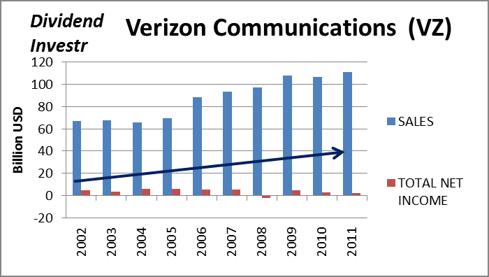

| Verizon Communications (VZ) | 115.3 | Technology | 4.9% | 43.7 | 0.55 | 9.7% |

Click on graphics below to enlarge:

ConocoPhillips is an integrated energy company operating worldwide. COP has plans to sell $10 billion of assets in 2012, namely from Vietnam. COP recently traded at $54.13 and has a 4.8% dividend yield. ConocoPhillips lost 0.3% during the past 12 months. The stock has a market cap of $69.5 billion, P/E ratio of 6 and Total Debt/Equity ratio of 0.41. COP also had an EPS growth rate of -1.5% during the last five years.

Enterprise Products Partners provides midstream energy services to producers and consumers of natural gas, NGLs, crude oil, refined products, and petrochemicals in North America. EPD recently traded at $52.56 and has a 4.8% dividend yield. EPD gained 34.6% during the past 12 months. The stock has a market cap of $46.7 billion, P/E ratio of 22.2 and Total Debt/Equity ratio of 1.2. EPD also had an EPS growth rate of 14.4% during the last five years.

Eli Lilly provides pharmaceutical products worldwide. Eli Lilly recently reported some news with a strong Q1 with EPS of $0.92 versus consensus estimates of $0.78. Eli Lilly recently traded at $41.34 and has a 4.7% dividend yield. Eli Lilly gained 14.8% during the past 12 months. The stock has a market cap of $48.1 billion, P/E ratio of 10.8 and Total Debt/Equity ratio of 0.52. Eli Lilly also had an EPS growth rate of 9.8% during the last five years.

Altria Group provides cigarettes, smokeless products, and wine worldwide. MO recently traded at $32.57 and has a 5.1% dividend yield. MO gained 26.9% during the past 12 months. The stock has a market cap of $65.9 billion, P/E ratio of 19.4 and Total Debt/Equity ratio of 3.7. MO also had an EPS growth rate of 1.6% during the last five years. Louis Navellier initiated a $34 million position in MO during the last quarter of 2011.

AT&T is a domestic telecom services company with a $194 billion market cap. AT&T recently traded at $33.12 and has a 5.3% dividend yield. AT&T gained 9.8% during the past 12 months. The stock has a P/E ratio of 47.9 and Total Debt/Equity ratio of 0.63. AT&T also had an EPS growth rate of -18.8% during the last five years.

Verizon Communications is a domestic telecom services company.Verizon now leads the wireless services sector in USA with more than 107.8 million connections (including 92.8 million retail customers and 15.6 million wholesale & other connections), and ranks second in the wire-line sector after AT&T . Verizon recently traded at $40.69 and has a 4.9% dividend yield. Verizon gained 13.3% during the past 12 months. The stock has a market cap of $115.3 billion, P/E ratio of 43.7 and Total Debt/Equity ratio of 1.41. Verizon also had an EPS growth rate of -14.7% during the last five years.

Note: This article is a guest post by Dividendinvestr.