In this article, we discussed the 14 Best Warren Buffett Stocks to Invest in.

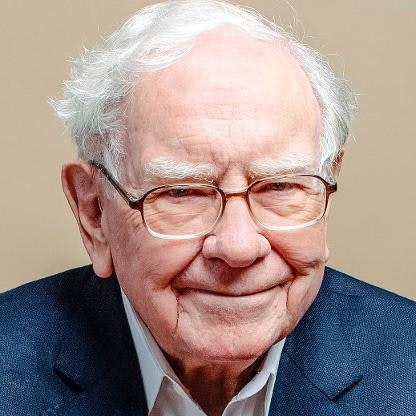

Having built a fortune of $142.7 billion with a disciplined focus on identifying undervalued companies with solid fundamentals, Warren Buffett is considered one of the greatest investors of all time. Starting his journey toward wealth creation at an early age, he eventually acquired Berkshire Hathaway in 1965, which was a struggling textile business at the time, transforming it into a diversified $1 trillion conglomerate. Today, the company’s portfolio includes iconic brands such as Dairy Queen and GEICO, alongside several publicly traded stocks. His success is marked by strong principles like “never lose money” and “buy businesses, not stocks.” Furthermore, his investment philosophy has consistently revolved around early investments, reinvesting profits, and maintaining a long-term perspective.

Meanwhile, companies with stable revenue, solid profitability, and reliable dividend payouts have always drawn the investor’s attention. Buffett preferred such stocks due to their ability to drive compounding cash flow and sustained growth. This strategy’s success is evident in his company’s performance, where a $500 investment in 1965 has grown into a multi-million-dollar holding.

With this backdrop in mind, let’s move on to our list of the 14 Best Warren Buffett Stocks to Invest in.

Our Methodology

To curate our list of the 14 Best Warren Buffett Stocks to Invest in, we scanned Berkshire Hathaway’s investment portfolio to extract stocks, ranking these stocks in ascending order based on the number of hedge funds holding stakes in the respective stocks, as of Q1 2025. For this purpose, we used Insider Monkey’s hedge fund database, which tracks over 1,000 hedge funds. For stocks tied based on hedge fund interest, we used Berkshire Hathaway’s stake value in them as of the end of Q1 2025.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

14. Charter Communications, Inc. (NASDAQ:CHTR)

Number of Hedge Fund Holders: 59

Berkshire Hathaway Stake Value: $731,258,969

With a significant presence in Warren Buffett’s portfolio and strong hedge fund interest, Charter Communications, Inc. (NASDAQ:CHTR) secures a spot on our list of the 14 Best Warren Buffett Stocks to Invest in.

Following the company’s softer-than-expected Q2 results, UBS reduced its price target on Charter Communications, Inc. (NASDAQ:CHTR) from $425 to $355, maintaining a ‘Neutral’ rating. CHTR reported a modest 0.6% YoY growth, taking its revenue to $55.22 billion, while adjusted EBITDA fell by 0.1%. This comes after a 4.8% EBITDA growth in Q1. Meanwhile, its Residential segment’s revenue decreased by 0.4% due to broadband subscriber losses associated with higher non-pay churn among former Affordable Connectivity Program customers.

Looking ahead, UBS expects Q3 revenue to fall by 0.5% and EBITDA to grow only 0.3%. As such, the investment firm reduced its full-year growth expectations to negative 0.1% for revenue and positive 1.1% for EBITDA. Yet, a $1 billion cash tax benefit in 2026 is expected to drive Charter Communications, Inc. (NASDAQ:CHTR)’s $1.6 billion quarterly share buybacks, strengthening its capital strategy amid ongoing market uncertainties.

Charter Communications, Inc. (NASDAQ:CHTR), a leading U.S. broadband and cable TV provider, serves residential and business customers. It is included in our list of the best Warren Buffett stocks.

13. Lennar Corporation (NYSE:LEN)

Number of Hedge Fund Holders: 62

Berkshire Hathaway Stake Value: $16,641,028

Lennar Corporation (NYSE:LEN) is included in our list of the 14 Best Warren Buffett Stocks to Invest in.

On August 4, 2025, Lennar Corporation (NYSE:LEN) announced a change in its leadership. After helping the company with its expansion, legal challenges, and shifting economic cycles, Mark Sustana, General Counsel and Vice President, will retire on September 2, 2025. Sustana will continue serving the company as a consultant. Katherine Lee Martin, a legal expert who has served Hertz, X Corp., and the U.S. Department of Justice previously, will replace Sustana, joining as Chief Legal Officer, the same day.

Furthermore, Lennar Corporation (NYSE:LEN) also announced that Fred Rothman, Chief Operating Officer, will retire on September 2, after serving the company for almost 20 years. Rothman has helped the company with its scaling operations, implementation of a land-light strategy, and veteran housing initiatives. He will also keep serving the company as a consultant.

Operating across the U.S., Lennar Corporation (NYSE:LEN) builds high-quality yet affordable homes, offering mortgage, title, and multifamily rental services. It is included in our list of the best Warren Buffett stocks.

12. The Kroger Co. (NYSE:KR)

Number of Hedge Fund Holders: 64

Berkshire Hathaway Stake Value: $3,384,499,999

With a significant presence in Warren Buffett’s portfolio and strong hedge fund interest, The Kroger Co. (NYSE:KR) secures a spot on our list of the 14 Best Warren Buffett Stocks to Invest in.

On July 29, 2025, The Kroger Co. (NYSE:KR) announced leadership changes, aiming to strengthen its operations and enhance customer experience. Bringing over 25 years of retail and supply chain experience, Ed Oldham, who previously served at PetSmart, has joined the company as Head of Sourcing.

Meanwhile, Ann Reed, who brings decades of merchandising and leadership experience, will serve as Group Vice President of Our Brands. She previously worked as president of the Cincinnati-Dayton division.

Replacing Reed, Jake Cannon, who was previously president of the Louisville division, has taken over the role of Cincinnati-Dayton president. Lastly, Josh Harpole, who previously worked as Vice President of Deli, Bakery, and Prepared Foods, will replace Jake Cannon’s former role.

CEO Ron Sargent expects an inflow of deep operational knowledge, customer focus, and commitment to community with these leadership changes, setting up The Kroger Co. (NYSE:KR) for continued growth in a competitive market.

The Kroger Co. (NYSE:KR), based in Cincinnati, Ohio, operates as one of the largest food and drug retailers in the U.S. It is included in our list of the best Warren Buffett stocks.

11. Aon plc (NYSE:AON)

Number of Hedge Fund Holders: 68

Berkshire Hathaway Stake Value: $1,636,269,000

Aon plc (NYSE:AON) is included in our list of the 14 Best Warren Buffett Stocks to Invest in.

Previously, on July 7, 2025, Barclays reduced its price target on Aon plc (NYSE:AON) from $415 to $401, maintaining an ‘Overweight’ rating. The price target revision was attributed to expectations for softening rates and unfavorable business mix, resulting in margin pressures in the property and casualty carriers market. At the same time, the analyst expects strong capital return and unique tailwinds in the reinsurance market.

However, on July 31, 2025, the analyst reversed course, raising the price target on Aon plc (NYSE:AON) to $420, driven by the company’s latest earnings results. With the earnings release, there’s renewed confidence in the company’s performance despite broader market headwinds.

Aon plc (NYSE:AON) offers risk, retirement, and health solutions, serving clients in more than 120 countries. It is included in our list of the best Warren Buffett stocks.

10. T-Mobile US, Inc. (NASDAQ:TMUS)

Number of Hedge Fund Holders: 75

Berkshire Hathaway Stake Value: $1,035,673,603

With a significant presence in Warren Buffett’s portfolio and strong hedge fund interest, T-Mobile US, Inc. (NASDAQ:TMUS) secures a spot on our list of the 14 Best Warren Buffett Stocks to Invest in.

On July 25, 2025, RBC Capital increased its price target on T-Mobile US, Inc. (NASDAQ:TMUS) from $265 to $270, maintaining a ‘Sector Perform’ rating. This comes after the company’s strong Q2, where it beat expectations on EBITDA, free cash flow, and subscriber growth. Thanks to the stronger-than-expected Q2 performance, TMUS raised the lower end of its guidance for EBITDA, operating cash flow, and free cash flow by $100 million.

Furthermore, T-Mobile US, Inc. (NASDAQ:TMUS) raised its guidance for postpaid phone net additions due to strong customer demand and retention. Thus, the investment firm’s price revision highlights the growing confidence in the company’s operational momentum amid intense competition in the telecom market.

Serving millions of subscribers, T-Mobile US, Inc. (NASDAQ:TMUS) operates as a leading American wireless network operator. It is included in our list of the best Warren Buffett stocks.

9. American Express Company (NYSE:AXP)

Number of Hedge Fund Holders: 75

Berkshire Hathaway Stake Value: $40,790,858,835

American Express Company (NYSE:AXP) is included in our list of the 14 Best Warren Buffett Stocks to Invest in.

On July 21, 2025, Deutsche Bank increased its price target on American Express Company (NYSE:AXP) from $371 to $375, maintaining a ‘Buy’ rating. This price target revision reflects the strong Q2 performance of the company.

American Express Company (NYSE:AXP) recorded stronger-than-expected revenue, positioning it well for continued growth. While expenses were on the higher side, they remained within the company’s guidance range, aligning with the robust revenue performance. The price revision reflects the optimism that the company will sustain momentum in the second half of the year, driven by solid consumer spending trends and disciplined financial management.

American Express Company (NYSE:AXP), a global financial services company, offers credit cards, charge cards, and travel-related services. It is included in our list of the best Warren Buffett stocks.

8. Moody’s Corporation (NYSE:MCO)

Number of Hedge Fund Holders: 82

Berkshire Hathaway Stake Value: $11,488,468,917

With a significant presence in Warren Buffett’s portfolio and strong hedge fund interest, Moody’s Corporation (NYSE:MCO) secures a spot on our list of the 14 Best Warren Buffett Stocks to Invest in.

On July 23, 2025, Moody’s Corporation (NYSE:MCO) announced its results for Q2 2025. The company recorded adjusted earnings per share (EPS) of $3.56, exceeding estimates of $3.39 per share. Meanwhile, resilient Ratings performance, strong growth in Moody’s Analytics (up 11%), and increasing demand for private credit ratings (up 75% from a low base) helped the company achieve a 4% YoY revenue increase, taking it to $1.9 billion. While softness remained in April for the issuance market, May and June brought strong momentum, resulting in the second consecutive quarter of over $1 billion in Ratings revenue.

Furthermore, Moody’s Corporation (NYSE:MCO)’s Private Credit segment accounted for nearly 25% of first-time mandates, remaining a standout. Meanwhile, key strategic partnerships, including MSCI and Microsoft, enhanced the company’s positioning within data, AI, and workflow solutions. Moreover, AI-enabled offerings and insurance solutions experienced strong growth, further expanding the company’s recurring revenue to 96% of the total. Looking ahead, the company raised its MIS revenue growth guidance to the low-to-mid single digits for 2025. A 10% EPS growth is projected at the midpoint for the full year.

With its credit ratings, risk analysis, and financial intelligence solutions, Moody’s Corporation (NYSE:MCO) helps businesses, governments, and investors make informed decisions. It is included in our list of the best Warren Buffett stocks.

7. The Coca-Cola Company (NYSE:KO)

Number of Hedge Fund Holders: 87

Berkshire Hathaway Stake Value: $28,648,000,000

The Coca-Cola Company (NYSE:KO) is included in our list of the 14 Best Warren Buffett Stocks to Invest in.

On July 22, 2025, The Coca-Cola Company (NYSE:KO) announced its results for Q2. The company’s organic revenue, gross margin, and operating profit surpassed analyst forecasts. While its gross margin hit 61.07%, its core EPS is now nearing the high end of its guidance, thanks to easing foreign exchange pressures.

However, The Coca-Cola Company (NYSE:KO) expects low-single-digit second-half EPS growth, which is below mid-single-digit Street expectations. As such, the company’s shares trailed the Consumer Staples Select Sector SPDR Fund (XLP) by 150 basis points on the day of its earnings release.

On the same day, UBS reduced its price target on The Coca-Cola Company (NYSE:KO) from $86 to $84, maintaining a ‘Buy’ rating. The investment firm remains bullish on the company due to expectations for a potentially stronger FY2026 performance compared to its peers. Furthermore, the bullish rating is reinforced by the company’s consistent top and bottom-line growth.

The Coca-Cola Company (NYSE:KO) is a multinational beverages company, producing and marketing soft drinks, juices, teas, and bottled water. It is included in our list of the best Warren Buffett stocks.

6. Capital One Financial Corporation (NYSE:COF)

Number of Hedge Fund Holders: 93

Berkshire Hathaway Stake Value: $1,281,995,000

With a significant presence in Warren Buffett’s portfolio and strong hedge fund interest, Capital One Financial Corporation (NYSE:COF) secures a spot on our list of the 14 Best Warren Buffett Stocks to Invest in.

On July 22, 2025, Capital One Financial Corporation (NYSE:COF) released its second-quarter results. Costs associated with its Discover acquisition resulted in a net loss of $4.3 billion. Meanwhile, its adjusted earnings reached $2.8 billion, thanks to strong operational performance. Moreover, the partial-quarter contribution from Discover boosted revenue. Pre-provision earnings surged 34%. The company looks ahead with confidence, seeing long-term growth potential because of the deal.

Following the earnings release, Redburn Atlantic initiated coverage on Capital One Financial Corporation (NYSE:COF) on August 1, 2025, with a ‘Buy’ rating and a $290 price target. The company’s shares are trading at $208.23, as of the time of writing. The analyst’s bullish rating is driven by the expectations for operational gains and synergies from the Discover acquisition.

Operating through its Credit Card, Consumer Banking, and Commercial Banking segments, Capital One Financial Corporation (NYSE:COF) offers credit cards, auto loans, banking, and savings products. It is included in our list of the best Warren Buffett stocks.

5. Bank of America Corporation (NYSE:BAC)

Number of Hedge Fund Holders: 117

Berkshire Hathaway Stake Value: $26,355,563,449

Bank of America Corporation (NYSE:BAC) is included in our list of the 14 Best Warren Buffett Stocks to Invest in.

On August 6, 2025, Bank of America Corporation (NYSE:BAC) announced that Christine Williams, who previously served the bank as Retail Banking Business Control Executive, will now assume the role of President of its Myrtle Beach market. Under this new role, she will lead integration across the bank’s eight lines of business, strengthening local connections and identifying opportunities to expand and deepen client relationships.

Bank of America Corporation (NYSE:BAC) expects that this leadership will enhance its operational strength, driven by Williams’ ability to foster strong ties with teammates, clients, and the community to drive responsible growth.

With a presence in over 35 countries, Bank of America Corporation (NYSE:BAC) offers banking, investing, asset management, and other financial and risk management services. It is included in our list of the best Warren Buffett stocks.

4. Mastercard Incorporated (NYSE:MA)

Number of Hedge Fund Holders: 155

Berkshire Hathaway Stake Value: $2,185,161,502

With a significant presence in Warren Buffett’s portfolio and strong hedge fund interest, Mastercard Incorporated (NYSE:MA) secures a spot on our list of the 14 Best Warren Buffett Stocks to Invest in.

On August 1, 2025, RBC Capital raised its price target on Mastercard Incorporated (NYSE:MA) from $650 to $656, maintaining an ‘Outperform’ rating. The price revision follows the company’s better-than-expected quarterly results. The quarterly results were also marked by guidance increase for the full year.

The analyst believes Mastercard Incorporated (NYSE:MA)’s business trends remained stable through the quarter and into July. Accordingly, consumer spending is expected to remain resilient for the rest of the year. Thus, RBC Capital expects upside potential as the company’s growth drivers remain intact and execution remains strong.

Operating in the U.S. and the rest of the world, Mastercard Incorporated (NYSE:MA) offers transaction processing and other payment-related products and services. It is included in our list of the best Warren Buffett stocks.

3. Apple Inc. (NASDAQ:AAPL)

Number of Hedge Fund Holders: 159

Berkshire Hathaway Stake Value: $66,639,000,000

Apple Inc. (NASDAQ:AAPL) is included in our list of the 14 Best Warren Buffett Stocks to Invest in.

On August 7, 2025, Apple Inc. (NASDAQ:AAPL) announced an additional $100 billion investment, raising its total domestic commitment to $600 billion over the next four years. This move follows the company’s February pledge of $500 billion and 20,000 new jobs. With this announcement, Apple extends its commitment to support its American Manufacturing Program, expanding U.S. manufacturing and supply chain capacity amid continued tariff tensions.

Furthermore, Apple Inc. (NASDAQ:AAPL) announced the expansion of its partnership with Corning. With this partnership, the company intends to increase smartphone glass production at Corning’s Kentucky plant, increasing domestic component sourcing.

Following these critical developments, Wedbush reaffirmed its ‘Outperform’ rating on Apple Inc. (NASDAQ:AAPL) with a $270 price target.

Apple Inc. (NASDAQ:AAPL) manufactures smartphones, personal computers, tablets, wearables, and accessories. It also sells related software and services globally. It is included in our list of the best Warren Buffett stocks.

2. Visa Inc. (NYSE:V)

Number of Hedge Fund Holders: 165

Berkshire Hathaway Stake Value: $2,907,927,832

With a significant presence in Warren Buffett’s portfolio and strong hedge fund interest, Visa Inc. (NYSE:V) secures a spot on our list of the 14 Best Warren Buffett Stocks to Invest in.

On July 30, 2025, Morgan Stanley raised its price target on Visa Inc. (NYSE:V) from $386 to $402, maintaining an ‘Overweight’ rating. This price revision is attributed to the company’s June-quarter earnings beat. Still, its share price was down 3% on the day of earnings release, primarily due to no change in the full-year revenue outlook. However, the investment firm believes that this is typical for the company, which rarely revises guidance in the third quarter. At the same time, the analyst noted that Visa Inc. (NYSE:V) boasts a track record of consistently outperforming in its fiscal fourth quarter.

Visa Inc. (NYSE:V) is a payment-processing company, operating in the U.S. and the rest of the world. It is included in our list of the best Warren Buffett stocks.

1. Amazon.com, Inc. (NASDAQ:AMZN)

Number of Hedge Fund Holders: 328

Berkshire Hathaway Stake Value: $1,902,600,000

Amazon.com, Inc. (NASDAQ:AMZN) is included in our list of the 14 Best Warren Buffett Stocks to Invest in.

Following the company’s Q2 earnings release on August 1, 2025, DA Davidson increased its price target on Amazon.com, Inc. (NASDAQ:AMZN) from $230 to $265, maintaining a ‘Buy’ rating. This price revision reflects growing retail revenue and growth stabilization in Amazon Web Services (AWS).

While the company’s Q2 revenue and profit beat expectations, the analyst noted investor sentiment was affected by higher Capex guidance for the second half of 2025. Meanwhile, Amazon.com, Inc. (NASDAQ:AMZN) highlighted growing demand for AWS compute capacity, which continues to exceed supply.

On the same day, Citigroup also reiterated its ‘Buy’ rating on Amazon.com, Inc. (NASDAQ:AMZN), raising its price target from $265 to $270.

With its North America, International, and Amazon Web Services (AWS) segments, Amazon.com, Inc. (NASDAQ:AMZN) operates online and physical stores in North America and the rest of the world, offering consumer products, advertising, and subscription services. It is included in our list of the best Warren Buffett stocks.

While we acknowledge the potential of AMZN to grow, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than AMZN and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: Bill Ackman Stock Portfolio: Top 10 Stock Picks and 13 Best Oil Refinery Stocks to Buy Right Now.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email below.