What are the biggest gainers during the 2008 market crash? We have been receiving questions about recession risks in recent months. Investors believe that they should allocate a bigger percentage of their portfolios into recession resistant stocks. Contrary to investor expectations, several growth stocks including Apple Inc. (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), and Netflix Inc. (NASDAQ:NFLX) grew during the 2008 recession, so investors don’t have to ignore growth stocks to be conservative.

Actually only one of these three stocks (Apple Inc., Amazon.com and Netflix) delivered positive returns during the 2008 crash and found a place in our list. Currently all three stocks are among the 30 most popular stocks among hedge funds though Netflix is declining sharply in rankings. Investors know that Netflix is recession resistant but they aren’t certain that it is Disney+ resistant.There are some businesses that actually flourish during recessions because budget conscious consumers start paying attention to the prices and flock into discount stores or businesses that enable them to complete their DIY projects at a steep discount to services offered elsewhere. Instead of buying a new car, consumers decide to fix their clunkers and spend their dollars at businesses that cater to this segment of the market. If you want to learn more about these businesses, you should consider visiting 15 business and industries that make money during recession. For example, the fast food industry grew significantly in popularity during the 2008 recession, as it was cheap and many people couldn’t afford anything else.

Insider Monkey is an investment website. Our monthly newsletter’s stock picks returned 72% over the last 33 months and beat the S&P 500 ETFs by 33 percentage points (see more here). We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals.

Image By peshkov – Adobe Stock

Back to the biggest gainers during 2008. The biggest gainers in the 2008 market crash had a lot in common. A large majority of these were ‘defensive’ stocks, which alludes to stock which are generally considered to not be risky. At a time when the global markets were falling, investors were selling and put their money in these stocks to avoid losing everything. These defensive stocks are likely to generate better returns in the next recession as well. There were also some pharmaceutical stocks that returned strong returns and these aren’t as likely to deliver strong returns in the next recession for obvious reasons.

We have determined 10 stocks that went up during the 2008 crash, based on the data available for stock prices during the year. Each of these stocks had a higher share price in March 2009 when compared to September 2008. However, it is important to note that these are not the only stocks which gained in value during the 2008 recession; these are just the most interesting ones. Let’s take a look at these miraculous stocks, which earned their investors double digits returns when the world around them was collapsing:

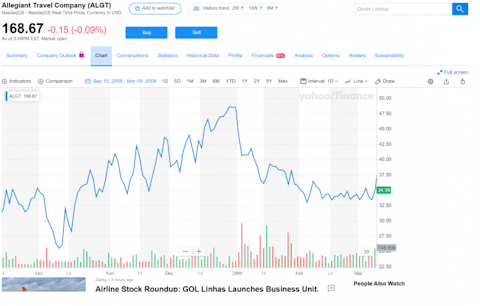

10. Allegiant Travel Company (NASDAQ:ALGT)

When you think of a company which would deliver positive gains during the biggest recession of our lifetime, a travel company would not be your first thought. After all, who would consider travelling at a time when disposable income was but a distant dream. But Allegiant is a budget airline, and due to oil prices falling during the recession, they were actually able to cut their costs while maintaining flights which were at least 90% full.

9. Career Education Corporation (NASDAQ:CECO)

A dark entry perhaps in this list, Career Education Corporation was able to take advantage of the recession by offering education as a surety for jobs in uncertain times. People forked out tens of thousands of dollars on degrees in the hopes that they would guarantee them a job, despite the recession, which certainly shows where the US lacks when compared to other developed nations where for-profit schools are unfathomable.

8. Coca-Cola Consolidated Inc. (NASDAQ:COKE)

Despite the recession, Coke sales never dipped and their volume based business continued to grow, which is why many analysts have labeled Coke as a recession proof stock.