In this article, we discuss the 10 healthcare stocks to buy according to Peter S. Park’s Park West Asset Management based on Q2 holdings of the fund. If you want to skip our detailed analysis of Park’s history, investment philosophy, and hedge fund performance, go directly to the 5 Healthcare Stocks to Buy According to Peter S. Park’s Park West Asset Management.

Mr. Peter S. Park manages Park West Asset Management as its Chief Investment Officer. Park West Asset Management is based in Larkspur, California, and was established by Peter S. Park in November 2002.

Park West Asset Management‘s investing approach is opportunistic. The three significant techniques pursued by the hedge fund are long/short (hedged equity) investment, event-driven investing, and credit/high yield investing. While Park West Asset Management concentrates on these methods, it may diversify from time to time to capitalize on shifting market circumstances and other investment possibilities.

Peter S. Park likes to diversify his portfolio. As a result, his hedge fund has stakes in small and large companies with solid fundamentals and future growth potential. Some of these companies include Square, Inc. (NYSE:SQ), Twitter, Inc. (NYSE:TWTR), and Cloudflare, Inc. (NYSE:NET).

On September 15, Evercore ISI analyst David Togut raised his price target on Square, Inc. (NYSE:SQ) to $371 from $361 and maintained an “Outperform” rating on the shares.

Another notable stock in Peter S. Park’s portfolio is Twitter, Inc. (NYSE:TWTR). The investor owns a $18.61 million stake in the company. On September 13, Goldman Sachs analyst Eric Sheridan initiated coverage of Twitter, Inc. (NYSE:TWTR) with a “Sell” rating and gave his price target of $60.

Why is it important to pay attention to hedge funds’ stock picks? Insider Monkey’s research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 86 percentage points since March 2017. Between March 2017 and July 2021, our monthly newsletter’s stock picks returned 186.1%, vs. 100.1% for the SPY. Our stock picks outperformed the market by more than 86 percentage points (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to. You can subscribe to our free newsletter on our homepage to receive our stories in your inbox.

Here are the 10 healthcare stocks to buy according to Peter S. Park’s Park West Asset Management. We picked these healthcare stocks from the Q2 portfolio of Park’s hedge fund.

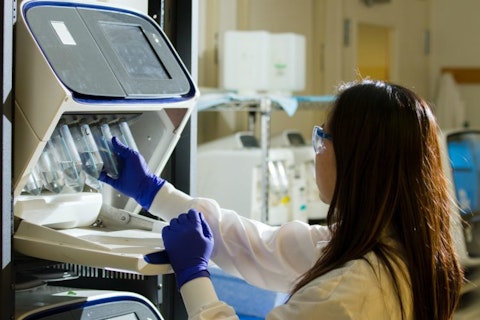

national-cancer-institute-GcrSgHDrniY-unsplash

Healthcare Stocks to Buy According to Peter S. Park’s Park West Asset Management

10. Viking Therapeutics, Inc. (NASDAQ:VKTX)

Park’s Stake Value: $9,995,000

Percentage of Peter S. Park’s 13F Portfolio: 0.28%

Number of Hedge Fund Holders: 13

Viking Therapeutics, Inc. (NASDAQ:VKTX) is a clinical-stage biopharmaceutical firm that develops metabolic and endocrine diseases treatments. The company was incorporated in 2012 and is placed tenth on the list of 10 healthcare stocks to buy according to Peter S. Park’s Park West Asset Management.

On July 29, BTIG analyst Justin Zelin initiated coverage of Viking Therapeutics, Inc. (NASDAQ:VKTX) with a “Buy” rating and gave his price target of $20.

Peter S. Park’s Park West Asset Management currently holds 1.67 million shares of Viking Therapeutics, Inc. (NASDAQ:VKTX) that amounts to $10 million.

9. Angion Biomedica Corp. (NASDAQ:ANGN)

Park’s Stake Value: $13,009,000

Percentage of Peter S. Park’s 13F Portfolio: 0.37%

Number of Hedge Fund Holders: 9

Angion Biomedica Corp. (NASDAQ:ANGN) is a biopharmaceutical firm specializing in the development, marketing, and discovery of small molecule therapies for acute organ damage and fibrotic illnesses.

Park West Asset Management holds 1.01 million shares in Angion Biomedica Corp. (NASDAQ:ANGN) worth over $13.01 million, representing 0.37% of their portfolio. The hedge fund has trimmed its stake in the firm by 5% in the second quarter of 2021. Mark Lampert’s Biotechnology Value Fund / BVF Inc is a leading shareholder in Angion Biomedica Corp. (NASDAQ:ANGN) with 1.04 million shares worth $13.50 million.

In addition to Square, Inc. (NYSE:SQ), Twitter, Inc. (NYSE:TWTR), and Cloudflare, Inc. (NYSE:NET), Angion Biomedica Corp. (NASDAQ:ANGN) is one of the stocks preferred by Peter S. Park.

8. The Beauty Health Company (NASDAQ:SKIN)

Park’s Stake Value: $17,271,000

Percentage of Peter S. Park’s 13F Portfolio: 0.49%

Number of Hedge Fund Holders: 33

The Beauty Health Company (NASDAQ:SKIN) is a beauty and health firm that focuses on developing new products.

On September 1, Piper Sandler analyst Erinn Murphy raised her price target on The Beauty Health Company (NASDAQ:SKIN) to $33 from $27 and kept an “Overweight” rating on the shares.

The stock is a new arrival on Peter S. Park’s portfolio, as his hedge fund bought about 1.03 million shares of The Beauty Health Company (NASDAQ:SKIN), worth $17.27 million. Redmile Group, with 6.35 million shares, is the most significant stakeholder in The Beauty Health Company (NASDAQ:SKIN).

7. PLx Pharma Inc. (NASDAQ:PLXP)

Park’s Stake Value: $20,330,000

Percentage of Peter S. Park’s 13F Portfolio: 0.57%

Number of Hedge Fund Holders: 8

PLx Pharma Inc. (NASDAQ:PLXP) is a late-stage specialized pharmaceutical business focusing on our PLxGuardTM drug delivery platform, which has been clinically proven and is covered by a patent. It was incorporated in 2002 and is placed seventh on the list of 10 healthcare stocks to buy according to Peter S. Park’s Park West Asset Management.

On September 21, BWS Financial analyst Hamed Khorsand initiated coverage of PLx Pharma Inc. (NASDAQ:PLXP) with a “Buy” rating, setting his price target at $29.

Park West Asset Management holds 1.47 million shares in PLx Pharma Inc. (NASDAQ:PLXP), worth over $20.33 million, representing 0.57% of their portfolio.

6. Evolent Health, Inc. (NYSE:EVH)

Park’s Stake Value: $21,625,000

Percentage of Peter S. Park’s 13F Portfolio: 0.61%

Number of Hedge Fund Holders: 24

Evolent Health, Inc. (NYSE:EVH) provides health care delivery and payment solutions in the United States through its subsidiary, Evolent Health LLC. It was incorporated in 2011 and is ranked sixth on the list of 10 healthcare stocks to buy according to Peter S. Park’s Park West Asset Management.

On September 13, BTIG analyst David Larsen raised his price target on Evolent Health, Inc. (NYSE:EVH) to $35 from $30 and kept a “Buy” rating on the shares.

Click to continue reading and see 5 Healthcare Stocks to Buy According to Peter S. Park’s Park West Asset Management.

Suggested articles:

- 10 Cheap Healthcare Stocks To Buy Now

- Top 10 Large-Cap Healthcare Stocks to Buy Now

- 15 Best Small-Cap Healthcare Stocks to Buy

Disclosure: None. 10 Healthcare Stocks to Buy According to Peter S. Park’s Park West Asset Management is originally published on Insider Monkey.