Speaking on CNBC’s ‘Fast Money’, Wedbush analyst Dan Ives recently revealed that he believes that the AI revolution is hitting its next stage of growth. 2026, he noted, is going to be the year of AI monetization for the tech sector.

Ives forecast 20-25% upside for the Big Tech names, with an acceleration already seen in AI deals from hyperscalers in the recent weeks.

“We believe that 2026 will be another strong year for the tech trade with the AI Revolution front and center as the AI infrastructure getting built out throughout 2025 will lead to transformational monetization opportunities into 2026 and beyond,” said analysts led by Daniel Ives.

According to the analysts, these are still very early days in the AI Revolution as more enterprise customers and CIOs discover what role AI will be playing in their respective organizations. This will in turn drive massive AI strategic deployments in the future.

“In our view Big Tech will continue to lead the market in 2026 along with the 2nd/3rd/4th AI Revolution derivatives trades playing out with monetization and use cases front and center. We expect tech stocks to be up another 20% in 2026 as this next stage of the AI Revolution hits its stride.”

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. The hedge fund data is as of Q3 2025.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 427.7% since May 2014, beating its benchmark by 264 percentage points (see more details here).

10. CrowdStrike Holdings, Inc. (NASDAQ:CRWD)

Number of Hedge Fund Holders: 66

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is one of the 10 Buzzing AI Stocks on Wall Street. On December 1, KeyBanc raised the firm’s price target on the stock to $570 from $510 and kept an “Overweight” rating on the shares. The firm is optimistic about Crowdstrike’s role as a consolidator and leader in agentic SOC.

According to the firm, Crowdstrike is becoming a leader in its category and is best positioned to “deliver upon an agentic SOC strategy.” However, solid firm checks and positive qualitative feedback still aren’t strong enough to serve as a positive catalyst on earnings.

CrowdStrike (CRWD) will be reporting their next quarter earnings on Tuesday, December 02, 2025.

“We see opportunity for ~$255M NNARR in F3Q (+15% q/q, vs. 13% in FY22/FY24). Key questions for the call: update to FY27 NNARR guide of +20% y/y, expected FCF margins in FY27, M&A strategy (identity, network, observability), AI contribution, timing of transitioning to a Flexonly licensing model, Falcon re-flexes in the quarter…”

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is a leader in AI-driven endpoint and cloud workload protection.

9. Marvell Technology, Inc. (NASDAQ:MRVL)

Number of Hedge Fund Holders: 77

Marvell Technology, Inc. (NASDAQ:MRVL) is one of the 10 Buzzing AI Stocks on Wall Street. On December 1, Morgan Stanley reiterated the stock as “Equal Weight” and raised its price target on the stock ahead of earnings on Tuesday to $86 per share from $76. “

“We expect strength in optical to continue, and are hopeful that the expectations shortfalls on Trainium are behind us.”

On the same day, shares of the stock rose after the company announced an expanded collaboration with Microsoft to extend cloud security services in Europe. These services will be powered by Marvell LiquidSecurity hardware security modules (HSMs), adding to existing cloud-based security offerings in Asia and North America.

“Marvell has been the pioneer in cloud-based HSMs and remains the industry leader. Common Criteria EAL4+ and eIDAS certifications represent the latest steps by Marvell in forging a more diverse and larger market for HSM services.”

-Michela Menting, senior research director at ABI Research.

Marvell Technology, Inc. (NASDAQ:MRVL) engages in the development and production of semiconductors, focusing heavily on data centers.

8. Snowflake Inc. (NYSE:SNOW)

Number of Hedge Fund Holders: 102

Snowflake Inc. (NYSE:SNOW) is one of the 10 Buzzing AI Stocks on Wall Street. On December 1, DA Davidson raised its price target on the stock to $300 from $275 while maintaining a “Buy” rating.

The firm is optimistic on the stock ahead of its third-quarter earnings report, citing Salesforce as one of the best stories in Software.

According to the firm, conversations with The Den as well as DaVinci Developer Data indicate that Snowflake is witnessing strength across its product portfolio.

Snowflake’s upcoming 3Q26 earnings on Wednesday, December 3, will offer deeper insights into the firm’s top infrastructure pick.

“This past quarter, we’re observing strength across Snowflake’s products supported by the conversations we’ve held with The DEN, along with our DaVinci Developer Data that’s indicating significantly accelerating growth particularly in the core data warehouse. Given what remains as arguably one of the best stories in Software, we reiterate our BUY rating and raise our price target to $300 from $275.”

Snowflake Inc. (NYSE:SNOW) is a cloud-based data storage company providing a data analysis, storage, and sharing platform.

7. Salesforce, Inc. (NYSE:CRM)

Number of Hedge Fund Holders: 119

Salesforce, Inc. (NYSE:CRM) is one of the 10 Buzzing AI Stocks on Wall Street. On December 1, Oppenheimer maintained an “Outperform” rating on the stock but reduced its price target to $300.00 from $315.00 due to lower group multiples. The firm is staying optimistic on the stock ahead of F3Q results despite muted near-term catalysts.

Oppenheimer’s optimism stems from Salesforce’s long-term AI positioning, supported by “pricing benefits, strong Agentforce and Data Cloud momentum.” The firm’s 4Q customer and IT spending surveys indicate normal end-of-year seasonality, and “with low expectations and bar to overcome this quarter.”

While upcoming results are not anticipated to shift sentiment significantly, the firm believes that Salesforce should be a winner in the AI transition owing to the “breadth and richness of its customer data,” and also because of the CEOs focus on steering it through this transition.

Continued margin growth and closing of the Informatica deal removes an overhang, analysts noted.

“Additionally, margin growth continues, Informatica closing removes an overhang, and an 8% FCF yield limits further downside. Lower PT to $300 from $315 on lower group multiples.”

Salesforce, Inc. (NYSE:CRM) is a cloud-based CRM company that has gained popularity after it unveiled its AI-powered platform called Agentforce.

6. Tesla, Inc. (NASDAQ:TSLA)

Number of Hedge Fund Holders: 120

Tesla, Inc. (NASDAQ:TSLA) is one of the 10 Buzzing AI Stocks on Wall Street. On December 1st, TD Cowen analyst Itay Michaeli reiterated a “Buy” rating on the stock with a $509.00 price target. The rating affirmation follows the firm’s direct experience testing RoboTaxi rides in Austin, reinforcing confidence in Tesla’s autonomy progress.

The firm recounted testing three Tesla RoboTaxi rides in Austin, covering an estimated 40 miles at $1.08/mile. Overall, analysts found the rides to be impressive “all around,” with the autonomous systems handling complex scenarios effectively.

Noting this progress, TD Cowen believes that Tesla is well on track to remove safety monitors in Austin by year-end.

“We had an opportunity to take three Tesla RoboTaxi rides in Austin last week, covering nearly 40 miles over ~2hrs at a $1.08 price/mile. Rides were impressive all around, with two notably complex scenarios (emergency vehicles & construction site) handled very well. Does Tesla seem to be on track to begin removing Austin safety monitors by year-end? We think so. Maintain Buy, $509 target.”

Tesla, Inc. (NASDAQ:TSLA) is an automotive and clean energy company that leverages advanced artificial intelligence in its autonomous driving technology and robotics initiatives.

5. Oracle Corporation (NYSE:ORCL)

Number of Hedge Fund Holders: 122

Oracle Corporation (NYSE:ORCL) is one of the 10 Buzzing AI Stocks on Wall Street. On November 26, HSBC maintained its Buy rating on the stock with a $382.00 price target. The rating affirmation reflects optimism in Oracle’s execution and backlog visibility, but flags the company’s flexibility in finding large-scale data center buildouts.

According to the firm, Oracle hasn’t yet communicated its specific funding approach for building out infrastructure needs, even though there are plenty on the horizon. However, the company has highlighted that large capital-intensive projects can utilize techniques like special purpose vehicles or joint ventures to avoid balance sheet bloat and mitigate risk by delegating to others and the debt markets.

The firm pointed out to Meta’s recent joint venture with Blue Owl Capital as an example of alternative funding structures.

“Meta recently announced a joint venture (JV) with Blue Owl Capital that will issue debt to bond investors through a private offering (source: Meta). The bottom line is that Oracle has successfully contracted over USD500bn of RPO (some of it outside OpenAI), with good revenue timing visibility, and is skillfully planning to meet these commitments.”

The firm believes that Oracle has been refining its data center model for more than a decade to challenge established players such as AWS and Azure. It is also committed to maintaining its investment grade rating and is considering all funding options.

“Oracle has been studying the data center model for more than a decade as it meticulously planned to take share from established players, AWS and Azure. And Oracle has been impressively executing to plan and making tremendous gains against these incumbents. We believe that the company is committed to maintaining its investment grade rating and will consider all funding options, with an eye on mitigating/reallocating risk and potentially using JVs.”

Oracle Corporation (NYSE:ORCL) is a database management and cloud service provider.

4. Apple Inc. (NASDAQ:AAPL)

Number of Hedge Fund Holders: 166

Apple Inc. (NASDAQ:AAPL) is one of the 10 Buzzing AI Stocks on Wall Street. On December 1, JPMorgan has reiterated its Overweight rating on the stock with a $305.00 price target. The rating affirmation follows the firm’s analysis of product availability, highlighting strong y/y iPhone 17 demand due to tighter supply ramp.

According to JPMorgan’s Apple Product Availability Tracker, lead times across the iPhone 17 series increased by one day in week 12. The firm noted that this trend is consistent with seasonal patterns due to increased consumer demand during Black Friday.

Meanwhile, on average lead times are tracking at an estimated 6 days, ahead of 4 days in week 12 of the previous year. This implies better demand trends year over year.

The firm also discussed lead times for the Base model.

“Lead times for the Base model remain in the double-digit days range, continuing to signify that the ramp in supply is still trailing demand, and continues to be the primary driver of higher demand for iPhone 17 series over iPhone 16.”

Weekly trends reveal that the lead times on average increased by 1 day, with base iPhone 17 maintaining stable lead times, iPhone Air and iPhone 17 Pro witnessing increases of two days each, and the iPhone 17 Pro Max experiencing a one-day increase “(vs. an increase of 2 days across each model last year).”

Apple is a technology company known for its consumer electronics, software, and services.

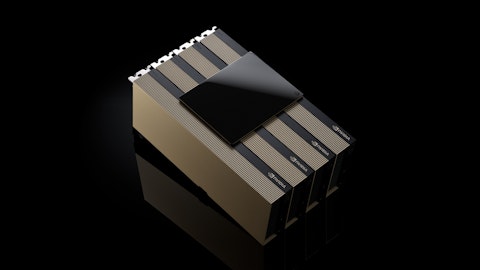

3. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 234

NVIDIA Corporation (NASDAQ:NVDA) is one of the 10 Buzzing AI Stocks on Wall Street. On December 1, Seaport Global Securities analyst Jay Goldberg reiterated a “Sell” rating on the stock with a $140 price target.

The firm has flagged competitive risks such as from Google’s TPUs as well as financial pressure rising from heavy customer investment commitments and working-capital spikes. It believes that Nvidia is facing growing competitive pressure and relying on financial arrangements that are not fully reflected in its results but are already becoming “material.”

Nvidia’s $26 billion of cloud compute service agreements, which it says will support research and its DGX platform, function like rebates that could significantly reduce gross margins (“400bps off gross margins next year, or at least $0.30”)

Moreover, Google’s growing ability to promote third party use of its TPUs, as well as Nvidia’s growing commitments and investments to customers are also adding to the pressure.

“Google has surprised with its ability to promote third party use of its internally designed TPUs. TPUs are not for everyone, but can outperform Nvidia systems on many metrics. ● Growing commitments and investments to customers. The company spent $6 billion this year in private companies. It has commitments for another $17 billion (including $5 billion to Intel). The OpenAI agreement is not signed but could add another $100 billion to the list.”

Seaport Securities also discussed how working capital is significantly up this quarter. While this may be a sign of strong demand, the firm also sees it as a function of the company “smoothing out working capital needs among its ODM customers.”

NVIDIA Corporation (NASDAQ:NVDA) specializes in AI-driven solutions, offering platforms for data centers, self-driving cars, robotics, and cloud services.

2. Alphabet Inc. (NASDAQ:GOOGL)

Number of Hedge Fund Holders: 243

Alphabet Inc. (NASDAQ:GOOGL) is one of the 10 Buzzing AI Stocks on Wall Street. On December 1st, Guggenheim raised its price target on the stock to $375.00 from $330.00, while maintaining a “Buy” rating. Analysts at the firm are optimistic about the company’s AI-led monetization and cloud momentum through 2026, stating that the stock has room to run higher.

According to analyst Michael Morris, the most scaled companies in his coverage are the best positioned to drive investor returns and vast growth next year.

“We expect Alphabet to outperform consensus estimates and see additional relative multiple expansion on further investor confidence that artificial intelligence–driven changes in the business, advertising and consumer marketplaces are expansion opportunities.”

Particularly for Google, three key developments support the firm’s bullish outlook; exceptional cloud backlog growth backed by accelerating enterprise AI demand, YouTube’s continued dominance in streaming viewership, and Google Gemini’s emergence as a leading AI platform.

Guggenheim acknowledged how recent share appreciation reflects positive sentiment, but believes that market may still be underestimating Google’s revenue potential.

“We see a plausible bull case at Cloud that would indicate consensus under-appreciates run-rate revenue potential by ~ $40bn based on backlog growth.”

The firm has raised its 2026 and 2027 revenue and profit estimates for GOOGL supported by upward revisions to Google Cloud segment revenue and further margin expansion.

Alphabet Inc. (NASDAQ:GOOGL) is an American multinational technology conglomerate holding company wholly owning the internet giant Google, amongst other businesses.

1. Meta Platforms, Inc. (NASDAQ:META)

Number of Hedge Fund Investors: 273

Meta Platforms, Inc. (NASDAQ:META) is one of the 10 Buzzing AI Stocks on Wall Street. On November 24, Citizens reiterated its Market Outperform rating on the stock with a price target of $900.00. The rating affirmation follows Meta’s recent developments in artificial intelligence.

Citizens highlighted Meta’s introduction of the Segment Anything Model 3 (SAM 3) on November 19th. The SAM 3 is a promptable computer vision system that allows detecting, segmenting, and tracking a visual concept indicated by text prompts, image exemplars, or both.

The model update enhances the company’s ability to comprehend objects within images and video by tracking visual concepts. Firm analysts believe that the SAM 3 will allow Meta to scale its data engine more efficiently. Annotation speeds are now 5 times faster than human annotators for negative prompts and 36% faster for positive prompts.

Through the technological advancement, Meta has been able to create a dataset containing 4 million unique concepts. Overall, the firm believes that AI-driven improvements will act as a tailwind for user engagement and ad performance on Meta’s platforms.

Meta Platforms has been expanding its advertising capabilities and also invests heavily in artificial intelligence and the metaverse.

While we acknowledge the potential of META as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than META and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 10 AI Stocks on the Market’s Radar and 10 AI Stocks Making Headlines on Wall Street

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.