In this article, we discuss the 10 best stocks to buy according to billionaire Izzy Englander based on Q2 holdings of the fund. If you want to skip our detailed analysis of Englander’s history, investment philosophy, and hedge fund performance, go directly to the 5 Best Stocks to Buy According to Billionaire Izzy Englander.

Israel Englander is a philanthropist, hedge fund manager, and investor in the United States. He earned a BS degree in finance from New York University in 1970. Englander specialized in trading convertible securities and options at Kaufmann Alsberg. Ronald Shear and Israel Englander started Millennium Management, a hedge fund, in 1989. The fund began with a seed capital of $35 million and grew to $13 billion in assets under management by 2011.

As of the second quarter, Millennium Management holds significant stakes in top companies, including Apple Inc. (NASDAQ: AAPL), Alibaba Group Holding Limited (NYSE: BABA), and Facebook, Inc. (NASDAQ: FB).

In Apple Inc. (NASDAQ: AAPL), Izzy Englander owns 6.98 million shares, worth $955.94 million. On September 8, Baird analyst William Power raised the price target on Apple Inc. (NASDAQ: AAPL) to $170 from $160 and kept an “Outperform” rating on the shares.

The fund manager also has a significant stake in Alibaba Group Holding Limited (NYSE: BABA). Billionaire Izzy Englander owns 3.38 million shares in Alibaba Group Holding Limited (NYSE: BABA), worth over $766 million. On September 9, Alibaba Group Holding Limited (NYSE: BABA) pledged to invest $15.5 billion in Beijing’s “shared prosperity” program over the next five years.

The billionaire is also bullish on Facebook, Inc. (NASDAQ: FB). Even though his hedge fund slashed its stake in the tech giant by 29% in the second quarter of 2021, it still owns 1.64 million shares of the company, worth $571.64 million.

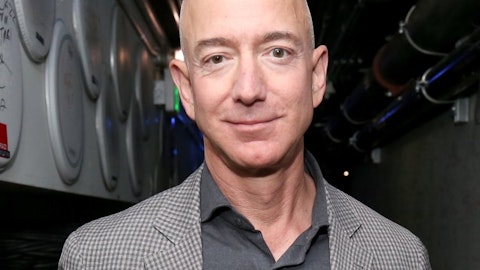

Israel Englander of Millennium Management

Why should we pay attention to Englander’s stock picks? Insider Monkey’s research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 86 percentage points since March 2017. Between March 2017 and July 2021, our monthly newsletter’s stock picks returned 186.1%, vs. 100.1% for the SPY. Our stock picks outperformed the market by more than 86 percentage points (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to. You can subscribe to our free newsletter on our homepage to receive our stories in your inbox.

With this context and industry outlook in mind, let’s start our list of the 10 best stocks to buy according to billionaire Izzy Englander. We picked these stocks from the Q2 portfolio of Englander.

Best Stocks to Buy According to Billionaire Izzy Englander

10. salesforce.com, inc. (NYSE: CRM)

Englander’s Stake Value: $338,416,000

Percentage of Izzy Englander’s 13F Portfolio: 0.2%

Number of Hedge Fund Holders: 108

salesforce.com, inc. (NYSE: CRM) is a global provider of business cloud computing solutions. The company was founded in 1999, and it stands tenth on the list of 10 best stocks to buy according to billionaire Izzy Englander. salesforce.com, inc. (NYSE: CRM) presently has a market capitalization of $257.1 billion.

On August 27, Loop Capital analyst Yun Kim raised the price target on Salesforce to $265 from $235 and kept a “Hold” rating on the shares. On August 5, salesforce.com, inc. (NYSE: CRM) declared earnings for the second quarter of 2021. It posted earnings per share of $1.48, surpassing the estimates by $0.55.

In the second quarter of 2021, Izzy Englander’s Millennium Management owned 1.39 million shares in salesforce.com, inc. (NYSE: CRM), worth $338.42 million. This represented 0.2% of the investment portfolio of Millennium Management. salesforce.com, inc. (NYSE: CRM) saw an increase in hedge fund sentiment recently. The number of long hedge fund positions rose to 108 in the second quarter of 2021 compared to 91 positions in the previous quarter.

In addition to Apple Inc. (NASDAQ: AAPL), Alibaba Group Holding Limited (NYSE: BABA), and Facebook, Inc. (NASDAQ: FB), analysts are paying attention to salesforce.com, inc. (NYSE: CRM) amid the company’s long-term growth potential.

ClearBridge Investments, in its first-quarter 2021investor letter, mentioned salesforce.com, inc. (NYSE: CRM). Here is what the fund said:

“We added to our software-as-a-service (SaaS) exposure with the initiation of SaaS leader salesforce.com, which develops software for customer relationship management (we added Workday, which enterprise resource planning applications, last quarter). Saleforce.com is well-positioned in the most attractive end markets in software and will benefit from secular drivers such as remote work and the digital transformation. Salesforce.com is a sustainability leader as well, with a commitment to carbon-neutral cloud, toward which it has set a goal of 100% renewable energy for global operations by fiscal year 2022. The company has a strong focus on equality, in terms of equal rights, pay, education and opportunity. As a data company it has been leading on workforce disclosures and seeks to have 50% of its U.S. workforce made up of underrepresented groups by 2024.”

9. Walmart Inc. (NYSE: WMT)

Englander’s Stake Value: $375,136,000

Percentage of Izzy Englander’s 13F Portfolio: 0.23%

Number of Hedge Fund Holders: 71

Walmart Inc. (NYSE: WMT) owns discount department stores, hypermarkets, and grocery stores across the world. It was founded in 1945 and is placed ninth on the list of 10 best stocks to buy according to billionaire Izzy Englander. Walmart Inc. (NYSE: WMT) currently has a market capitalization of $411.19 billion.

On September 2, Walmart Inc. (NYSE: WMT) announced earnings for the second quarter of 2021. It posted earnings per share of $1.78, beating the market predictions by $0.21. Revenue over the period was $139.87 billion, surpassing the estimates by $3.87 billion. On August 18, Cowen analyst Oliver Chen raised the price target on Walmart Inc. (NYSE: WMT) to $175 from $170 and maintained an “Outperform” rating on the shares.

The hedge fund managed by Izzy Englander owns 2.66 million shares in Walmart Inc. (NYSE: WMT), worth over $375.14 million, representing 0.23% of their portfolio. Millennium Management has increased its stake in the firm by 157% in the second quarter of 2021. Ken Fisher’s Fisher Asset Management is the most significant stakeholder in Walmart Inc. (NYSE: WMT) with 12.63 million shares, worth $1.78 billion. Hedge funds are loading up on Walmart Inc. (NYSE: WMT), as Insider Monkey’s data shows that 71 hedge funds held a stake in the company in the second quarter of 2021, compared to 58 funds in the previous quarter.

In addition to Apple Inc. (NASDAQ: AAPL), Alibaba Group Holding Limited (NYSE: BABA), and Facebook, Inc. (NASDAQ: FB), analysts are paying attention to Walmart Inc. (NYSE: WMT).

8. Honeywell International Inc. (NASDAQ: HON)

Englander’s Stake Value: $388,954,000

Percentage of Izzy Englander’s 13F Portfolio: 0.23%

Number of Hedge Fund Holders: 57

Honeywell International Inc. (NASDAQ: HON) is a multinational technology and manufacturing corporation. It was founded in 1985 and is placed eighth on the list of 10 best stocks to buy according to billionaire Izzy Englander. Honeywell International Inc. (NASDAQ: HON) shares have offered investors more than 33.93% in returns over the course of the past 12 months.

On August 16, Pipistrel, a Slovenian aircraft manufacturer, chose Honeywell International Inc.’s (NASDAQ: HON) Small UAV SATCOM system for three of its new aircraft: the fixed-wing Surveyor and two unmanned Nuuva platforms, the V300 and V20. On July 26, Deutsche Bank analyst Nicole DeBlase raised the price target on Honeywell International Inc. (NASDAQ: HON) to $251 from $245 and kept a “Buy” rating on the shares.

Izzy Englander’s Millennium Management increased its hold in Honeywell International Inc. (NASDAQ: HON) by 90% in the second quarter of 2021. The fund owns 1.77 million shares of Honeywell International Inc. (NASDAQ: HON), worth $388.95 million. Hedge fund sentiment increased for Honeywell International Inc. (NASDAQ: HON) in the second quarter of 2021. Insider Monkey’s data shows that 57 elite hedge funds held stakes in the company in the second quarter of 2021, up from 56 funds a quarter earlier.

In addition to Apple Inc. (NASDAQ: AAPL), Alibaba Group Holding Limited (NYSE: BABA), and Facebook, Inc. (NASDAQ: FB), analysts are paying attention to Honeywell International Inc. (NASDAQ: HON) amid the company’s long-term growth potential.

ClearBridge Investments, in its first-quarter 2021 investor letter, mentioned Honeywell International Inc. (NASDAQ: HON). Here is what the fund said:

“The portfolio’s quality bias and valuation discipline have generated compelling returns over time with typically strong relative results in more challenging environments as it did through the first three quarters of 2020. However, that same quality bias tends to create a more challenging relative performance environment for the Strategy during periods of sharp economic acceleration, which tend to benefit stocks that are more commodity linked or of lower quality. This has been the case during the vaccine- and stimulus-driven rally experienced late last year and during the most recent quarter. Sectors that lagged in the quarter included industrials, Honeywell also lagged in the quarter after previously generating strong returns over extended periods.”

7. IHS Markit Ltd. (NYSE: INFO)

Englander’s Stake Value: $508,661,000

Percentage of Izzy Englander’s 13F Portfolio: 0.31%

Number of Hedge Fund Holders: 61

IHS Markit Ltd. (NYSE: INFO) provides vital data, analytics, and solutions to a wide range of sectors and markets. It was incorporated in 1959 and stands seventh on the list of 10 best stocks to buy according to billionaire Izzy Englander. IHS Markit Ltd. (NYSE: INFO) shares have offered investors returns exceeding 55.31% over the course of the past 12 months.

On September 1, CME Group Inc. (NASDAQ: CME) and IHS Markit Ltd. (NYSE: INFO) started their joint enterprise, OSTTRA. Its mission is to deliver cutting-edge post-trade solutions for interest rate, foreign exchange, equities, and credit asset classes in the worldwide OTC markets. On July 15, Deutsche Bank analyst Sameer Kalucha raised the price target on IHS Markit Ltd. (NYSE: INFO) to $127 from $123 and kept a “Buy” rating on the shares.

Millennium Management owns 4.52 million shares of IHS Markit Ltd. (NYSE: INFO), worth $508.66 million. This represented 0.31% of the investment portfolio of Millennium Management. There were 61 hedge funds in our database that held stakes in IHS Markit Ltd. (NYSE: INFO) in the second quarter of 2021, compared to 54 funds in the previous quarter.

In addition to Apple Inc. (NASDAQ: AAPL), Alibaba Group Holding Limited (NYSE: BABA), and Facebook, Inc. (NASDAQ: FB), analysts are paying attention to IHS Markit Ltd. (NYSE: INFO).

Artisan Partners, in its first-quarter 2021investor letter, mentioned IHS Markit Ltd. (NYSE: INFO). Here is what the fund said:

“We ended our campaign in IHS Markit. IHS Markit is a global provider of information services to the financial services, automotive and energy sectors. Since beginning our investment campaign in 2009, we have been attracted to the company’s position relative to the meaningful secular tailwind driving demand for data and analytics to help guide business decisions. The company announced in Q4 it is merging with S&P Global, one of the largest credit ratings agencies globally and a provider of benchmarks, data and analytics to the global capital and commodities markets. We believe the combination provides a good level of cost and revenue synergies which will help drive profit growth, and S&P Global has a solid track record of acquiring and integrating new businesses. However, we exited our position as the combined entity will be well beyond our mid-cap market cap mandate.”

6. Facebook, Inc. (NASDAQ: FB)

Englander’s Stake Value: $571,638,000

Percentage of Izzy Englander’s 13F Portfolio: 0.35%

Number of Hedge Fund Holders: 266

Facebook, Inc. (NASDAQ: FB) develops software that enables people all over the world to engage and communicate through mobile phones, computers, virtual reality headsets, and in-home devices. It was incorporated in 2004 and stands sixth on the list of 10 best stocks to buy according to billionaire Izzy Englander. On September 9, HSBC analyst Nicolas Cote-Colisson raised the price target on Facebook, Inc. (NASDAQ: FB) to $300 from $275 and maintained a “Reduce” rating on the shares.

Millennium Management holds more than 1.64 million shares in Facebook, Inc. (NASDAQ: FB), worth $571.64 million, representing 0.35% of their investment portfolio. The hedge fund has trimmed its stake in Facebook, Inc. (NASDAQ: FB) by 29% in the second quarter of 2021. There were 266 hedge funds in our database that held stakes in Facebook, Inc. (NASDAQ: FB) in the second quarter of 2021, compared to 257 funds in the previous quarter. Crake Asset Management is the company’s most significant stakeholder, with 485,052 shares worth $168.66 billion.

In addition to Apple Inc. (NASDAQ: AAPL) and Alibaba Group Holding Limited (NYSE: BABA), Facebook, Inc. (NASDAQ: FB) is one of the top picks of Izzy Englander.

Polen Capital, in its second-quarter 2021 investor letter, mentioned Facebook, Inc. (NASDAQ: FB). Here is what the fund said:

“Facebook was the top contributor to our return for the second consecutive quarter. The company has over $1 trillion market capitalizations. Yet, based on first quarter 2021 results, FB is currently still growing revenue at over 30% organically! In fact, last quarter Facebook grew revenue 48% year over year. Facebook has generated earnings and intrinsic value growth for many years, driven largely by the mostly free services the company provide to people who can easily choose to stop using them and spend their time elsewhere.

That said, we are regularly asked about the perceived high regulatory risk around Facebook. We examine risks to businesses and, in particular, regulatory risks through a lens of risk exposure versus actual risk. For instance, the antitrust complaints globally against Facebook based on their size, influence, and strong competitive positioning, definitionally exposes these companies to more regulatory risk than much smaller businesses. However, we do not believe risk exposure is the same as actual risk…” (Click here to see the full text).

Click to continue reading and see 5 Best Stocks to Buy According to Billionaire Izzy Englander.

Suggested articles:

- 10 Best Stocks To Buy According To Billionaire Larry Robbins

- 10 Best Stocks to Buy According to Billionaire Mario Gabelli

- 8 Best Stocks to Buy According to Billionaire Nicholas J. Pritzker

Disclosure: None. 10 Best Stocks to Buy According to Billionaire Izzy Englander is originally published on Insider Monkey.