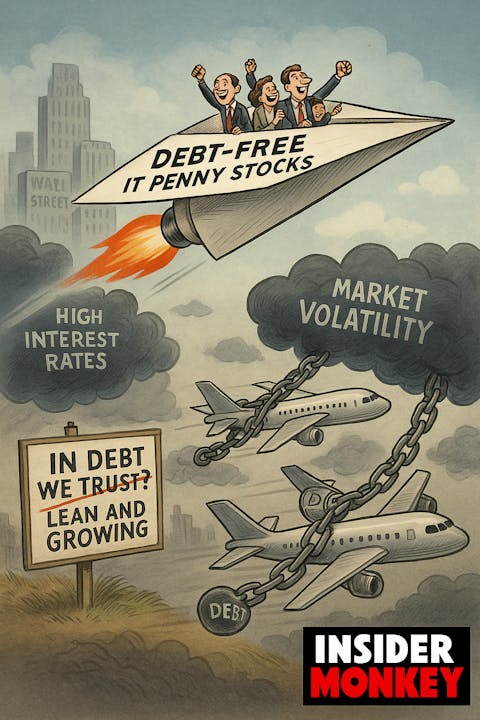

In a market where interest rates remain high and uncertainty continues to weigh on investor sentiment, companies with low or zero-debt balance sheets are worth a closer look. This is particularly true in the case of stocks that trade under $5, generally called penny stocks, as for them, financial discipline could mean the difference between survival and sustained growth.

Within this space, IT companies that operate without debt deserve attention. For micro and small-cap firms, access to capital is often limited, and carrying debt can quickly undermine margins. By avoiding debt, these companies avoid interest payments and refinancing risk—giving them more flexibility to reinvest in their core business and weather tougher market conditions.

Today’s interest rate backdrop only reinforces the case. While there is some anticipation of future rate cuts, borrowing costs remain elevated. In a May 23 interview with CNBC, Ed Yardeni, President of Yardeni Research, noted that rising bond yields continue to unsettle equity markets. The U.S. 10-year Treasury yield remains near 4.5%, while the 30-year yield recently moved above 5%, a level that has drawn concern from global investors.

Still, Yardeni remains optimistic on the U.S. economy. He highlighted the strength of consumer spending, which remains supported by the financial power of retiring baby boomers—a demographic holding close to $80 trillion in net worth. Yardeni maintains that as long as consumer demand holds steady, markets are likely to stay on stable footing—even in the face of rising yields.

That makes debt-free IT penny stocks particularly interesting right now. With no debt weighing them down, these companies aren’t forced to divert cash toward interest payments. Instead, they can use their limited capital on core areas like product development, hiring, and scaling their operations, moves that could position them more competitively as macro conditions evolve.

While these kinds of smaller stocks always carry higher volatility and liquidity risk, companies in this category with zero debt have a better chance of navigating uncertain conditions and positioning themselves for long-term success.

With those insights, let’s explore the 10 best debt-free IT penny stocks to buy.

Our Methodology

We used online screeners to compile a list of IT stocks with a stock price below $5 and a market capitalisation of at least $100 million. For the shortlisted stocks, we compared their enterprise value (EV) to their market capitalisation (EV to Market cap ratio). A ratio below 1.0 indicates that the company has no debt or minimal net debt. We then identified the top 10 stocks with the highest hedge fund ownership from this refined list by leveraging data from Insider Monkey’s Q1 2025 hedge fund database. Finally, we ranked these stocks in ascending order based on the number of hedge funds holding positions in them.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

10 Best Debt Free IT Penny Stocks to Buy

10. Silvaco Group Inc. (NASDAQ:SVCO)

EV to Market Cap: 0.5

Share Price: $4.5

Number of Hedge Fund Holders: 7

Silvaco Group Inc. (NASDAQ:SVCO) is one of the 10 best debt-free IT penny stocks to buy. Recent developments suggest that Silvaco Group, Inc. (NASDAQ:SVCO) is taking measured steps to position itself for long-term growth, even as near-term revenue performance shows some softness.

TD Cowen analyst Krish Sankar recently reaffirmed a Buy rating on the stock, though the price target was revised down to $10 from $12 following a revenue miss in Q1 FY25, attributed largely to order delays. Despite this, Sankar sees reason for optimism. Strategic acquisitions, specifically Cadence’s PPC group and Tech-X, are expected to broaden Silvaco’s addressable market by roughly $600 million. Additionally, with nine new customers added during the quarter and expected strength in the second half of the year, management guidance for 12% revenue growth in CY 2025 signals a healthy outlook.

The analyst also highlights that while the acquisitions have increased operating expenses and introduced some complexity in performance comparisons, expectations for improved gross margins and stronger order bookings in the second half help balance the near-term challenges.

At the same time, Silvaco continues to strengthen its position in advanced semiconductor technologies. The company, on June 24, announced an R&D partnership with Fraunhofer ISIT aimed at accelerating the development of next-generation Gallium Nitride (GaN) devices. Through this collaboration, Fraunhofer will use Silvaco’s Design Technology Co-Optimization (DTCO) tools, including Victory TCAD and SmartSpice, to develop high-performance power and sensor devices on 8-inch wafers.

Taken together, Silvaco’s strategic investments and growth initiatives should enhance long-term value creation, provided the company executes well in the coming quarters.

Silvaco Group Inc. (NASDAQ:SVCO) provides software and services for semiconductor design, development, and manufacturing. The company’s solutions address key needs in TCAD (technology computer-aided design), EDA (electronic design automation), and semiconductor IP, serving various industries.

9. Telos Corporation (NASDAQ:TLS)

EV to Market Cap: 0.7

Share Price: $2.5

Number of Hedge Fund Holders: 10

Telos Corporation (NASDAQ:TLS) is one of the 10 best debt-free IT penny stocks to buy.

Recent developments indicate that Telos Corp (NASDAQ:TLS) continues to build on its strengths in secure communications and cyber governance, even as the stock faces pressure following a recent downward revision in its price target.

Around mid-May, a B. Riley analyst lowered his price target on Telos to $3.75 from $4.50, while maintaining a Buy rating. The analyst highlighted that the company’s Q1 results exceeded consensus on both revenue and adjusted EBITDA. The company also reaffirmed its full-year guidance. According to him, the stock’s decline after results appear more of an overreaction and doesn’t reflect the company’s improving fundamentals. He also believes that this decline undermines the fact that Telos anticipates a stronger performance in the second half of 2025.

Meanwhile, Telos secured two key government contracts, in the first two weeks of June, that reinforce its relevance in national security-focused IT solutions. The first is a $3.7 million contract renewal with the U.S. Air Force Intelligence Community for continued use of its Xacta platform. This extension allows the Air Force to automate and manage cyber compliance across sensitive networks, an area where Telos has built a solid track record.

Additionally, Telos was awarded a $14 million, five-year contract from the Defense Information Systems Agency (DISA) to support the Organizational Messaging Service (OMS). Through its Automated Message Handling System (AMHS), Telos will continue providing secure and efficient message delivery across the Department of Defense, allied military partners, and federal agencies.

These contract wins highlight Telos’ established relationships with defense clients and its ongoing role in managing mission-critical communication infrastructure.

Telos Corporation (NASDAQ:TLS) delivers cybersecurity, secure mobility, and identity management solutions to government and commercial clients.

8. Rimini Street Inc. (NASDAQ:RMNI)

EV to Market Cap: 0.9

Share Price: $3.1

Number of Hedge Fund Holders: 11

Rimini Street Inc. (NASDAQ:RMNI) is one of the 10 best debt-free IT penny stocks to buy. At the TD Cowen Technology, Media & Telecom Conference held on May 29, Rimini Street laid out its strategic roadmap, with a focus on balancing near-term cost efficiency and long-term growth opportunities, particularly in a shifting enterprise software landscape.

A key message was the company’s value proposition: offering support services that can cut vendor maintenance costs by around 50%. Rimini is positioning itself to benefit from major upcoming changes in the software market—most notably the 2027 sunset of SAP ECC. Management sees this as a window to capture customers seeking to avoid costly migrations, providing them with support and modernization alternatives.

One of the most notable developments is Rimini’s new partnership with ServiceNow. This collaboration is aiming to help enterprise clients modernize their systems and adopt AI capabilities without undergoing a full re-platforming. This integration is aimed at leveraging the Now platform alongside clients’ existing ERP systems. While the partnership isn’t exclusive, it is expected to become a key revenue driver starting in 2026.

In parallel, Rimini is winding down its PeopleSoft support business, which currently accounts for about 7% of revenue. Management expects the majority of those clients to transition over the next 2–3 years. In order to support future growth, the company is focusing on building its indirect sales channel.

Following the conference, TD Cowen analyst Derrick Wood reiterated his Hold rating and $4 price target. More recently, on June 18, Jeff Van Rhee from Craig-Hallum maintained a Buy rating on Rimini Street, without giving a price target.

Rimini Street Inc. (NASDAQ:RMNI) provides end-to-end enterprise software support, products, and services for Oracle, SAP, and other leading enterprise software systems.

7. Kaltura Inc. (NASDAQ:KLTR)

EV to Market Cap: 0.9

Share Price: $2.0

Number of Hedge Fund Holders: 14

Kaltura Inc. (NASDAQ:KLTR) is one of the 10 best debt-free IT penny stocks to buy. On May 8, Needham’s Ryan Koontz reaffirmed his Buy rating on Kaltura, holding firm on a $3 price target. His positive outlook was based on the company’s strong first-quarter performance and encouraging strategic progress.

The company reported strong growth in subscription revenue and posted its highest operating margin since 2020. Several key deals closed during the period, lifting core financial metrics compared to the prior year.

While management expects a slight revenue dip in the second quarter due to customer churn, they left full-year guidance unchanged, a sign they remain confident in their roadmap and execution.

Regarding the long-term goals, Koontz highlighted the company’s aim to double EBITDA by fiscal 2026. It is also targeting to achieve the “Rule of 30,” a widely used benchmark in the software industry which indicates a good balance between growth and profitability. These goals suggest a shift toward stronger operational discipline.

He also noted that better execution, and further consolidation in the enterprise video space could strengthen Kaltura’s competitive edge.

Kaltura Inc. (NASDAQ:KLTR) provides a cloud-based video platform that powers real-time, on-demand, and live video experiences for enterprises, educational institutions, and media companies.

6. CS Disco Inc. (NYSE:LAW)

EV to Market Cap: 0.6

Share Price: $4.1

Number of Hedge Fund Holders: 14

CS Disco Inc. (NYSE:LAW) is one of the 10 best debt-free IT penny stocks to buy. On June 23, Canaccord Genuity analyst David Hynes reaffirmed his Buy rating on CS Disco (NASDAQ:LAW), with an unchanged and consensus-high price target of $9. The analyst’s view appear confident towards company’s effort to reshape its sales approach.

CS Disco is shifting its focus towards larger enterprises that deal with complex legal matters, a move Hynes believes could help resolve past sales execution issues. The company’s native cloud platform and use of AI give it an edge over older, more rigid systems, which may improve its chances of winning business from larger firms.

Hynes also believes that the leadership team, under CEO Eric Friedrichsen, is well equipped with relevant experience in scaling software companies and managing transitions.

Though profitability remains some distance off and growth has slowed, Hynes suggests that the changes now in progress could improve the company’s longer-term trajectory. For investors with an eye on undervalued small-cap tech names, CS Disco may be one to watch as its strategy plays out.

CS Disco Inc. (NYSE:LAW) is a legal technology company that provides an AI-powered cloud platform for eDiscovery, legal document review, and case management.

5. Agora Inc. (NASDAQ:API)

EV to Market Cap: 0.7

Share Price: $3.7

Number of Hedge Fund Holders: 17

Agora Inc. (NASDAQ:API) is one of the 10 best debt-free IT penny stocks to buy. On June 28, Bank of America Securities’ analyst Daley Li reiterated a Buy rating on Agora (NASDAQ: API), setting a price target of $7.10.

Agora’s Q1 2025 results showed modest top-line growth, with revenue up 1% year-over-year. While overall growth was limited, the company’s international business stood out, benefiting from stronger demand in areas like live shopping and entertainment.

For the second quarter, management guided for core revenue growth of 7% to 13% year-over-year. This range broadly matches market expectations and suggests that conditions are starting to improve—particularly in China’s social entertainment and education markets—while international demand continues to hold up well.

The analyst also pointed to signs of progress on the profitability front. Q1 2025 was Agora’s second straight profitable quarter, along with an improvement in gross margins. The company is also commanding a stronger net cash position which adds further flexibility, allowing it to pursue growth opportunities like in the field of AI.

Agora Inc. (NASDAQ:API) is a China-based company that provides a real-time engagement platform-as-a-service (PaaS), enabling developers to embed voice, video, and live interactive streaming capabilities into their applications.

4. Vuzix Corporation (NASDAQ:VUZI)

EV to Market Cap: 0.9

Share Price: $2.8

Number of Hedge Fund Holders: 17

Vuzix Corporation (NASDAQ:VUZI) is one of the 10 best debt-free IT penny stocks to buy. Vuzix (NASDAQ:VUZI) has recently announced two strategic partnerships, one with Sphere Technology Holdings and another with AI startup Ramblr, both aimed at strengthening the use of AI and augmented reality (AR) in frontline applications.

The more recent update, on June 24, revealed a collaboration with Sphere, a spatial computing company known for its mixed reality (MR) platforms. Sphere’s software is now available on Vuzix’s M400 and M4000 smart glasses, bringing spatial computing tools to enterprise users, including features such as environment mapping, gesture recognition, and multi-user collaboration. These features support solving tough challenges in industries like manufacturing, defense, and healthcare, helping workers interact with digital content while staying focused on the job at hand.

Earlier, on May 29, Vuzix announced a partnership with Ramblr, a German firm focused on video intelligence and task automation. Ramblr’s platform enables enterprise users to receive real-time, spoken instructions based on video analysis and company-specific content, such as manuals or workflow videos. The system, when deployed on Vuzix smart glasses, helps workers execute tasks hands-free with contextual AI support. The enhanced capability of the system will increase accuracy and efficiency, particularly in environments like factory floors and service centers.

By working with partners that offer adaptable, domain-specific solutions, Vuzix is enhancing the real-world utility of its devices and building stronger use cases for broader adoption.

Vuzix Corporation (NASDAQ:VUZI) designs and manufactures augmented reality (AR) and smart glasses for enterprise and consumer applications.

3. BigBear.ai Holdings Inc. (NYSE:BBAI)

EV to Market Cap: 1.0

Share Price: $4.2

Number of Hedge Fund Holders: 17

BigBear.ai Holdings Inc. (NYSE:BBAI) is one of the 10 best debt-free IT penny stocks to buy. On June 10, BigBear.ai reported that it has partnered with aviation security firm Analogic to strengthen airport screening systems through the integration of AI and advanced imaging technology. The collaboration brings together BigBear.ai’s Pangiam Threat Detection platform with Analogic’s ConneCT security system, a CT-based Explosive Detection System used at airport checkpoints.

The Pangiam platform will provide airport security teams with AI-powered insights in real time, thus helping them identify potential threats more quickly and accurately. Its open architecture also allows it to connect with different systems and tools, offering flexibility for future upgrades or custom solutions.

The companies are combining real-time computer vision with CT scanning, and by doing that they are targeting to improve both safety and efficiency at airports. Their common goal is not just stronger detection, but smoother operations, with less disruption to passengers and lower operating costs for airports.

For BigBear.ai, this collaboration supports a broader push into transportation and national security markets. The collaboration highlights growing interest in using AI to modernize infrastructure in ways that are both scalable and practical.

BigBear.ai Holdings Inc. (NYSE:BBAI) specializes in edge AI-powered decision intelligence solutions, catering to national security, supply chain management, and digital identity applications.

2. Vimeo Inc. (NASDAQ:VMEO)

EV to Market Cap: 0.6

Share Price: $3.9

Number of Hedge Fund Holders: 24

Vimeo Inc. (NASDAQ:VMEO) is one of the 10 best debt-free IT penny stocks to buy. Vimeo recently announced that its Chief Financial Officer, Gillian Munson, will be stepping down from her role, effective August 8, 2025. The company has begun the search for her successor with the help of an external recruitment firm. The company has entered into a separation agreement with Munson, which includes standard severance terms and a bonus arrangement.

On a brighter note, despite the leadership change, Vimeo has reiterated its financial guidance for the full year ending December 31, 2025. The company also plans to announce its second-quarter results on August 4.

On the other side, analyst sentiment saw a slight adjustment. In early May, Piper Sandler’s analyst Thomas Champion revised Vimeo’s price target from $10 to $8, citing a lower valuation multiple. Still, the firm maintained an Overweight rating on the stock. First-quarter revenue and EBITDA came in ahead of expectations, but the breakdown between segments showed a divergence. While the Self-Serve business returned to growth, helped by recent price increases, Enterprise bookings were softer, with macroeconomic pressures reportedly delaying some deals.

While the departure of the CFO introduces a degree of uncertainty, the reaffirmed outlook and steady performance in core metrics provide some reassurance.

Vimeo Inc. (NASDAQ:VMEO) operates a global video hosting, streaming, and editing platform tailored for professionals and enterprises.

1. Blend Labs Inc. (NYSE:BLND)

EV to Market Cap: 0.9

Share Price: $3.3

Number of Hedge Fund Holders: 33

Blend Labs Inc. (NYSE:BLND) is one of the 10 best debt-free IT penny stocks to buy. On May 28, William Blair analyst Dylan Becker reiterated a Buy rating on Blend Labs (BLND), though he didn’t assign a price target to the stock. In Becker’s view, the company’s recent decision to divest its Title365 business marks an important strategic change. By moving away from the more services-heavy segment, Blend is now better positioned to operate as a focused vertical SaaS company.

Becker notes that this step should have a positive impact on Blend’s financial profile, particularly by improving gross margins and bringing them more in line with those of software-first businesses. More importantly, the move allows management to sharpen its focus on the core business—developing digital tools for banking products like mortgages and consumer loans.

With this narrowed focus, Becker expects Blend to strengthen its position in the market over time, particularly as it looks to deliver improved customer experiences in the financial services space. While broader mortgage market remains challenging, he sees potential for the company to unlock improved profitability and generate stronger revenue growth from 2025 onwards.

Blend Labs Inc. (NYSE:BLND) offers a cloud-based banking software platform that simplifies and automates consumer banking experiences, including mortgage applications, personal loans, and deposit account openings.

While we acknowledge the potential of BLND as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than BLND and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None.