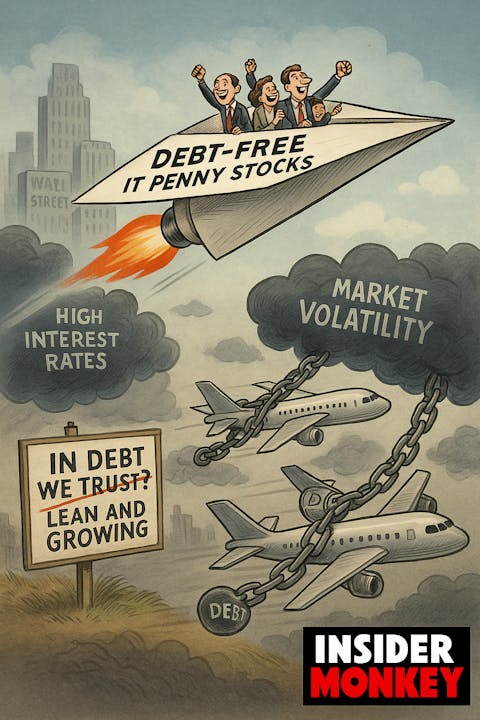

In a market where interest rates remain high and uncertainty continues to weigh on investor sentiment, companies with low or zero-debt balance sheets are worth a closer look. This is particularly true in the case of stocks that trade under $5, generally called penny stocks, as for them, financial discipline could mean the difference between survival and sustained growth.

Within this space, IT companies that operate without debt deserve attention. For micro and small-cap firms, access to capital is often limited, and carrying debt can quickly undermine margins. By avoiding debt, these companies avoid interest payments and refinancing risk—giving them more flexibility to reinvest in their core business and weather tougher market conditions.

Today’s interest rate backdrop only reinforces the case. While there is some anticipation of future rate cuts, borrowing costs remain elevated. In a May 23 interview with CNBC, Ed Yardeni, President of Yardeni Research, noted that rising bond yields continue to unsettle equity markets. The U.S. 10-year Treasury yield remains near 4.5%, while the 30-year yield recently moved above 5%, a level that has drawn concern from global investors.

Still, Yardeni remains optimistic on the U.S. economy. He highlighted the strength of consumer spending, which remains supported by the financial power of retiring baby boomers—a demographic holding close to $80 trillion in net worth. Yardeni maintains that as long as consumer demand holds steady, markets are likely to stay on stable footing—even in the face of rising yields.

That makes debt-free IT penny stocks particularly interesting right now. With no debt weighing them down, these companies aren’t forced to divert cash toward interest payments. Instead, they can use their limited capital on core areas like product development, hiring, and scaling their operations, moves that could position them more competitively as macro conditions evolve.

While these kinds of smaller stocks always carry higher volatility and liquidity risk, companies in this category with zero debt have a better chance of navigating uncertain conditions and positioning themselves for long-term success.

With those insights, let’s explore the 10 best debt-free IT penny stocks to buy.

Our Methodology

We used online screeners to compile a list of IT stocks with a stock price below $5 and a market capitalisation of at least $100 million. For the shortlisted stocks, we compared their enterprise value (EV) to their market capitalisation (EV to Market cap ratio). A ratio below 1.0 indicates that the company has no debt or minimal net debt. We then identified the top 10 stocks with the highest hedge fund ownership from this refined list by leveraging data from Insider Monkey’s Q1 2025 hedge fund database. Finally, we ranked these stocks in ascending order based on the number of hedge funds holding positions in them.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

10 Best Debt Free IT Penny Stocks to Buy

10. Silvaco Group Inc. (NASDAQ:SVCO)

EV to Market Cap: 0.5

Share Price: $4.5

Number of Hedge Fund Holders: 7

Silvaco Group Inc. (NASDAQ:SVCO) is one of the 10 best debt-free IT penny stocks to buy. Recent developments suggest that Silvaco Group, Inc. (NASDAQ:SVCO) is taking measured steps to position itself for long-term growth, even as near-term revenue performance shows some softness.

TD Cowen analyst Krish Sankar recently reaffirmed a Buy rating on the stock, though the price target was revised down to $10 from $12 following a revenue miss in Q1 FY25, attributed largely to order delays. Despite this, Sankar sees reason for optimism. Strategic acquisitions, specifically Cadence’s PPC group and Tech-X, are expected to broaden Silvaco’s addressable market by roughly $600 million. Additionally, with nine new customers added during the quarter and expected strength in the second half of the year, management guidance for 12% revenue growth in CY 2025 signals a healthy outlook.

The analyst also highlights that while the acquisitions have increased operating expenses and introduced some complexity in performance comparisons, expectations for improved gross margins and stronger order bookings in the second half help balance the near-term challenges.

At the same time, Silvaco continues to strengthen its position in advanced semiconductor technologies. The company, on June 24, announced an R&D partnership with Fraunhofer ISIT aimed at accelerating the development of next-generation Gallium Nitride (GaN) devices. Through this collaboration, Fraunhofer will use Silvaco’s Design Technology Co-Optimization (DTCO) tools, including Victory TCAD and SmartSpice, to develop high-performance power and sensor devices on 8-inch wafers.

Taken together, Silvaco’s strategic investments and growth initiatives should enhance long-term value creation, provided the company executes well in the coming quarters.

Silvaco Group Inc. (NASDAQ:SVCO) provides software and services for semiconductor design, development, and manufacturing. The company’s solutions address key needs in TCAD (technology computer-aided design), EDA (electronic design automation), and semiconductor IP, serving various industries.

9. Telos Corporation (NASDAQ:TLS)

EV to Market Cap: 0.7

Share Price: $2.5

Number of Hedge Fund Holders: 10

Telos Corporation (NASDAQ:TLS) is one of the 10 best debt-free IT penny stocks to buy.

Recent developments indicate that Telos Corp (NASDAQ:TLS) continues to build on its strengths in secure communications and cyber governance, even as the stock faces pressure following a recent downward revision in its price target.

Around mid-May, a B. Riley analyst lowered his price target on Telos to $3.75 from $4.50, while maintaining a Buy rating. The analyst highlighted that the company’s Q1 results exceeded consensus on both revenue and adjusted EBITDA. The company also reaffirmed its full-year guidance. According to him, the stock’s decline after results appear more of an overreaction and doesn’t reflect the company’s improving fundamentals. He also believes that this decline undermines the fact that Telos anticipates a stronger performance in the second half of 2025.

Meanwhile, Telos secured two key government contracts, in the first two weeks of June, that reinforce its relevance in national security-focused IT solutions. The first is a $3.7 million contract renewal with the U.S. Air Force Intelligence Community for continued use of its Xacta platform. This extension allows the Air Force to automate and manage cyber compliance across sensitive networks, an area where Telos has built a solid track record.

Additionally, Telos was awarded a $14 million, five-year contract from the Defense Information Systems Agency (DISA) to support the Organizational Messaging Service (OMS). Through its Automated Message Handling System (AMHS), Telos will continue providing secure and efficient message delivery across the Department of Defense, allied military partners, and federal agencies.

These contract wins highlight Telos’ established relationships with defense clients and its ongoing role in managing mission-critical communication infrastructure.

Telos Corporation (NASDAQ:TLS) delivers cybersecurity, secure mobility, and identity management solutions to government and commercial clients.