Many of our domestic oil plays lack the necessary pipeline infrastructure to bring oil to market, and that has resulted in a prolonged period of low oil prices. That’s great for refiners, but it can be rough on producers. Much of the problem is expected to be resolved by 2014, after a number of pipeline projects come online. However, oil producers in the Permian Basin are starting to see some important changes right now. Today we’ll take a closer look at what’s going on in the West Texas oil game.

The Permian

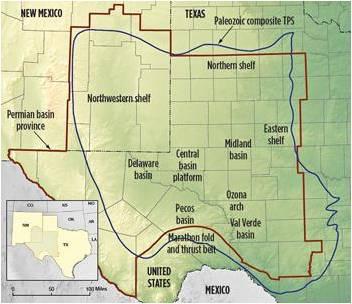

Stretching across West Texas and into New Mexico, the Permian Basin features a mix of carbonate and sandstone formations. Some formations, in fact, are stacked on top of each other in certain locations, making the region home to some pretty enticing drilling opportunities, both horizontal and vertical.

Source: U.S. Geological Survey.

Historically, this West Texas oil play is one of the most prolific oil-producing regions in the United States. Production in the Permian Basin peaked in 1973 at 2.085 million barrels per day. Current production is estimated to be close to 1 million bpd but is expected to grow significantly, reaching 1.86 million by 2016, according to Bentek Energy. The top dog in the play, Occidental Petroleum Corporation (NYSE:OXY), produced 146,000 barrels of per day there in the fourth quarter of 2012.

The significance

Last year, crude oil coming out of the Permian was trading at a discount to crude oil coming out of the hub at Cushing, Okla. WTI-Midland and West Texas Sour were about $13 cheaper per barrel than the Cushing crude, largely because of intense pipeline congestion. The lack of pipeline capacity forced crude to sit, and when crude sits, it loses value.

Finally, earlier this week WTI-Midland rose to a premium over WTI-Cushing for the first time in nearly three years. The increase comes on anticipation of the start of Magellan Midstream Partners, L.P. (NYSE:MMP)‘ Longhorn Pipeline system, which should commence shipping crude to the Gulf Coast in mid-April.

Magellan Midstream Partners, L.P. (NYSE:MMP) reversed the Longhorn and will be capable of transporting 75,000 barrels per day from the Permian to the Gulf. That number is expected to climb to 225,000 by the third quarter of this year.

DCP Midstream Partners, LP (NYSE:DPM) will also bring a Permian-Gulf Coast pipeline online this summer. This pipe will have an initial capacity of 200,000 bpd, eventually expanding to 350,000 bpd.

The Midland premium was only $0.10 as of Tuesday, but it’s the first premium since May of 2010, and that’s significant. West Texas Sour narrowed its discount to $0.25, the smallest gap since April 2009.

While Gulf Coast refiners may be disappointed that the price of oil is going up, it’s still cheaper than imported crude, and higher prices typically incentivize producers to keep drilling, which bodes well for the long-term outlook for investors of both types of companies.