Per a Form 4 filing last week, it was made public that Buck Holdings is continuing its selloff of one of the U.S.’s leading discount retailers, Dollar General Corp. (NYSE:DG). Buck Holdings, controlled by KKR & Co. L.P. (NYSE:KKR), took Dollar General private and then in November 2009 helped orchestrate Dollar General’s IPO at $21 per share.

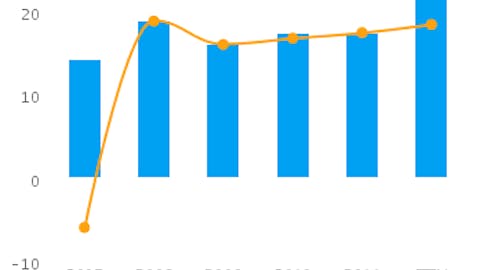

Buck Holdings has been decreasing its stake in the retailer over the past year and sold off over 35 million shares for $1.8 billion earlier this month. The most recent sale was for 5.4 million shares and puts Buck’s total stake at just over 70 million shares—only about 20% of Dollar General’s outstanding float. Back in June, Buck Holdings owned over 146 million shares—almost 44% of Dollar General. Buck Holdings has been taking advantage of Dollar General’s strong performance and the fact that the company is up over 20% year to date.

Buck Holdings’ manager, KKR, is not like some of the other publicly traded private equity firms, in that over 80% of its fee-paying assets are in private equity funds, making it less diversified than the other firms. Yet, KKR keeps a large portion of its AUM in publicly traded securities, as opposed to less liquid assets. KKR and Buck took Dollar General private in 2007 for just under $7 billion, and the company currently trades with a market cap over $16 billion. The private equity firm has made good money on the transaction, and Buck Holdings’ remaining 20% stake in the company alone is worth around $3.5 billion.

During the down economy, Dollar General and other discount stores, such as Dollar Tree, Inc. (NASDAQ:DLTR) and Family Dollar Stores, Inc. (NYSE:FDO), have seen increased traffic given their low prices on everyday necessities. Worth noting is all of these companies are somewhat insulated from broader market fluctuations, as evidenced by their low betas. Dollar Tree has the highest beta at 0.3, Family Dollar at 0.2 and Dollar General at 0.05.

Family Dollar is up year to date around 20%. Having posted recent EPS that beat estimates last quarter, the company is up over 6% the last few weeks alone. Family Dollar pays the only dividend of the discount retailers, yielding 1.2%. The company has managed to avoid the downgrades seen by Dollar Tree, but the market does believe the company will outpace its peers—see our earnings analysis on Family Dollar.

Unlike Dollar General and Family Dollar, up almost 20% year to date, Dollar Tree is relatively flat so far this year. However, the company did beat 2Q estimates handedly, posting $0.51 versus $0.39 estimates. Yet, the company recently lowered guidance, with management citing higher fuel prices and financial uncertainty—related to fiscal concerns—as the key reasons. The stock was down over 10% and saw a slew of downgrades from investment firms. Most notably were JPMorgan and Jefferies Group, lowering their price targets to $50 and $41, respectively—the stock is currently trading around $41.

Another notable competitor, although not considered a true discount retailer, but a company that is definitely a formidable competitor to Dollar General is Wal-Mart Stores, Inc. (NYSE:WMT). Being a diverse retailer with a wide product mix, the company is widely loved by a number of top fund managers. Warren Buffett is the top fund owner as of 2Q, with over 46 million shares, and other notable owners include George Soros and Jim Simons. Also, six of the firms we track had 5% or more of their 2Q 13F portfolio invested in Wal-Mart—check out all funds owning Wal-Mart. Wal-Mart is an international power-house, and will no doubt continue to put pressure on the discount retailers, but we believe the discount retailers can excel given their easier to navigate stores and lower priced goods—but see for yourself whether Wal-Mart is a good stock to buy.

Dollar General posted 2Q results of $0.69, compared to consensus of $0.52. All of Dollar General’s products saw growth, as the company continues to boost its product mix and attempts to gain new customers and increase average total transaction size by offering more consumable goods and health/beauty products. The company has beat estimates each of the last four quarters and plans to expand into new markets, namely California and the Northeast.

In looking at the companies from a valuation standpoint, all three major discount retailers appear to trade in line with each other. Dollar General trades at a P/E of 19 and P/S of 1.1, with the peer averages at P/E 18 and P/S 1.1. However, when it comes to growth prospects we like Dollar General the best. The company is expected to grow EPS at an 18% CAGR over the next five years, versus the industry average of 13%. Even with a rebound in the economy, Dollar General’s increasing product diversification and expansion into new markets should help drive its growth.