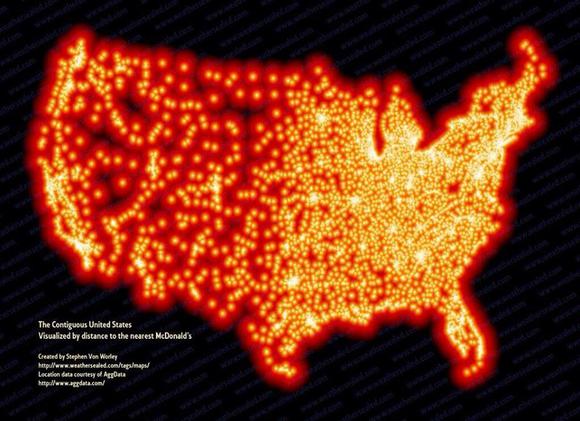

Can you imagine a world without McDonald’s Corporation (NYSE:MCD)? Well, at least we can all agree that there is no America without McDonald’s in the near future. The following graph is an amazing map of the United States visualized by distance to the nearest McDonald’s: the most clear depiction of McDonald’s Corporation (NYSE:MCD) leading market position. America, though, is not the exception; it is the rule. McDonald’s Corporation (NYSE:MCD) is the leading fast food chain in virtually every country where it operates, with the whole exception of China. Looking at the amazing scale the company has achieved, you might be wondering if there is further room available for growth in an increasingly fierce industry. I can bet my boots on that.

Illustration by Stephen Von Worley

Still growing

Can the world largest restaurant chain keep growing? Well, it’s happening. The latest earnings call showed a global comparable sales increase of 1.0% year over year and a consolidated revenues increase of 2%. Considering the enormous scale of operations that McDonald’s has achieved already (over 34,000 locations in more than 100 countries) and the not so easy environment (though pricing in the US and a 6.1% sales reduction in China for the second quarter, due to the negative impact from Avian Influenza), the numbers are quite respectable.

Therefore, not only is McDonald’s Corporation (NYSE:MCD) able to maintain its leading market position in most countries where it operates, but it is also growing its sales. A $700+ million marketing budget to keep the brand strong, free WiFi access and diversification of its coffee products is paying off. The above map showed us how far McDonald’s can penetrate a given economy and the success in America can, in theory, be replicated in other countries. Therefore, global expansion opportunities still exist for the biggest fast food chain.

Value stock

This shouldn’t be surprising, considering that McDonald’s Corporation (NYSE:MCD) has been able to consistently produced strong cash flow for the past 10 years. Owning 45% of the land and 70% of the buildings for its restaurants also brings more safety to the stock.

At the moment, McDonald’s shares remain rationally priced at 17 times earnings. The latest earnings call was not received well by investors (due to the short term negative outlook) and shares are trading at a significant discount from their all-time high of $103. Even better, most analysts and research firms agree with the fact that the latest earnings call negative outlook is not a strong reason enough to decrease their fair value estimates of McDonald’s. For example, Morningstar keeps a fair value estimate of $105 per share, almost $9 above the current price. Credit Suisse, on the other hand, has a $108 price target.

A simple dividend growth model also suggests McDonald’s Corporation (NYSE:MCD) may be a bargain. Assuming a 9% perpetual growth rate (which is reasonable considering that share buybacks will also help EPS to grow artificially) and that dividends will grow 9% annually for the next 10 years, suggests McDonalds fair value as a dividend stock would be $102 per share, also above the current trading price.