Many top hedge funds and investors got caught up in the euphoric atmosphere that was present when Warren Buffett bought Burlington Northern. Hedge funds and investors got into rail stocks on hopes of renewed U.S. economic growth. Back in 4Q 2009 Buffett announced he would acquire the remaining 77.4% of the company that he did not already own. Since Buffett’s Burlington purchase in November 2009, the Dow Jones U.S. Railroads Index is up over 100%, versus the Dow Jones Index’s 40% increase over the same time period. At the time of the purchase, Buffett noted that the U.S.’s future prosperity would be dependent on a well-maintained rail system.

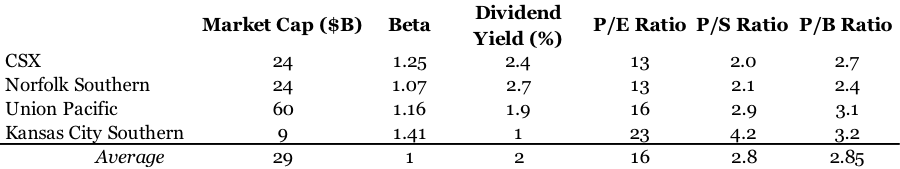

However, year to date trading has been mixed for key rail stocks, with CSX flat, Norfolk down 1%, Union Pacific up 17%, and Kansas City up 15%. Below is a table detailing other relevant statistics.

We believe many of the top hedge funds likely saw a downgrade coming. CSX has seen weakness in its utility coal business due to rising inventories. The coal segment makes up around 30% of CSX’s revenues, and with a weak U.S. outlook for coal, the company will likely seem declined revenues going forward, and so D.E. Shaw decreased his position in CSX by 76% in 1Q 2012, and then decreased his position again by 19% in 2Q 2012.

Norfolk has seen on onslaught of insider sales to match the sell offs of Jim Simons of Renaissance Technologies and D.E. Shaw during the second quarter, each reducing their shares by 67% and 19%, respectively. Ken Fisher reduced his shares by 52% in 1Q 2012. The second quarter coal revenues for Norfolk fell by 15%, with volume down 12%, while train utilization fell by the same proportions. As with many of the other rail companies, low natural gas prices and a warmer than usual winter and spring has put strains on coal demand.

Union Pacific has managed to mitigate the impact of coal demand decline, better than other rail companies. Coal has historically been the largest portion of total revenues, but lost this status in 2Q, with revenue declining by 9% and a 17% volume drop. Export coal did somewhat mitigate the U.S. coal demand decline for the company, with revenue per train car up 10% in the second quarter for coal exports. However, these positive aspects has not fully insulated the company’s stock from concerns over the U.S. economy. Although insiders have been exiting Union Pacific, D.E. Shaw did maintain his ownership, and remains the hedge fund owning the most shares in his 13F portfolio of those we track. Jim Simons reduced his position by 25% and Ken Fisher closed out his position entirely, this after having reduced his ownership by 44% in 1Q.

As with the many of the other rail companies, Kansas City Southern insiders followed suit with hedge funds and limited exposure to the railroad industry. The company has been in debt reduction mode for the last 5-6 years after an expensive acquisition of KCSM. However, the company managed to insulate itself slightly from the coal shipments decline. The company announced 2Q EPS of $0.76 versus consensus of $0.71 and revenues were up 4%, mainly due to cross-border shipments. The two hedge funds owning the most shares of Kansas City Southern, according to their 2Q 13F filings, were Ken Fisher and Michael Karsch of Karsch Capital Management, both of whom downsized their ownership, 11% and 23%, respectively.

A major rail company, up 19% year to date, that managed to avoid the sweep of downgrades was Canadian National Railway (NYSE: CNI). Although Canadian National avoided the downgrade, is it really a better investment than any of the other four railway stocks? The company trades at a premium to its peers on a P/E and P/B basis, coming in at 22 and 3.1, compared to peer average P/E and P/B ratios of 16 and 2.85 respectively. Canadian National’s P/S trades at the peer average. Although Canadian National did escape the downgrade, they did not escape the relative sell off of rail stocks by hedge funds in 2Q; Ray Dalio of Bridgewater Associates dumped 58% of his shares in the second quarter.

We believe that freight rates should increase and volume has shown signs of stabilizing, excluding coal and grain, which will meet continued demand. Although the railway companies are struggling of late, we still believe that the stronger growth prospects and greater potential share movement make the rail companies a better investment than utilities.