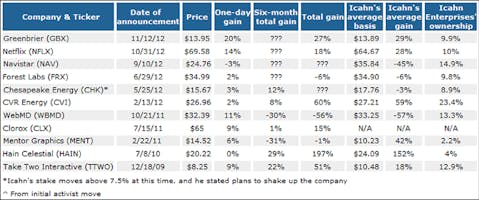

Though this effect can be seen every few months — most recently with quick spikes for Netflix, Inc. (NASDAQ:NFLX) and Greenbrier Companies Inc (NYSE:GBX) — it’s a trend you should ignore or even bet against. Simply put, Icahn is great at rattling cages, but has a pretty poor track record when it comes to spotting truly undervalued companies. Looking at trading data during the past few years, it’s hard to understand why his investment moves have gleaned a cult following.

Let’s take Mentor Graphics Corp (NASDAQ:MENT) as an example. In February 2011, he offered $17 a share to buy the maker of electronic design software. But he was never keen to follow through with such a move, and instead admitted it was just a ploy. “We believe that there are potential strategic bidders for Mentor Graphics whose bid will reflect inherent synergies and should be superior to our $17 offer,” he said at the time.

Any investor who sought to profit from Icahn’s saber-rattling was badly burned, as shares eventually fell below $10, and still remain below Icahn’s offer price. That’s not to suggest that Icahn himself hasn’t profited. He owned more than 10% of the company prior to going public with his acquisition plans, with an average cost basis below $10, and cashed out most of his stake after he got the investing public to pay attention — and bid shares up.

Poaching big game

Icahn tends to pick on smaller companies (withmarket values below $2.5 billion) as they are more likely to succumb to his pressure tactics. When he goes after bigger prey, he usually meets his match, as more sophisticated company boards simply dismiss him away.

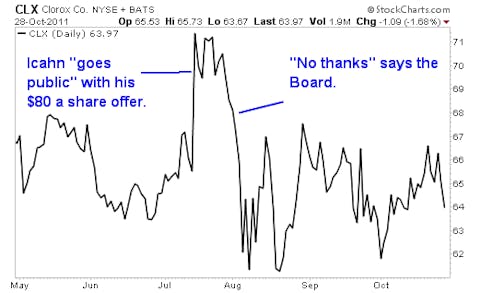

That was the case with The Clorox Company (NYSE:CLX), the consumer goods maker that is valued at nearly $10 billion. In July 2011, he offered to buy the company for almost $80 a share, causing the stock to spike above $70. “While we stand ready and able to buy Clorox, we encourage you to hold an open and friendly ‘go-shop’ sale process” he wrote to Clorox’s board, “we are confident the process will result in numerous superior bids for this company.” No such suitors emerged and for any investors still hanging around in Icahn’s wake, quick profits turned into quick losses.

Icahn has also failed miserably in his attempts to juice the stock of Navistar International Corp (NYSE:NAV) and WebMD Health Corp. (NASDAQ:WBMD). Each stock now trades well below the levels he thought represented deep value.

Carl Icahn’s Losing Streak

Unfortunately, investors appear to have short memories, having recently bid up shares of Netflix and Greenbrier. Each stock spiked by double-digits on the day Icahn announced his intention to force the company to unlock shareholder value. Yet if history is any guide, then his moves will come to naught. Shares will eventually drift back to levels seen before he arrived on the scene.

Take Netflix as an example. After a stunning fall, shares had settled into the $60 to $70 range. Back in April, I said that fair value for Netflix was “somewhere in the high $60s” and the company’s operating metrics have deteriorated further since then. During the past 90 days, analysts have trimmed their consensus 2013 earnings forecast from 94 cents a share to 44 cents a share on the heels of lowered guidance.

Though Icahn wants Netflix to put itself up for sale, Netflix’s CEO Reed Hastings realistically notes that a potential suitor is unlikely to emerge, so he recently authorized his board to adopt a “poison pill” plan to get Icahn to back off. That’s OK with Icahn. He can use this time to lock in his gains, while other investors still think a lucrative offer may be coming. By the time most investors realize Netflix is not in play and shares drift back down, Icahn’s current 10% stake in the company will likely be quite lower.

Risks to Consider: As an upside risk, an upturn in deal-making could lead investors to think Icahn’s moves will pay off, and they may bid shares higher.

Action to Take –> If you wake up one morning to find that one of your investments has spiked higher on news that Icahn has arrived on the scene, then that may be a wise time to book profits. And if you are thinking about profiting from the “Icahn effect” after he has already goosed a stock, then you should think again.

This article was originally written by David Sterman, and posted on StreetAuthority.