It’s no secret that hedge funds have been underperforming the market for years in aggregate, as many in the media are only all too happy to pound home. That could lead the average reader to think that hedge funds are bad stock pickers, which is not actually the case. When we look at the third-quarter returns of the hedge funds in our database which had at least 5 long positions in companies valued at $1 billion or more, we see their long picks returned 8.3% on average, which was 5.0 percentage points above S&P 500 ETFs. However, that long stock-picking prowess is often overshadowed by the hedged portion of their portfolios, in options, bonds, and short positions. We believe that investors should pay attention to hedge funds’ top picks for a chance to beat the market.

Concourse Capital Management is a hedge fund based in Atlanta, Georgia that was founded by Joseph Mathias in 2008. The fund manages an equity portfolio worth $154.09 million as of the end of September. According to our calculations, the fund returned 12.07% from 35 of its long stakes in companies worth over $1.0 billion in the third quarter. In this article, we’ll discuss four of Concourse’s stock picks, including Live Nation Entertainment, Inc. (NYSE:LYV), Zoe’s Kitchen Inc (NYSE:ZOES), MGM Resorts International (NYSE:MGM) and MDC Partners Inc. (USA) (NASDAQ:MDCA).

3d Pictures/Shutterstock.com

Concourse Capital Management reported ownership of 250,616 shares of Live Nation Entertainment, Inc. (NYSE:LYV) worth $6.89 million as of the end of September. During the third quarter, amid a 16.9% gain registered by the stock, the fund cut its stake in the company by 29%. Live Nation Entertainment, Inc. (NYSE:LYV) was included in the equity portfolios of 33 funds from our database at the end of June, down from 38 funds a quarter earlier. The largest stake in Live Nation Entertainment, Inc. (NYSE:LYV) was held by Renaissance Technologies, which reported holding $70.2 million worth of stock as of the end of June. It was followed by GMT Capital with a $66.1 million position. Other investors bullish on the company included Ashe Capital, Horizon Asset Management, and Diamond Hill Capital.

Follow Live Nation Entertainment Inc. (NYSE:LYV)

Follow Live Nation Entertainment Inc. (NYSE:LYV)

Receive real-time insider trading and news alerts

In Zoe’s Kitchen Inc (NYSE:ZOES), Concourse amassed 198,104 shares worth $4.40 million at the end of September. During the third quarter, Zoe’s Kitchen’s stock lost 38.8%. At the end of June, there were nine funds followed by us long the stock, down by four over the quarter. The largest stake in Zoe’s Kitchen Inc (NYSE:ZOES) was held by Miura Global Management, which held $29 million worth of stock at the end of June. It was followed by Columbus Circle Investors with a $13.7 million position. Other investors bullish on the company included Harvest Capital Strategies and Cupps Capital Management.

Follow Zoe's Kitchen Inc. (NYSE:ZOES)

Follow Zoe's Kitchen Inc. (NYSE:ZOES)

Receive real-time insider trading and news alerts

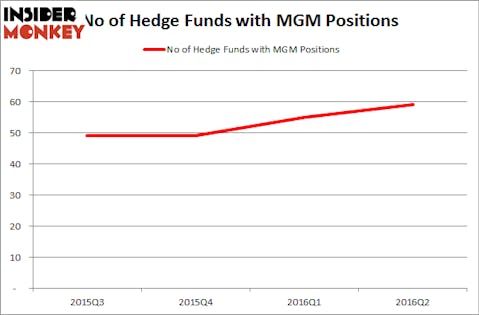

Concourse Capital Management inched down its stake in MGM Resorts International (NYSE:MGM) by 3% to 299,167 shares worth $7.79 million during the third quarter. Meanwhile, the stock advanced by 15% in the same period. The number of funds tracked by Insider Monkey with stakes in MGM Resorts International (NYSE:MGM) increased by four to 59 during the second quarter. Among these funds, Canyon Capital Advisors was the largest shareholder with a position valued at $394 million at the end of June. It was followed by OZ Management with a $263.9 million stake. Other investors bullish on the company included Brookside Capital, PAR Capital Management, and Highfields Capital Management.

Follow Mgm Resorts International (NYSE:MGM)

Follow Mgm Resorts International (NYSE:MGM)

Receive real-time insider trading and news alerts

As MDC Partners Inc. (USA) (NASDAQ:MDCA)’s stock plunged by 40.5% during the third quarter, Concourse decided to dump the position and sold 216,306 shares it had held at the end of June. Overall, 18 funds from our database amassed long positions in MDC Partners Inc. (USA) (NASDAQ:MDCA) at the end of June, down by 5% over the quarter. Among these funds, GMT Capital held the most valuable stake in MDC Partners Inc. (USA) (NASDAQ:MDCA), which was worth $58 million at the end of the second quarter. On the second spot was Cardinal Capital which amassed $53.9 million worth of shares. Moreover, Roystone Capital Partners, Columbus Circle Investors, and Lionstone Capital Management were also bullish on MDC Partners Inc. (USA) (NASDAQ:MDCA)

Follow Stagwell Inc (NASDAQ:STGW)

Follow Stagwell Inc (NASDAQ:STGW)

Receive real-time insider trading and news alerts

Disclosure: none