Here’s the list of key investor issues:

Continued Margin Compression

Declining Comparable Earnings

A Perceived Innovation Vacuum

Too Much Balance Sheet Cash

Let’s briefly examine each one.

Margin compression

Gross margin represents net sales less the direct costs associated with producing the goods and services sold by a company. It is commonly expressed as a percentage. Historically, Apple Inc. (NASDAQ:AAPL) has enjoyed very high gross margins.

Here’s a five-year chart showing Apple’s quarterly gross margins:

courtesy of ycharts.com

Since the 47.4% peak captured in the quarter ending March 2012, margins have fallen the last four quarters. Management has forecast a another drop in gross margin to 36.5% in the quarter ending June 30.

Until gross margin (GM) stabilizes, the Street will conclude that underlying operating and net margins will likewise remain under pressure, thereby eroding earnings.

The problem may be fixed in two ways. First, product costs and mix could change thereby rekindling higher margins. Alternatively, higher revenues can overshadow declining GM. The math for this second fix is somewhat challenging, but plausible.

Let me illustrate. Last quarter, Apple Inc. (NASDAQ:AAPL) recorded a dollar-denominated gross margin of $16.35 billion on net sales of $43.6 billion (or a 37.5% margin ratio). A two-and-a-half point GM ratio increase, equating to a 40% margin would have generated $17.44 billion. In order for Apple Inc. (NASDAQ:AAPL) to generate equivalent 40% gross margin dollars, it would have been necessary for the company to net $46.5 billion in sales, an increase of $1.09 billion; or a 6.7% uplift from the actual. Actual sales were up 11% quarter over quarter (QoQ).

Declining comparable earnings

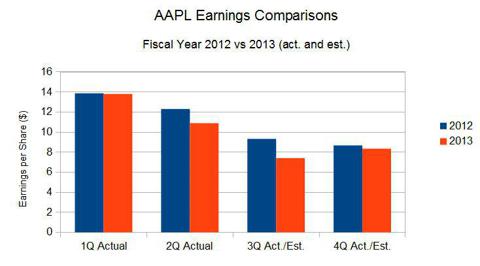

A close cousin to declining margins are Apple Inc. (NASDAQ:AAPL)’s declining year-over-year earnings per share. I put together the following graph:

(estimates via TDAmeritrade consolidated forecasts)

Indeed, comparable EPS figures have declined the last two quarters, and analysts project the decline to last at least another two. Furthermore, upon the April 23 fiscal year 2013 second quarter earnings conference call, Apple’s management set expectations that the QoQ third quarter decline will accelerate.

Until earnings stabilize and the Street begins to anticipate earnings growth, the stock price is unlikely to step up.

Perceived innovation vacuum

Under the late Steve Jobs, Apple Inc. (NASDAQ:AAPL) rode a wave of customer and investor enthusiasm over his innovative capabilities and demand for perfection. Since his departure, the company’s ability to innovate has been called to question. Whether this is true or false is irrelevant.

In the investment world, sentiment and perception become reality.

I contend that new CEO Tim Cook is being called out by Wall Street. He’s being asked to amplify his role from an outstanding operations man into a visionary leader. I am not yet questioning his ability to do so. However, the results have not materialized.

Apple management must bridge the perceived innovation gap. Otherwise, it is reasonable to believe that Street expectations will remain soft. Soft Wall Street expectations translate into soft share prices until such time that the company can demonstrate the lowered expectations have been overdone to the downside.

Too much balance sheet Cash

Previously, Apple Inc. (NASDAQ:AAPL)’s unusually high balance sheet cash and liquid investments were considered an asset. Steve Jobs’ ferocious defense of the cash hoard was accepted due to his aura and rapidly rising stock price. Sure, some investors murmured about the billions bottled up on the balance sheet, but they largely kept their mouths shut.

The plummet in stock price and weakening associated metrics have changed all of that.

Management and the board of directors got the message. They announced some relief in April: a 15% dividend increase and a 32-month, $60 billion stock buyback program.

My view is that these items created a floor under the stock price. They were not silver bullets.