2). Dividend Growth: Since implementing their dividend program in 1986, the company has consistently raised their dividend payouts, and should continue to do so into the future, rewarding investors

3). Market Share: Any slight gain in market share the company acquires could equal millions in sales, and any growth in market share presents incredible opportunity to the company

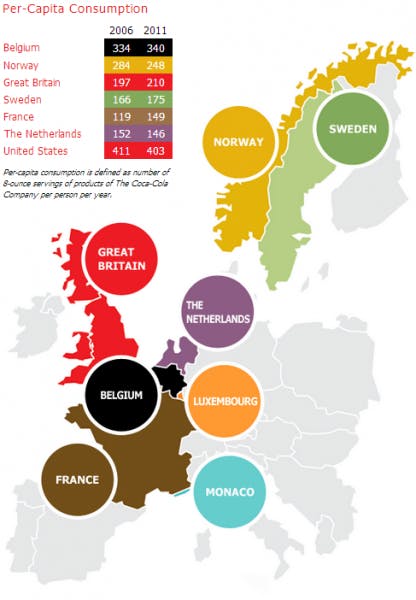

4). Growth in Core Markets: Since 2006, four out of the company’s six main regions have grown in per capita consumption, as the number of 8 ounce servings of products of the Coca-Cola company per person per year, and further growth in these core markets could present opportunity to investors

Threats:

1). Lack of Diversified Exposure: While the company’s reach spans across multiple countries in western Europe, Coca-Cola Enterprises’ lack of diversified exposure is a major threat to the company in the case of economic downfall exclusive or particularly severe in Western Europe

Competitors:

Major publicly traded competitors of Coca-Cola Enterprises includes Dr Pepper Snapple (NYSE:DPS) Group , The Coca-Cola Company , Coca-Cola FEMSA , and PepsiCo (NYSE:PEP) Incorporated . Dr Pepper and PepsiCo operate in the same regions as Coca-Cola Enterprises and compete directly with the company, while The Coca-Cola Company and Coca-Cola FEMSA operate under the same brand as the company, however in different regions. Dr Pepper is valued at $8.93 billion, pays out a dividend yielding 3.54%, and carries a price to earnings ratio of 14.46. The Coca-Cola Company is valued at $167.23 billion, pays out a dividend yielding 2.73%, and carries a price to earnings ratio of 19.03. Coca-Cola FEMSA is valued at $31.63 billion, pays out a dividend yielding 1.21%, and carries a price to earnings ratio of 32.98. PepsiCo is valued at $113.97 billion, pays out a dividend yielding 2.92%, and carries a price to earnings ratio of 19.63.

The Foolish Bottom Line:

Financially, Coca-Cola Enterprises is extremely solid. The company possesses solid revenue growth, a fairly reasonable valuation, and a growing dividend. Despite possessing a rather substantial debt position, the company has been strategically shrinking this statistic. All in all, Coca-Cola Enterprises is a blend of Coca-Cola FEMSA of Latin America’s growth and The Coca-Cola Company’s wide diversification and steadiness. However, many of the countries’ in Western Europe are facing major debt problems and are likely to be economically challenged in the coming years, and thus in the near future more opportunity is found in alternate Coca-Cola investments, however Coca-Cola Enterprises is a solid investment for the coming years.

The article Western Europe’s Carbonated Play originally appeared on Fool.com and is written by Ryan Guenette.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.