So far The Ultimate Dividend Growth Portfolio contains 11 stocks, but none them except The Western Union Company (NYSE:WU) are financial companies. Some degree of diversification is a good idea in a portfolio like this, so today I’ll add three banks stocks that have promising dividend growth potential. Many banks were forced to cut or suspend the dividend during the financial crisis and some have yet to reinstate a reasonable dividend. But there are a few bank stocks that meet the criteria to be included in the portfolio.

A bank is an entirely different animal than a normal company, and valuing one can be a lot more difficult. People sometimes use the book value as a proxy for how cheap the stock is, arguing that a bank selling for below the book value is undervalued. But it’s not quite this simple. Recently Warren Buffett was on CNBC and responded to a question regarding banks:

Well, a bank that earns 1.3% or 1.4% on assets is going to end up selling above tangible book value. If it’s earning 0.6% or 0.5% on asset it’s not going to sell. Book value is not key to valuing banks. Earnings are key to valuing banks. Now, it translates to book value to some extent because you’re required to hold a certain amount of tangible equity compared to the assets you have. But you’ve got banks like Wells Fargo and (NYSE:WFC) USB that earn very high returns on assets, and they at a good price to tangible book. You’ve got other banks … that are earning lower returns on tangible assets, and they’re going to sell — they’re going to sell [for less].

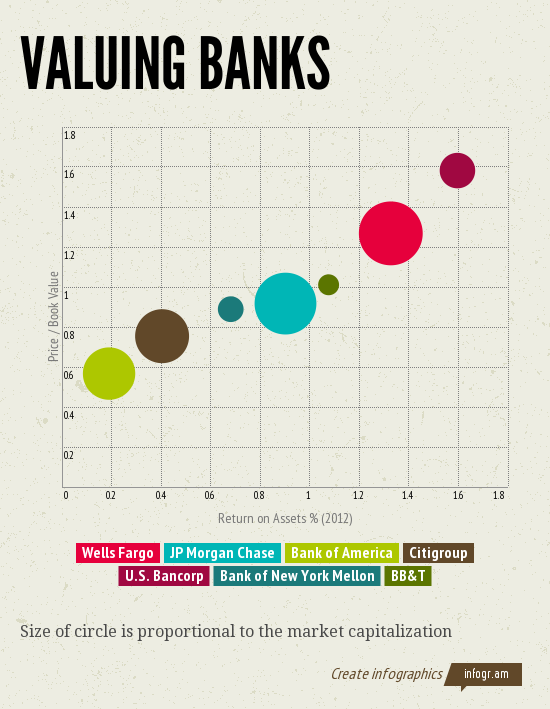

So earnings are the key, and the return on assets is a useful gauge of the quality of the bank. A sub-par bank in terms of earnings deserves a low P/B ratio, and an exceptional bank deserves a high P/B ratio.

Data from Morningstar

The general trend in the chart above shows that the higher return on assets that a bank earns the higher the P/B ratio. So simply buying banks with low P/B ratios means that you’re buying lower quality banks, not that the banks are necessarily undervalued.

Of course, since I’m looking for stocks to add to The Ultimate Dividend Growth Portfolio the dividends paid by these banks is the main factor. The bank with the highest ROA, U.S. Bancorp (NYSE:USB), pays a respectable dividend with a 2.35% yield, but the yield is too low compared to the other choices. Bank of America Corp (NYSE:BAC) and Citigroup Inc (NYSE:C) both pay only token $0.01 dividends, so they’re obviously out of consideration. And The Bank of New York Mellon Corporation (NYSE:BK), like U.S. Bancorp (NYSE:USB), has too low a yield at just 2.15%. So we’re left with the remaining three: Wells Fargo & Co (NYSE:WFC), JPMorgan Chase & Co. (NYSE:JPM), and BB&T Corporation (NYSE:BBT).

Wells Fargo & Co (NYSE:WFC)

Wells Fargo & Co (NYSE:WFC) is Warren Buffett’s favorite bank, and for good reason. Of the four largest banks, Wells Fargo & Co (NYSE:WFC) enjoys the highest return on assets and only trades for around 11 times earnings. The dividend, which has been raised twice within the last six months, now yields 3.17%. The next ex-div date is May 8, so I’m adding Wells Fargo & Co (NYSE:WFC) just in time to receive that dividend.

Like many companies Wells Fargo & Co (NYSE:WFC) was forced to cut the dividend due to the financial crisis. The cut was drastic, but since then the dividend has grown from $0.05 per share quarterly to $0.30 per share quarterly. With an EPS of $3.36 in 2012 the projected payout ratio is just 35% – before the financial crisis this number was closer to 50%. This suggest that the company has room to grow the dividend independent of earnings growth, and that the dividend should grow at an accelerated rate over the next few years.