Adam Peterson‘s Magnolia Capital Fund raised its equity portfolio to $170.61 million at the end of September, from $154.68 million at the end of June. The fund’s five holdings in companies that were worth at least $1 billion delivered a weighted average return of 14.43% in the third quarter, based on the size of those positions at the end of June. During the third quarter, the fund also made a number of changes to its holdings and in this article we’ll take a closer look at changes of the fund’s exposure to Rush Enterprises, Inc. (NASDAQ:RUSHA), Alliance Resource Partners, L.P. (NASDAQ:ARLP), Wells Fargo & Co (NYSE:WFC), and Alliance Holdings GP, L.P. (NASDAQ:AHGP).

According to our research, an investor can outperform the market by imitating the best investment moves of big hedge funds. That’s why we track around 750 funds and analyze performances of their top quarter picks.

solarseven/Shutterstock.com

In Rush Enterprises, Inc. (NASDAQ:RUSHA), Magnolia Capital cut its stake by 38% to 933,307 shares worth $22.85 million during the third quarter, as the stock advanced by 13.6% in the same period. Overall, heading into the third quarter of 2016, 10 funds tracked by Insider Monkey held long positions in this stock, down by 17% over the quarter. The largest stake in Rush Enterprises, Inc. (NASDAQ:RUSHA) was held by Ancient Art (Teton Capital), which reported holding $39.2 million worth of stock as of the end of June. Other investors bullish on the company included First Pacific Advisors LLC, Prescott Group Capital Management, and Arrowstreet Capital.

Follow Rush Enterprises Inc (NASDAQ:RUSHA)

Follow Rush Enterprises Inc (NASDAQ:RUSHA)

Receive real-time insider trading and news alerts

Another company in which Magnolia reduced its stake is Alliance Resource Partners, L.P. (NASDAQ:ARLP), whose stock gained 44.1% during the third quarter. Meanwhile, the fund unloaded 376,968 shares during the same period and reported a $31.82 million stake containing 1.43 million shares as of the end of September. Seven funds from our database held shares of Alliance Resource Partners, L.P. (NASDAQ:ARLP) at the end of June, including Bernard Selz’ Selz Capital, which held a $4 million position. Some other hedge funds and institutional investors with similar optimism contained Mitch Cantor’s Mountain Lake Investment Management, Jim Simons’s Renaissance Technologies and Robert Bishop’s Impala Asset Management.

Follow Alliance Resource Partners Lp (NASDAQ:ARLP)

Follow Alliance Resource Partners Lp (NASDAQ:ARLP)

Receive real-time insider trading and news alerts

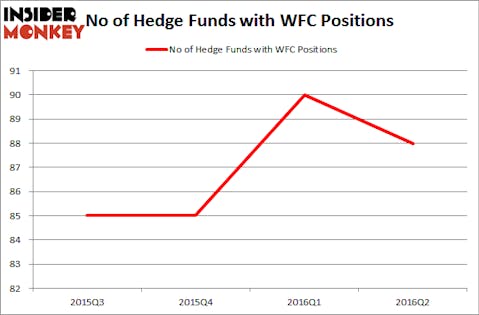

After having initiated a stake in Wells Fargo & Co (NYSE:WFC) during the second quarter, the fund further boosted it by 135% to 1.30 million shares worth $57.56 million during the third quarter. The stock inched down by 5.7% between July and September. Overall, the number of funds followed by us long Wells Fargo declined by 2% to 88 during the second quarter. Among these funds, Berkshire Hathaway, managed by Warren Buffett, held the biggest stake in Wells Fargo & Co (NYSE:WFC), which was worth $22.70 billion at the end of June. Coming in second was Fisher Asset Management, managed by Ken Fisher, which held a $911.4 million position. Remaining professional money managers that held long positions included Tom Russo’s Gardner Russo & Gardner, Patrick Degorce’s Theleme Partners and Phill Gross and Robert Atchinson’s Adage Capital Management.

Follow Wells Fargo & Company (NYSE:WFC)

Follow Wells Fargo & Company (NYSE:WFC)

Receive real-time insider trading and news alerts

In Alliance Holdings GP, L.P. (NASDAQ:AHGP), the fund had reduced its stake by by 46% to 330,449 shares worth $6.95 million during the second quarter and in the following three months, as the stock returned 26.6%, the fund sold its entire position. At the end of June, seven investors from our database were bullish on Alliance Holdings GP, unchanged over the quarter. One of the largest stakes in Alliance Holdings GP, L.P. (NASDAQ:AHGP) was reported by Selz Capital, which held a $5.4 million position. Other investors bullish on the company included Mountain Lake Investment Management, Renaissance Technologies, and Clinton Group.

Follow Alliance Holdings Gp L.p. (NASDAQ:AHGP)

Follow Alliance Holdings Gp L.p. (NASDAQ:AHGP)

Receive real-time insider trading and news alerts

Disclosure: None