Fang Zheng‘s Keywise Capital Management is a Hong Kong-based fund that uses a fundamental, bottom-up approach. The fund focuses on investing in companies in the Greater China markets and it also has an US equity portfolio, although the majority of it is represented by Chinese companies listed in the US. At the end of September, Keywise held an equity portfolio valued at $225.79 million, up from $189.80 million it had reported as of the end of June.

According to our calculations, which included Keywise’s nine long positions in companies worth over $1.0 billion, the fund generated a return of 20.61% in the third quarter, based on the size and value of the positions reported for the end of June. Even though our approach to calculating returns is not entirely accurate, we only take into account publicly-available data in order to determine whether or not a particular fund is worth following and if we should imitate its stock picks in order to try and beat the market.

Having said that, let’s take a look at Keywise’s four largest holdings that the fund held at the end of June and see how these positions were changed during the third quarter. The companies in question are NVIDIA Corporation (NASDAQ:NVDA), Taiwan Semiconductor Mfg. Co. Ltd. (ADR) (NYSE:TSM), Universal Display Corporation (NASDAQ:OLED), and Vipshop Holdings Ltd – ADR (NYSE:VIPS).

Iakov Kalinin / shutterstock.com

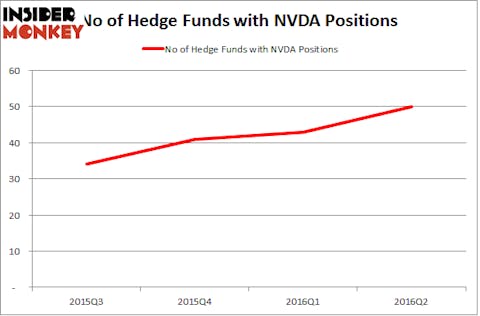

Let’s start with NVIDIA Corporation (NASDAQ:NVDA), in which Keywise inched up its stake by 2% to 1.18 million shares during the third quarter, after having increased it by 6% to 1.15 million shares in the second one. The bet paid off pretty well, seeing as NVIDIA’s shares have surged by 46% during the third quarter, resulting in a significant increase in the value of the position, which went up to $80.51 million from $53.83 million. Overall, during the second quarter, the number of funds from our database long NVIDIA went up by seven to 50. Among them, Egerton Capital Limited was the largest chareholder of NVIDIA Corporation (NASDAQ:NVDA), with a stake worth $223.4 millions reported as of the end of June. Trailing Egerton Capital Limited was Hudson Bay Capital Management, which amassed a stake valued at $215.5 millions. Renaissance Technologies, Arrowstreet Capital, and Millennium Management also held valuable positions in the company.

Follow Nvidia Corp (NASDAQ:NVDA)

Follow Nvidia Corp (NASDAQ:NVDA)

Receive real-time insider trading and news alerts

Taiwan Semiconductor Mfg. Co. Ltd. (ADR) (NYSE:TSM) is another stock in which Keywise substantially increased its stake in both second and third quarters. The fund entered July with a stake of over 1.14 million shares worth $30.01 million, after having increased it by 1.08 million shares during the quarter. In the following three months, amid a 16.6% growth registered by the stock, Keywise boosted its stake by 101% to 2.31 million shares worth $70.56 million at the end of September. Overall, 26 funds tracked by us were bullish on Keywise heading into the third quarter, down from 30 funds a quarter earlier. Among these funds, Fisher Asset Management, led by Ken Fisher, held the largest position in Taiwan Semiconductor Mfg. Co. Ltd. (ADR) (NYSE:TSM), which was worth $795.4 million at the end of June (it also disclosed a $881.76 million stake as of the end of September). Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, also amassed $441.9 million worth of stock at the end of June. Other professional money managers that held long positions contain Cliff Asness’s AQR Capital Management, Howard Marks’s Oaktree Capital Management and Jim Simons’s Renaissance Technologies.

Follow Taiwan Semiconductor Mfg Co Ltd (NYSE:TSM)

Follow Taiwan Semiconductor Mfg Co Ltd (NYSE:TSM)

Receive real-time insider trading and news alerts

In Universal Display Corporation (NASDAQ:OLED), Keywise had initiated a stake of 512,200 shares during the third quarter, but cut it by 96% to 16,000 shares in the following three months, as the stock slid by 18.1%. A total of 20 funds followed by Insider Monkey amassed shares of Universal Display Corporation (NASDAQ:OLED) at the end of June, down by 9% over the quarter. Among these funds, Columbus Circle Investors had the biggest position in Universal Display Corporation (NASDAQ:OLED), worth close to $81.1 million. On the second spot was Keywise and other funds that reported long positions included Brian Ashford-Russell and Tim Woolley’s Polar Capital, Jim Simons’s Renaissance Technologies and Rob Citrone’s Discovery Capital Management.

Follow Universal Display Corp (NASDAQ:OLED)

Follow Universal Display Corp (NASDAQ:OLED)

Receive real-time insider trading and news alerts

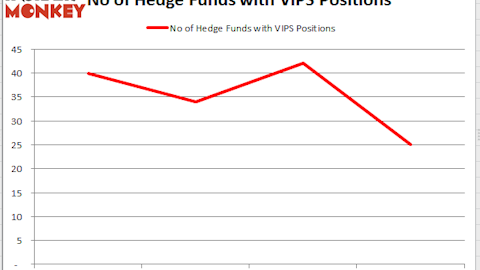

Finally, in Vipshop Holdings Ltd – ADR (NYSE:VIPS), Keywise cut its position in the previous two quarters and held 1.16 million shares at the end of June (down by 29% over the quarter) and 685,330 shares (down by 40% over the quarter). The value of the stake also declined to $10.05 million from $12.96 million during the third quarter. The reduction of the stake comes as the stock surged by 31.3% during the third quarter. The number of funds followed by our team long Vipshop Holdings also slid to 25 from 42 during the second quarter. The largest stake among these funds was held by Kylin Management, led by Ted Kang, which had a $243.4 million position in the stock at the end of June. On Kylin Management’s heels was Wang Chen of Serenity Capital, with a $51 million position. Remaining hedge funds and institutional investors that werebullish included Curtis Macnguyen’s Ivory Capital (Investment Mgmt), Panayotis Takis Sparaggis’s Alkeon Capital Management and Alok Agrawal’s Bloom Tree Partners.

Disclosure: none