AlphaOne Capital Partners, managed by Paul Hondros, had an equity portfolio worth $304.54 million at the end of the third quarter, up from $271.27 million a quarter earlier. The fund’s equity portfolio is fairly diversified, with the largest share represented by technology stocks, which amassed 35% of the fund’s equity portfolio at the end of September. The fund’s holding in 38 companies that were worth at least $1 billion, delivered a positive return of 10.63% in the third quarter, based on the size of those holdings at the end of June. In this article, we’ll take a look at three companies that AlphaOne was bullish on heading into the fourth quarter, as well as one stock that it dumped between July and September. The companies in question are Cisco Systems, Inc. (NASDAQ:CSCO), Facebook Inc (NASDAQ:FB), Yahoo! Inc. (NASDAQ:YHOO), and Micron Technology, Inc. (NASDAQ:MU)?

Although Insider Monkey only counts long positions in the companies with a market cap of $1 billion or more to calculate the returns, our measurements offer a way of assessing the fund’s investment expertise. With this in mind, let’s take a closer look at the above-mentioned companies and see what kind of returns they brought back in the third quarter.

lassedesignen/Shutterstock.com

As Cisco Systems, Inc. (NASDAQ:CSCO)‘s stock advanced by 11.6% during the third quarter, the fund slightly increased its stake by 600 shares after having initiated a position containing 361,470 shares worth around $10.37 million during the second quarter. In this way, at the end of September, AlphaOne held 362,070 shares of Cisco Systems valued at $11.49 million. Cisco Systems, Inc. (NASDAQ:CSCO) was included in the equity portfolios of 61 funds from our database at the end of June, down from 65 funds a quarter earlier. Among these funds, Yacktman Asset Management held the most valuable stake in Cisco Systems, Inc. (NASDAQ:CSCO), which was worth $807.6 million at the end of the second quarter. On the second spot was First Pacific Advisors LLC which amassed $562.5 million worth of shares. Moreover, Fisher Asset Management, AQR Capital Management, and Arrowstreet Capital were also bullish on Cisco Systems, Inc. (NASDAQ:CSCO).

Follow Cisco Systems Inc. (NASDAQ:CSCO)

Follow Cisco Systems Inc. (NASDAQ:CSCO)

Receive real-time insider trading and news alerts

In Facebook Inc (NASDAQ:FB), AlphaOne held 89,100 shares worth $11.43 million at the end of the third quarter, after the stock gained 12.2% between July and September. A total of 148 of the hedge funds tracked by Insider Monkey held long positions in Facebook heading into the third quarter, down by 10% over the quarter. The largest stake in Facebook Inc (NASDAQ:FB) was held by Viking Global, which reported holding $2.30 billion worth of stock at the end of June. It was followed by Lone Pine Capital with a $1.25 billion position. Other investors bullish on the company included Arrowstreet Capital, Egerton Capital Limited, and Lansdowne Partners.

Follow Meta Platforms Inc. (NASDAQ:META)

Follow Meta Platforms Inc. (NASDAQ:META)

Receive real-time insider trading and news alerts

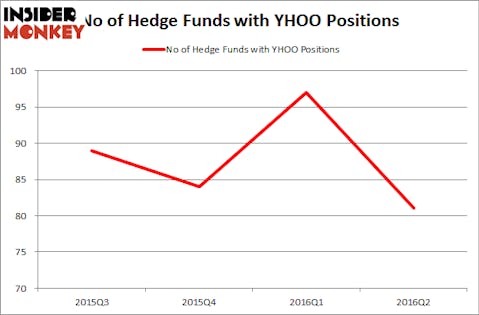

In Yahoo! Inc. (NASDAQ:YHOO), the fund closed its position during the third quarter amid a 14.7% gain registered by the stock. At the end of June, AlphaOne amassed 252,200 shares, up by 62% on the quarter. At the end of June, 81 funds followed by our team held shares of Yahoo! Inc. (NASDAQ:YHOO), down by 16 compared to the end of March. The largest stake in Yahoo! Inc. (NASDAQ:YHOO) was held by Canyon Capital Advisors, which reported holding $697.6 million worth of stock as of the end of June. It was followed by Owl Creek Asset Management with a $569.2 million position. Other investors bullish on the company included Starboard Value LP, Iridian Asset Management, and Hudson Bay Capital Management.

Follow Altaba Inc. (NASDAQ:AABA)

Follow Altaba Inc. (NASDAQ:AABA)

Receive real-time insider trading and news alerts

In Micron Technology, Inc. (NASDAQ:MU), AlphaOne also had initiated a stake during the second quarter and further increased it by 75% in the following three months, disclosing a stake of $10.87 million containing 611,500 shares as of the end of September. Meanwhile, the stock advanced by 29.2% during the third quarter. The number of funds from our database bullish on Micron Technology, Inc. (NASDAQ:MU) went up to 67 from 51 during the second quarter. The top shareholder among these funds was Arrowstreet Capital, which reported holding $107.7 million worth of stock. It was followed by Stelliam Investment Management with a $93.5 million position. Other investors bullish on the company included Orbis Investment Management, D E Shaw, and Columbus Circle Investors.

Follow Micron Technology Inc (NASDAQ:MU)

Follow Micron Technology Inc (NASDAQ:MU)

Receive real-time insider trading and news alerts

Disclosure: none