One of the traits an investor should have is an ability to display forward-thinking. It is always better to see whats next instead of what has already happened. There are plenty of stocks that are wonderful additions to a dividend growth portfolio. But can we find some companies that will be in this category five-to-10 years from now?

Let’s focus on companies that have some characteristics that point them in that direction. These companies will have rapid earnings-per-share or sales growth, as well as high cash flow. These companies are in the high-growth phase. As a company matures, its business model settles in.

As that company becomes established in its market, one of the paths it can take is to start rewarding its shareholders through means other than capital gains. A company may repurchase stock or pay dividends.

Visa Inc (NYSE:V): A company that pays for itself

Source: Yahoo! Finance

- Earnings-per-share growth (trailing-12 months): slightly less than 473.0%

- Five-year sales growth rate: 23.8%

- Cash on hand: $6.5 billion

Visa Inc (NYSE:V) is a financial-technology company that operates around the globe. Its primary function is to process payments that are made via Visa-branded debit and credit cards. It charges a percentage of each transaction from the merchant.

Visa Inc (NYSE:V)’s earnings will continue to grow as it benefits from a macroeconomic shift that sees plastic used more and more to make purchases. Potential government regulation over the fees Visa charges merchants has caused some uncertainty and a slight hit to the stock price. If you are a long-term believer in Visa, you may see this as a buying opportunity. Visa runs a low-debt, fast-growing operation that could mean massive dividends down the road.

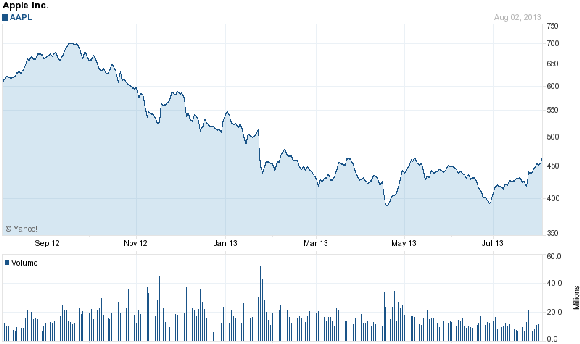

An “Apple” a day…..

Source: Yahoo! Finance

- Earnings-per-share growth (trailing-12 months): -5.9%

- Five-year sales growth rate: 44.8%

- Cash on hand: $145 billion (provided as by quarter)

Apple Inc. (NASDAQ:AAPL)is a technology company that manufactures and sells high-end electronic items and software. It is perhaps in a transition phase as its earnings growth has slowed some. It recently (last year) established a meaningful dividend. It also recently started buying back shares to help drive earnings growth. In its Q2 earnings report, it announced it spent $16 billion on share buybacks that quarter.

Apple Inc. (NASDAQ:AAPL) had strong sales volume for the quarter with:

- 3.9 million Macs

- 19.5 million iPads

- 37.4 million iPhones

With sales like this while achieving a 22.8% net profit margin, Apple Inc. (NASDAQ:AAPL) can continue to add to its massive cash position.

Apple Inc. (NASDAQ:AAPL) has a debt ratio of 10% while sitting on that mountain of cash. This means that Apple is in fantastic shape financially. It also means that Apple has a lot of options. It could make a major play with a game-changing acquisition of a company such as Netflix. The Netflix name and media content combined with Apple’s distribution system (iTunes) would reinvigorate Apple’s growth prospects moving forward.

Given that such a blockbuster move is unlikely (Apple has proven fond of holding onto its cash), Apple Inc. (NASDAQ:AAPL) could step up its shareholder returns. In addition to the recent buybacks, Apple could issue a “special” dividend, in addition to consistent dividend growth.

Moving forward, Apple Inc. (NASDAQ:AAPL) is at a bit of a crossroads. It has rapidly grown into one of the world’s largest and most successful companies. It seems it is about time for Apple to step in a new direction. It certainly has the capital and pull to do so.

The mad scientists at Celgene Corporation (NASDAQ:CELG)…

Source: Yahoo! Finance

- Earnings-per-share growth (trailing-12 months): 4.1%

- Five-year sales growth: 31.4%

- Cash on hand: $4.1 billion

is a globally operating pharmaceutical company that researches and produces cancer and other disease-fighting drugs for commercial use. It is one of the hot names in the pharmaceutical business. It brings in the majority of its revenue from its current active products, including Revlimid, Abraxane, Vidaza, Pomalyst, and Thalomid.

The pharmaceutical business is very lucrative, as a successful drug can mean over $1 billion in annual revenue. Due to the R&D-intense nature of the business ($910 million spent in first half of 2013), you see a gap between earnings-per-share growth and sales growth. Celgene Corporation (NASDAQ:CELG) also raised its guidance during its latest earnings call.