On the final day of 2012, Chicago-based Tribune Company (NASDAQOTH:TRBAA) announced that it had officially exited the bankruptcy reorganization process and emerged as a re-listed public company. The announcement is merely the first in a series of anticipated moves that could shed light on the company’s future plans. Chief areas of concern include Tribune Company’s struggling print media businesses, its ties to the CW television network, and its medium-term need to grow its footholds in the online and mobile media markets. The next two to four years will be instrumental in determining whether the company is capable of surviving on its own. In the absence of sustained profitability and clear affirmative moves to shore up its business model, the company could soon become the target of a private-equity buyout or hostile rival bid.

About Tribune Company (NASDAQOTH:TRBAA)

Tribune Company is a diversified media company that has shrunk dramatically in recent years. After being purchased for more than $8 billion by billionaire Sam Zell in 2006, the company entered a half-decade skid that ultimately saw it file for bankruptcy and put its iconic Chicago Cubs baseball team up for sale. With the advent of digital media, Tribune Company’s flagship Chicago Tribune and Los Angeles Times properties have lost much of their value.

In response, the company has shifted its focus towards its television businesses. Among other investments, it maintains sizable stakes in the CW network and the profitable Food Network cable property. During the past 10 years, Tribune Company has shed thousands of workers and shuttered or consolidated dozens of facilities. Its new over-the-counter shares launched in early January at an offer price of $50 per share.

How the reorganization plan unfolded

Tribune Company entered bankruptcy during the depths of the 2008-2009 financial crisis and remained there for the following four years. The reorganization process dragged on because of several contentious provisions that fomented disagreement between the company’s stakeholders. In particular, a cadre of junior creditors led by Aurelius Capital Management refused to bless the company’s initial reorganization plan without first receiving a sizable cash payout. This disagreement ultimately resulted in the issuance of a $534 million cash transfer from the company’s senior creditors to its junior lien-holders. In turn, this cleared the way for Tribune Company’s late-2011 issuance of a revised reorganization plan that would eventually facilitate its emergence from bankruptcy.

Tribune Company’s bankruptcy was widely regarded as the result of Sam Zell’s decision to leverage his buyout by saddling the already debt-ridden company with billions of dollars in extra debt. When it filed for bankruptcy, Tribune Company was laboring under a $13 billion debt yoke. Meanwhile, the bankruptcy destroyed a significant amount of Zell’s wealth. Ultimately, his holding company recovered just a fraction of its initial investment in the company.

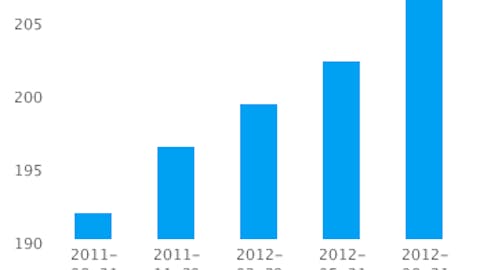

One key result of the reorganization was the installment of a brand-new Tribune Company board of directors. Many of the players who arguably drove the company into the ground during the late 2000s are no longer associated with it. This fresh slate has given market-watchers some confidence and may be the cause of the company’s swift post-bankruptcy stock price appreciation. Since its emergence, Tribune Company’s stock price has risen from $50 per share to a recent closing high of $54.75 per share. This represents a one-month return of 9.5 percent. After revamping its balance sheet and slashing its overhead and labor costs, Tribune Company appears to have considerably more room to run.