Ian Simm’s Impax Asset Management has filed its 13F with the SEC, disclosing its public equity holdings as of June 30. The investment firm was founded in 1998 and currently has assets worth $4.8 billion under management. According to the firm’s website, it seeks out “companies that operate in markets where there are long term themes that underpin growth and where those companies are poorly understood and, therefore, inefficiently priced to provide opportunities for a specialist active manager to add value.” Its latest 13F filing indicates an equity portfolio valued at $1.59 billion, with its top ten stocks accounting for 35.88% of the overall portfolio. Impax Asset Management hasan inclination towards industrial stocks, with nearly 57% of its equity portfolio dedicated towards them. Xylem Inc (NYSE:XYL), Pentair plc. Ordinary Share (NYSE:PNR), and Danaher Corporation (NYSE:DHR) are the top industrial stock positions of the investment manager and we’ll study them in this article.

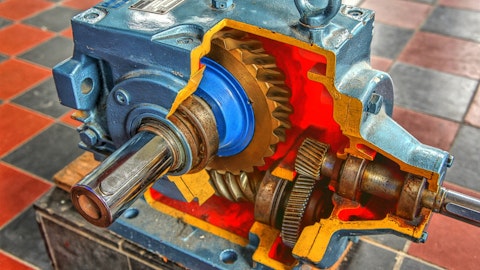

Alexander A.Trofimov/Shutterstock.com

We don’t just track the latest moves of funds. We are, in fact, more interested in their 13F filings, which we use to determine the top 15 small-cap stocks held by the funds we track. We gather and share this information based on 16 years of research, with backtests for the period between 1999 and 2012 and forward testing for the last 2.5 years. The results of our analysis show that these 15 most popular small-cap picks have a great potential to outperform the market, beating the S&P 500 Total Return Index by nearly one percentage point per month in backtests. Moreover, since the beginning of forward testing in August 2012, the strategy worked brilliantly, outperforming the market every year and returning 123%, which is more than 65 percentage points higher than the returns of the S&P 500 ETF (SPY) (see more details).

Follow Ian Simm's Impax Management 2

With more than half of its equity investments directed towards the industrial sector, it’s no surprise that Xylem Inc (NYSE:XYL), an industrial stock, is the top holding of Impax Asset Management. The investment advisory firm boosted its investment in the water-specific service provider by 7% in the second quarter to 2.29 million shares valued at $85.05 million. In its second quarter of 2015, Xylem Inc (NYSE:XYL) was able to match the markets’ earnings expectations of $0.43, although its revenue came in slightly short at $920.0 million. Its EPS declined by 10.41% in comparison with the prior-year quarter, whereas revenue was down by 8.5%. The shares of Xylem Inc (NYSE:XYL) have declined by 12.54% year-to-date and its shares are trading at $33.67 as of the reporting period. Among the hedge funds in our database that have filed 13Fs for the current reporting period, Adage Capital Management, led by Phill Gross and Robert Atchinson, has a position in the company of 53,691 shares valued at $1.99 million.