Joho Capital was founded in 1996 by Robert Karr, a Tiger Cub, who perfected his stock-picking skills during his four-year employment at Julian Robertson’s Tiger Management. At the end of June, Joho Capital held an equity portfolio worth $367.29 million, which was concentrated in a relatively small-number of stocks, the majority of which are from the technology and industrial sector.

According to our calculations, which take into account Joho’s investments in companies worth over $1.0 billion as of the end of June, the fund had a return of 26% during the third quarter, mainly from its investments in GrubHub Inc (NYSE:GRUB) and Alibaba Group Holding Ltd (NYSE:BABA), which together amassed over a half of its 13F portfolio. Even though, our way of measuring the fund’s performance provide only an approximate result, it still can give us an idea whether or not it’s worth following Joho Capital and mimicking some of its picks.

With this in mind, let’s take a look at four tech stocks in which Joho held the largest stakes heading into the third quarter.

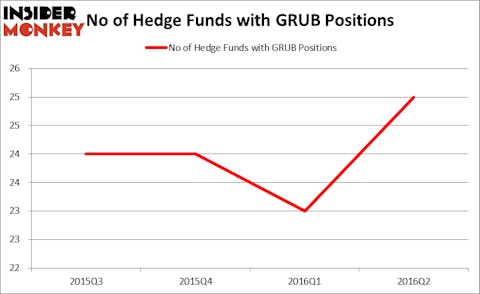

In GrubHub Inc (NYSE:GRUB), Joho reported ownership of 3.44 million shares valued at $106.75 million as of the end of June; the holding was cut by 9% during the second quarter. The stock advanced by 38.4% in the third quarter and are up by over 53% since the beginning of the year. Overall, heading into the third quarter of 2016, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from the previous quarter. The largest stake in GrubHub Inc (NYSE:GRUB) was held by Ross Turner’s Pelham Capital, which reported a stake worth close to $179.1 million, accounting for 85.1% of its total 13F portfolio as of the end of June. Coming in second was Paul Reeder and Edward Shapiro’s PAR Capital Management, which held a $169.5 million position. Moreover, Melvin Capital Management, led by Gabriel Plotkin, initiated the biggest position in GrubHub Inc (NYSE:GRUB) and had $27.2 million invested in the company at the end of the quarter.

Follow Grubhub Inc. (NASDAQ:GRUB)

Follow Grubhub Inc. (NASDAQ:GRUB)

Receive real-time insider trading and news alerts

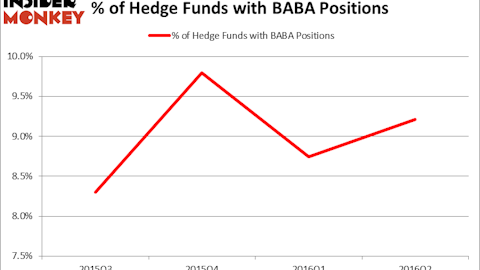

Alibaba Group Holding Ltd (NYSE:BABA) was Joho’s second largest stake at the end of June, as the fund held a $90.35-million stake containing 1.14 million shares, up by 13% over the quarter. It was another profitable bet for the fund as it saw Alibaba Group Holding Ltd (NYSE:BABA)’s shares gain 33% in the following three months. At the end of June, 69 funds followed by our team held long positions in this stock. Jim Davidson, Dave Rouxáand, and Glenn Hutchins’s Silver Lake Partners had the most valuable stake in Alibaba Group Holding Ltd (NYSE:BABA), worth close to $1.30 billion, comprising 27.2% of its total 13F portfolio. Other money managers with similar optimism included Viking Global, managed by Andreas Halvorsen, and Rob Citrone’s Discovery Capital Management.

Follow Alibaba Group Holding Limited (NYSE:BABA)

Follow Alibaba Group Holding Limited (NYSE:BABA)

Receive real-time insider trading and news alerts

In Cognex Corporation (NASDAQ:CGNX), Joho held 1.54 million shares worth $66.40 million at the end of June. In the following quarter, shares of Cognex surged by 22.8%. Even though, during the second quarter, the number of funds from our database long Cognex Corporation (NASDAQ:CGNX) went up by 33%, only eight funds held shares at the end of June. Among them, Joho held the second-largest holding, trailing Royce & Associates, managed by Chuck Royce, which had a $115.1 million position in the stock. D. E. Shaw & Co. created the most valuable position in Cognex Corporation (NASDAQ:CGNX) in the second quarter and had $1.2 million worth of stock in its equity portfolio at the end of June.

Follow Cognex Corp (NASDAQ:CGNX)

Follow Cognex Corp (NASDAQ:CGNX)

Receive real-time insider trading and news alerts

Last, but not least, Baidu Inc (ADR) (NASDAQ:BIDU) was represented in Joho’s equity portfolio by a $3.43-million position that contained 20,736 shares at the end of the June quarter. Even though shares of Baidu registered the lowest gain among the stocks covered in this article, they still ended the July-September period over 10% in the green. At the end of the second quarter, a total of 56 of the hedge funds tracked by Insider Monkey were long this stock, down by 22% over the quarter. Dmitry Balyasny’s Balyasny Asset Management unloaded around $76.4 million worth of Baidu Inc (ADR) (NASDAQ:BIDU)’s shares during the second quarter. Nevertheless, a number of other funds remained bullish on Baidu Inc (ADR) (NASDAQ:BIDU), including Scopia Capital, managed by Matt Sirovich and Jeremy Mindich, which held the number one position in Baidu.com, Inc. (ADR) (NASDAQ:BIDU). Scopia Capital had a $355 million position in the stock, comprising 7.3% of its 13F portfolio at the end of June. On Scopia Capital’s heels was William von Mueffling of Cantillon Capital Management, with a $343.7 million position; 5.8% of its 13F portfolio was allocated to the stock.

Follow Baidu Inc (NASDAQ:BIDU)

Follow Baidu Inc (NASDAQ:BIDU)

Receive real-time insider trading and news alerts

Disclosure: none