Many companies can claim to have earned outsized profits over a few years, but only a handful can do it year after year for decades. The kind of company that can consistently earn high returns on capital must be in a special position that its competitors are unable to reach; otherwise competition would drive down profitability. Companies that occupy this special position include American Express Company (NYSE:AXP), The Coca-Cola Company (NYSE:KO), and Moody’s Corporation (NYSE:MCO).

While few companies will ever join the ranks of Coca-Cola, many are in a position to earn outsized profits as long as they keep executing perfectly. Apple immediately comes to mind as an example, as long as it can continue innovating. The Boeing Company (NYSE:BA) is another, and will serve as an example for the remainder of this article.

Generating outsized profits today

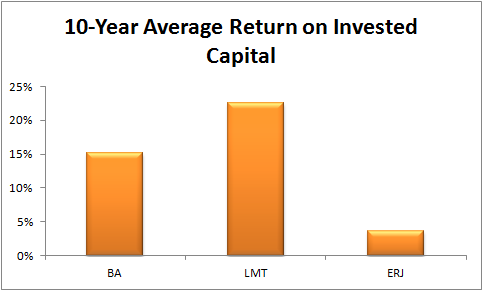

It is not difficult to identify which companies are executing at the moment; one need only make a simple calculation of historical operating performance. Boeing and Lockheed Martin Corporation (NYSE:LMT) earn outsized profits today, but Embraer SA (ADR) (NYSE:ERJ) does not.

The chart suggests that Lockheed Martin may have had an advantage greater than that of The Boeing Company (NYSE:BA) and Embraer over the last decade, but Boeing’s 15% return on capital is above-average as well. Meanwhile, Embraer’s mid-single-digit return on capital is not much better than one could earn investing in risk-free securities.

Tomorrow’s returns are more important

Although Lockheed Martin Corporation (NYSE:LMT) and The Boeing Company (NYSE:BA) have earned outsized profits in the past, investors should not assume that future profitability will be the same. Instead, investors should determine what enabled the companies to earn outsized profits in the past and decide if the enabling factors are likely to persist in the future.

For instance, Lockheed Martin benefited from the costly wars in Iraq and Afghanistan; the federal government ordered whatever equipment was needed to fight these wars, almost without regard to cost.

However, sequestration, calls for deficit reduction, and a president with a cautious foreign policy may hamper profitability in the future. Of course, every Democratic president since Roosevelt has either started a war or ramped up military spending — and the Obama administration’s arming of Syrian rebels suggests a continuation of this trend.

Lockheed Martin Corporation (NYSE:LMT)’s past and future profitability rests in the hands of the U.S. government; Embraer’s rests in the hands of the Brazilian government. The Sao Paulo-based aircraft manufacturer has traditionally been backed by the Brazilian government and banks, which facilitate loans and other support to the company’s customers.