Many companies can claim to have earned outsized profits over a few years, but only a handful can do it year after year for decades. The kind of company that can consistently earn high returns on capital must be in a special position that its competitors are unable to reach; otherwise competition would drive down profitability. Companies that occupy this special position include American Express Company (NYSE:AXP), The Coca-Cola Company (NYSE:KO), and Moody’s Corporation (NYSE:MCO).

While few companies will ever join the ranks of Coca-Cola, many are in a position to earn outsized profits as long as they keep executing perfectly. Apple immediately comes to mind as an example, as long as it can continue innovating. The Boeing Company (NYSE:BA) is another, and will serve as an example for the remainder of this article.

Generating outsized profits today

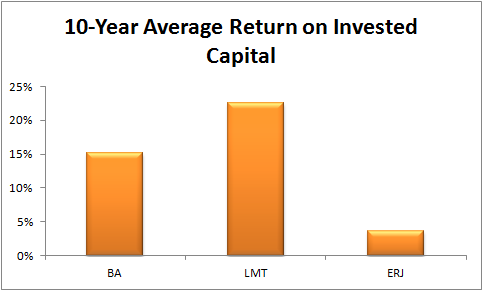

It is not difficult to identify which companies are executing at the moment; one need only make a simple calculation of historical operating performance. Boeing and Lockheed Martin Corporation (NYSE:LMT) earn outsized profits today, but Embraer SA (ADR) (NYSE:ERJ) does not.

The chart suggests that Lockheed Martin may have had an advantage greater than that of The Boeing Company (NYSE:BA) and Embraer over the last decade, but Boeing’s 15% return on capital is above-average as well. Meanwhile, Embraer’s mid-single-digit return on capital is not much better than one could earn investing in risk-free securities.

Tomorrow’s returns are more important

Although Lockheed Martin Corporation (NYSE:LMT) and The Boeing Company (NYSE:BA) have earned outsized profits in the past, investors should not assume that future profitability will be the same. Instead, investors should determine what enabled the companies to earn outsized profits in the past and decide if the enabling factors are likely to persist in the future.

For instance, Lockheed Martin benefited from the costly wars in Iraq and Afghanistan; the federal government ordered whatever equipment was needed to fight these wars, almost without regard to cost.

However, sequestration, calls for deficit reduction, and a president with a cautious foreign policy may hamper profitability in the future. Of course, every Democratic president since Roosevelt has either started a war or ramped up military spending — and the Obama administration’s arming of Syrian rebels suggests a continuation of this trend.

Lockheed Martin Corporation (NYSE:LMT)’s past and future profitability rests in the hands of the U.S. government; Embraer’s rests in the hands of the Brazilian government. The Sao Paulo-based aircraft manufacturer has traditionally been backed by the Brazilian government and banks, which facilitate loans and other support to the company’s customers.

However, even with government aid, Embraer is unable to earn an economic profit above its cost of capital. The company has already cut costs to the bone and reaps benefits from making airplanes with common parts. But the company’s cost-saving initiatives have left it without a comprehensive fleet offering, which makes it difficult for the company to sell entire fleets to corporations looking for a one-stop shop.

Lockheed Martin Corporation (NYSE:LMT)’s outsized profits stemmed from overseas conflicts; it is unclear whether these will persist in the years to come, but experience suggest that it will. Meanwhile, Embraer’s low return on capital is primarily due to its reliance on the cyclical regional jet market. It is quite likely that the conditions hampering Embraer’s profitability in the past will continue to exist for decades into the future. Therefore, investors should expect similar returns on capital in the future.

A different situation

But while Embraer earned low returns in the past and will continue to do so in the future, and Lockheed Martin Corporation (NYSE:LMT) earned high returns in the past and may or may not do so in the future, Boeing’s above-average returns of the past are likely to persist in the future.

As one of the most innovative aviation firms in existence — and with significant bargaining power with both customers and suppliers — Boeing has been able to average double-digit returns on capital over the last ten years.

However, investors are concerned about Boeing’s loss of market share in the fighter jet market to none other than Lockheed Martin Corporation (NYSE:LMT). Luckily, Boeing’s nearly-$400 billion backlog — almost five years worth of sales — secures the company’s outsized profits for at least half a decade.

The Boeing Company (NYSE:BA) is in a much better position than a company like Apple. Whereas Apple needs to come up with new products and make them affordable, Boeing simply needs to continue its low-cost manufacturing and deliver on already-signed contracts with customers. In other words, it just needs to execute to earn outsized profits.

Bottom line

The Boeing Company (NYSE:BA) does not have a durable competitive advantage that secures its above-average profitability for decades like Coca-Cola has, but it does have a history of superb execution that makes it likely for above-average profits to continue rolling in for years to come. Investors who own Boeing are part-owners in a company that receives $0.15 in annual profits for each dollar it invests — a recipe for shareholder value creation for years to come.

Ted Cooper has no position in any stocks mentioned. The Motley Fool recommends Embraer-Empresa Brasileira. The Motley Fool owns shares of Lockheed Martin.

The article Superb Execution Makes This Stock Attractive originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.