In Part 1 of this piece, I introduced the business of Fusion-IO, Inc. (NYSE:FIO) and one reason to believe this stock should be shorted. In this installment, I introduce two new bear cases and one variant view.

2. “Yet another IT company”

The decreasing rates in revenue growth show that it is easy to be a competitor, as there are low barriers to entry in this business. At first glance, the product and business of Fusion-IO, Inc. (NYSE:FIO) may sound very complex. Therefore, since Fusion-io was a pioneer in this field, one could infer that the company has strong competitive advantages in this field set in motion. This could lead to a buy conclusion.

Unfortunately, competition already has arrived. And although FIO was a pioneer in this field, its product may not be the best one available at the moment. Not anymore.

For example, with 60 employees, Virident (privately held) has manufactured an excellent product. In a recent paper, Neal M. Master et al. benchmark five data storage devices, including Fusion-IO, Inc. (NYSE:FIO)’s ioDrive and Virident’s tachIOn card.

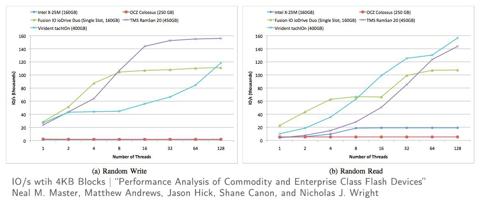

The result: “At low concurrencies, the Fusion-io ioDrive card is the best performing. However, at eight threads the performance advantage passes to the Virident tachIOn card, which with 128 threads achieves almost 50% greater performance than the Fusion-IO, Inc. (NYSE:FIO) card.” The paper compares various options and is in favor of Virident on most metrics. I present the results obtained for random write and read processes with 4KB block sizes below:

The story does not end here. As I mentioned in my first article, LSI Corporation is also in the same game and is already making some impressive sales. Because they just entered this market in late 2012, I expect their growth rate for this segment to resemble that of Fusion-io back in 2009. This is definitely not good news for Fusion-IO, Inc. (NYSE:FIO).

But do not think that all companies in the flash memory business are doing great. LSI is probably an exception. Furthermore, not all companies that are still in the HDD industry are doing terribly. We know that the shift towards mobile computing will eventually make solid state drives (SSDs) and flash memories replace the hard disk, but that is not happening in the short run. For example, Seagate Technology PLC (NASDAQ:STX), a hard disk manufacturer, has seen its stock price rise 90% this year. Why is this happening? Well, providing the “best technology” is not necessarily a guarantee of success. Seagate may not provide the best technology, but they do provide some of the best products among the HDD technological segment. Furthermore, the ongoing share buybacks, dividends and a great management team have all contributed to the success of Seagate.

At this point, it is worth mentioning that Fusion-IO, Inc. (NYSE:FIO) does recognize the quiet increase in competition as a major risk. On page 36 of the latest 10Q filing:

Significant developments in data storage systems such as advances in solid state storage drives or improvements in non-volatile memory may materially and adversely affect our business and prospects in ways we do not currently anticipate.

Well, that’s exactly what is occurring nowadays. And although it is too early to see a reflection of this phenomena on stock prices, I show below the one month performance of Fusion-IO, Inc. (NYSE:FIO) and LSI. Notice the inverse correlation: while Fusion-io seems to be losing momentum, LSI’s upward momentum is improving.

3. The acquisition of NextGen could be a sign of desperate need for organic growth

We know that expectations are high for the next quarter (June) and that increasing competition is making it hard for the company to keep the current level of sales. In the absence of organic growth, it seems that the main reason for buying NextGen is to add $5-$10 million of sales.

Variant View

Aggressive internationalization of Fusion-IO, Inc. (NYSE:FIO)’s business could be a positive catalyst, as the company needs to diversify its revenue sources as much as possible. David Flynn (former CEO) mentioned in the latest earnings call that international business already represented a full 50% of total revenue and that, specifically, orders from Asia Pacific grew 120% and from EMEA grew 90% year-over-year. I believe that Asia is an excellent market for Fusion-io’s products due to the existence of abundant social game companies, who need to handle big data on an every day basis.

Executive Summary

Fusion-IO, Inc. (NYSE:FIO) needs to deal with very high expectations for the next quarter’s earnings. The current revenue growth rate shows that Fusion-io will need to close some very big sales if they want to beat the street, which is unlikely, due to increasing competition and low barriers to entry. Finally, we introduced a variant view: an aggressive internationalization of Fusion-io’s business (with a focuss in Asia and, specifically, social gaming companies) could be a positive catalyst.

Final Remarks

Rating: Sell / from N.A.

Price target: $10

Investment Strategy: Event driven. Sell short before the next earnings call.

Uncertainty: High

The article The Bear Case for Fusion-io: Part 2 originally appeared on Fool.com and is written by Adrian Campos.

Adrian Campos has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Adrian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.