Tesla Inc (NASDAQ:TSLA) Offers Potential 81% Return in 47 Days for Bearish Traders

Tesla Inc (NASDAQ:TSLA) has been a market darling for a number of years now and has risen over 16% so far this year and is up 579% since March 2013.

Clearly, investors love this stock.

Hadrian / Shutterstock.com

The company has a great story and innovative products.

However, they have little to no earnings and still the stock is near all-time highs.

Source: Nasdaq.com

Wayne Duggen recently reported on Investor Place that “It’s difficult to fathom such a high valuation for a company that shipped just 76,000 vehicles last year and burned through another $448 million in cash in Q4.”

Goldman Sachs recently downgraded the stock to sell from neutral on concerns about an unproven solar business, cash needs and a potential delayed launch of the Model 3.

Tesla Inc (NASDAQ:TSLA) recently pulled back from $287 to $250 mostly due to the disappointing earnings numbers and the Goldman Sachs downgrade.

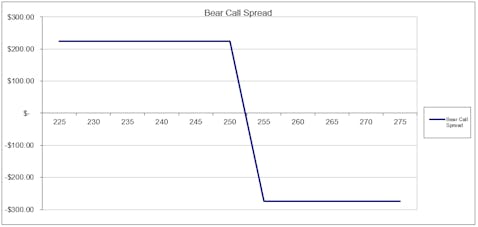

One trading opportunity for those traders with a bearish bias is a Bear Call Spread. Traders willing to bet that the stock will stay below $250, could use the $250 strike as the short call and the $255 strike as the long call.

During Monday’s session, this trade offered a roughly 81% return on risk over the next 47 calendar days when using the April 21st expiry.

The maximum profit on the trade would be $225 per contract with a maximum risk of $275. The spread would achieve the maximum 81% profit if TSLA closes below $250 on April 21st in which case the entire spread would expire worthless allowing the premium seller to keep the $225 option premium.

The maximum loss would occur if Tesla Inc (NASDAQ:TSLA) closes above $255 on April 21st which would see the premium seller lose $275 on the trade.

The breakeven point for the Bear Call Spread is $252.25 which is calculated as $250 plus the $2.25 option premium per contract. Keep in mind that due to the bid-ask spread, you may not be able to get filled at these prices.

Follow Tesla Inc. (NASDAQ:TSLA)

Follow Tesla Inc. (NASDAQ:TSLA)

Receive real-time insider trading and news alerts

Disclosure: I currently have short positions in TSLA

About the author: Gavin has a Masters in Applied Finance and Investment. He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. He likes to focus on short volatility strategies. Gavin has written 5 books on options trading, 3 of which were bestsellers. You can read more from Gavin at Options Trading IQ.