The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Ternium SA (ADR) (NYSE:TX) .

Hedge fund interest in Ternium SA (ADR) (NYSE:TX) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare TX to other stocks including Syntel, Inc. (NASDAQ:SYNT), VWR Corp (NASDAQ:VWR), and SYNNEX Corporation (NYSE:SNX) to get a better sense of its popularity.

Follow Ternium S.a. (NYSE:TX)

Follow Ternium S.a. (NYSE:TX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Andy.M/Shutterstock.com

Keeping this in mind, let’s take a gander at the latest action regarding Ternium SA (ADR) (NYSE:TX).

How have hedgies been trading Ternium SA (ADR) (NYSE:TX)?

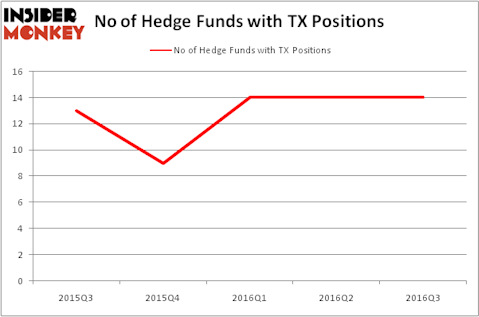

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TX over the last 5 quarters. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holds the number one position in Ternium SA (ADR) (NYSE:TX). Arrowstreet Capital has a $21.2 million position in the stock, comprising 0.1% of its 13F portfolio. On Arrowstreet Capital’s heels is Renaissance Technologies, led by Jim Simons, holding a $18.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism comprise Ken Griffin’s Citadel Investment Group, Israel Englander’s Millennium Management and D. E. Shaw’s D E Shaw. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that Ternium SA (ADR) (NYSE:TX) has weathered bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there were a few fund managers that decided to sell off their entire stakes last quarter. Interestingly, Matthew Hulsizer’s PEAK6 Capital Management cashed in the largest investment of all the hedgies tracked by Insider Monkey, totaling an estimated $1.2 million in call options. Michael Platt and William Reeves’s fund, BlueCrest Capital Mgmt., also said goodbye to its stock, about $0.4 million worth.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Ternium SA (ADR) (NYSE:TX) but similarly valued. These stocks are Syntel, Inc. (NASDAQ:SYNT), VWR Corp (NASDAQ:VWR), SYNNEX Corporation (NYSE:SNX), and Credit Acceptance Corp. (NASDAQ:CACC). This group of stocks’ market values are similar to TX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYNT | 15 | 53525 | -3 |

| VWR | 26 | 288144 | 5 |

| SNX | 17 | 126694 | 4 |

| CACC | 24 | 795952 | 3 |

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $316 million. That figure was $89 million in TX’s case. VWR Corp (NASDAQ:VWR) is the most popular stock in this table. On the other hand Syntel, Inc. (NASDAQ:SYNT) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Ternium SA (ADR) (NYSE:TX) is even less popular than SYNT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Top Ivy League Colleges For Pre-Med

Best Selling Smartphones In The World

Highest Paying Part-Time Jobs For 18 Year Olds

Disclosure: None