Everyone finds it easy to point the finger at Ben Bernanke for the recent turn of events in the stock market. It’s extremely difficult to feel any sense of empowerment when both stocks and bonds are falling or rising in tandem.

Market momentum is hard to determine

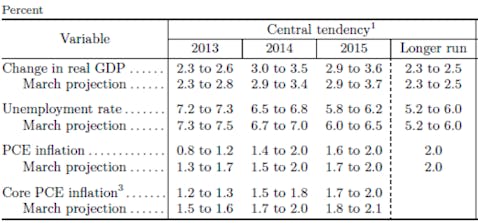

Recently, an economic report indicated that the United Sates economy rose by 1.8%. This is below the Federal Reserve’s goal of 2.3% to 2.5% long-term economic growth. Because of this, it is perceived that quantitative easing will continue.

What actually happened was a 1.8% growth rate for the economy in the first quarter of 2013. This growth is below the Federal Reserve’s projection. This is helping to ease the fears of an unanticipated end to quantitative easing. Both bonds and stocks are rallying on the basis of weaker economic data (sounds ridiculous, right? I agree completely).

By 2015, it is highly probable the Federal Funds rate will be raised. If that is the case, then the bond market will fare poorly. Investors have to diversify out of bonds into stocks. I compiled a list of stocks that I believe will have the most upside with a reasonable amount of risk and reward.

Semiconductors are an excellent start

Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) is a company that manufactures integrated circuits based on the specifications that different companies have. IDC projects that the smartphone market is likely to grow at a 16% compound annual growth rate up until 2017. Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) projects that the tablet market will grow at a 23% compound annual growth rate until 2017. The company is likely to thrive going forward.

Tablets are seen as a compelling alternative to traditional tower and laptop computers in emerging market economies. Fortunately, Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) will be deeply involved in the process of building integrated circuits for these devices. The company also has 45% of the foundry market share, so it’s likely to grow based on the macroeconomic headwinds of the industry.

The company trades at a 16.3 earnings multiple, which is reasonable when considering the projected demand for both tablet and smartphone devices. Analysts on a consensus basis anticipate the company to grow earnings by 15% per year over the next five years. The growth paired with a 2.8% dividend yield is appealing.

Web services

Yahoo! Inc. (NASDAQ:YHOO) could have a lot of potential. Remember, we’re talking about a company that has recently switched management to Marissa Mayer. The CEO is busy at work cutting back on unnecessary spending, juggling the needs of the media empire, and expanding into new business opportunities. The CEO believes that Hulu and Tumblr could be compelling investment opportunities. While I’m not exactly certain of why the company bought out Tumblr, there’s no denying that it has to acquire more companies in order to sustain revenue growth.

Tumblr may be advertised the heck out of, or the company could provide certain blog writers a subscription feature and collect fees from turning content into something that can be monetized.

The company provided full-year guidance of doubling non-GAAP operating income from $566 million in the previous fiscal year to $1.1 billion in the current fiscal year. I find it highly likely that the company’s position in the web space will remain constant if it can continue to lower the cost of running the business. It should be able to sustain high rates of earnings growth just by finding ways to save money.

Websites really don’t cost that much money to run, and when you operate at the scale of Yahoo! Inc. (NASDAQ:YHOO), the company could grow earnings substantially. Beyond just saving money, the company will grow earnings by finding lucrative business opportunities and investing into them.

Convenience a great commodity

Walgreen Company (NYSE:WAG) has a lot of earnings growth potential going forward as the company has plans of growing its store footprint through using leverage. The company plans to increase its debt load to $11 billion from its current $5.3 billion in order to increase the amount of revenue it can earn. It also plans to increase its capital expenditure spending, as well. The company plans to grow its revenue by 80.5% through 2016. Walgreen Company (NYSE:WAG) also plans to increase its operating income by 131% over the same period.

Over the past five years, the company has been able to grow revenue by 21.3%. It grew earnings per share by approximately 11.5% over the past five years. So if Walgreen is able to pull this off, it’s going to be disruptive in nature, and will throw off any historically driven earnings growth-rate projection that analysts have on the stock.

Assuming Walgreen Company (NYSE:WAG) is successful at this, then it is a lucrative investment opportunity. The stock trades at a 14.8 earnings multiple, but with the company hoping to double operating income in a span of just three years, the stock is actually really cheap. Walgreen also compensates investors with a 2.5% dividend yield.

Conclusion

I believe that investors should buy Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) as the company has the most growth potential of the three companies. Yahoo! Inc. (NASDAQ:YHOO) will grow earnings the fastest of the three as there is very little overhead needed to run a website, a lot of the internal functions of the company can be outsourced to third- party content creators, and the amount of web-development could be reduced to even smaller teams. Finally, I believe that Walgreen Company (NYSE:WAG) — if it were to deliver upon its plans for rapid growth — could turn into a significant investment opportunity.

Alexander Cho has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

The article Three Hidden Gems for the Next Five Years originally appeared on Fool.com.

Alexander is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.