Everyone finds it easy to point the finger at Ben Bernanke for the recent turn of events in the stock market. It’s extremely difficult to feel any sense of empowerment when both stocks and bonds are falling or rising in tandem.

Market momentum is hard to determine

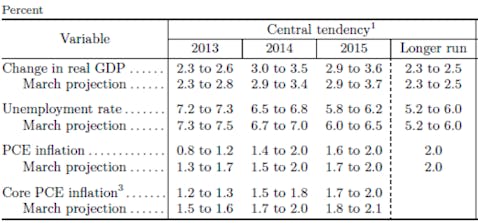

Recently, an economic report indicated that the United Sates economy rose by 1.8%. This is below the Federal Reserve’s goal of 2.3% to 2.5% long-term economic growth. Because of this, it is perceived that quantitative easing will continue.

What actually happened was a 1.8% growth rate for the economy in the first quarter of 2013. This growth is below the Federal Reserve’s projection. This is helping to ease the fears of an unanticipated end to quantitative easing. Both bonds and stocks are rallying on the basis of weaker economic data (sounds ridiculous, right? I agree completely).

By 2015, it is highly probable the Federal Funds rate will be raised. If that is the case, then the bond market will fare poorly. Investors have to diversify out of bonds into stocks. I compiled a list of stocks that I believe will have the most upside with a reasonable amount of risk and reward.

Semiconductors are an excellent start

Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) is a company that manufactures integrated circuits based on the specifications that different companies have. IDC projects that the smartphone market is likely to grow at a 16% compound annual growth rate up until 2017. Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) projects that the tablet market will grow at a 23% compound annual growth rate until 2017. The company is likely to thrive going forward.

Tablets are seen as a compelling alternative to traditional tower and laptop computers in emerging market economies. Fortunately, Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) will be deeply involved in the process of building integrated circuits for these devices. The company also has 45% of the foundry market share, so it’s likely to grow based on the macroeconomic headwinds of the industry.

The company trades at a 16.3 earnings multiple, which is reasonable when considering the projected demand for both tablet and smartphone devices. Analysts on a consensus basis anticipate the company to grow earnings by 15% per year over the next five years. The growth paired with a 2.8% dividend yield is appealing.

Web services

Yahoo! Inc. (NASDAQ:YHOO) could have a lot of potential. Remember, we’re talking about a company that has recently switched management to Marissa Mayer. The CEO is busy at work cutting back on unnecessary spending, juggling the needs of the media empire, and expanding into new business opportunities. The CEO believes that Hulu and Tumblr could be compelling investment opportunities. While I’m not exactly certain of why the company bought out Tumblr, there’s no denying that it has to acquire more companies in order to sustain revenue growth.

Tumblr may be advertised the heck out of, or the company could provide certain blog writers a subscription feature and collect fees from turning content into something that can be monetized.

The company provided full-year guidance of doubling non-GAAP operating income from $566 million in the previous fiscal year to $1.1 billion in the current fiscal year. I find it highly likely that the company’s position in the web space will remain constant if it can continue to lower the cost of running the business. It should be able to sustain high rates of earnings growth just by finding ways to save money.

Websites really don’t cost that much money to run, and when you operate at the scale of Yahoo! Inc. (NASDAQ:YHOO), the company could grow earnings substantially. Beyond just saving money, the company will grow earnings by finding lucrative business opportunities and investing into them.