Larry Chen and Terry Zhang‘s Tairen Capital is one of more than 700 hedge funds that Insider Monkey tracks as part of its small-cap strategy. During the third quarter, Tairen had a pretty good run, registering a return of 28.52%, based on our calculations, which takes into account the fund’s long positions from its last 13F filing in companies valued at over $1.0 billion. The most gains came from its investment in Alibaba Group Holding Ltd (NYSE:BABA), as Tairen boosted its stake by nearly 1,300% in the second quarter and profited from a 30% surge the stock registered between July and September. In this article, we are going to take a closer look at some of Tairen’s top picks and will see how the smart money industry traded them.

However, it’s important to point out that the actual returns of Tairen can be different from what we calculated. A 13F filing doesn’t reveal all of the fund’s investments, omitting short bets, investments in derivatives and other instruments. Moreover, we take into account the positions as they were held at the beginning of a quarter, while funds usually make changes to their holdings during a quarter. Nevertheless, even a rough approximation of a fund’s performance can give us an idea about the stock-picking skills of an individual fund.

As stated earlier, Tairen gained 28.52% in the third quarter, but it is still down by over 20% year-to-date. The fund held an equity portfolio valued at $467.27 million at the end of June, with 62% invested in the technology stocks. Further below, we will discuss Tairen’s largest position as well as a number of stocks in which the fund initiated stakes during the second quarter.

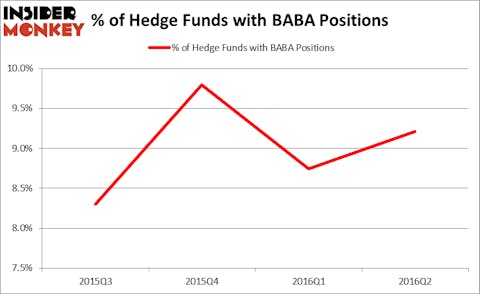

After it boosted its stake in Alibaba Group Holding Ltd (NYSE:BABA) by nearly 1,300% during the second quarter, Tairen Capital held over 1.38 million shares at the end of June. The move was very timely as the stock gained over 33% in the following three months. Meanwhile, at the end of the second quarter, a total of 69 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from one quarter earlier.

According to publicly-available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Davidson, Dave Rouxáand, and Glenn Hutchins’s Silver Lake Partners has the most valuable position in Alibaba Group Holding Ltd (NYSE:BABA), worth close to $1.30 billion, accounting for 27.2% of its total 13F portfolio as of the end of June. On Silver Lake Partners’s heels is Andreas Halvorsen of Viking Global, with a $320.6 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism about Alibaba Group Holding Ltd (NYSE:BABA) included Rob Citrone’s Discovery Capital Management, Ken Fisher‘s Fisher Asset Management and Cliff Asness’s AQR Capital Management.

In Amazon.com, Inc. (NASDAQ:AMZN), Tairen initiated a stake containing 28,700 shares during the second quarter and consecutively saw the stock gain 17% in the third quarter. With earnings season ahead and a number of other developments, investors expect Amazon’s stock to grow further this year. Heading into the third quarter of 2016, a total of 145 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from one quarter earlier. Viking Global amassed the largest position in Amazon.com, Inc. (NASDAQ:AMZN): worth $2.35 billion and comprising 10% of its 13F portfolio. Moreover, Scopus Asset Management, managed by Alexander Mitchell, assembled the most valuable call position in Amazon.com, Inc. (NASDAQ:AMZN). Scopus Asset Management had $500.9 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $294.6 million position during the quarter.