Former Goldman Sachs partners Edward A. Mulé and Robert J. O’Shea founded Silver Point Capital in 2002, focusing on credit and special situations investments. The fund reportedly had $9.62 billion in assets under management at the end of the first quarter. Silver Point Capital also oversees an equity portfolio that carried a market value of $669 million at the end of September. The fund has concentrated most of its investments in consumer discretionary, financial and industrial stocks, which together account for 93% of its portfolio’s value.

To evaluate a fund manager’s ability to pick stocks, Insider Monkey analyzes their equity positions in companies that have a market cap of $1 billion or more. According to this metric, Silver Point Capital picks had weighted average returns of 14.76% in the third quarter from 10 stocks that qualified under the above-mentioned criteria. Those results placed the fund among the top-100 best performing funds in our database. In this article we’ll take a look at Silver Point’s bets on Cooper-Standard Holdings Inc (NYSE:CPS), American International Group Inc (NYSE:AIG), EnPro Industries, Inc. (NYSE:NPO), and Nortek Inc (NASDAQ:NTK), and see how these positions were adjusted heading into the fourth quarter.

First up is Cooper-Standard Holdings Inc (NYSE:CPS), Silver Point’s top dog. During the second quarter, the fund’s management chose to reduce its investment by 25%, taking it to 2.67 million shares worth $264 million at the end of September. Nevertheless, this is still an extremely important position, as it accounts for roughly 40% of the fund’s portfolio value. Cooper-Standard shareholders were all smiles at the end of the third quarter, as the stock returned 25.1% from July to September.

Hedge fund interest in the stock tumbled by 13% during the second quarter, with only 20 of the hedge funds tracked by Insider Monkey having reported a position in it as of the end of June. At that point, the largest stake in Cooper-Standard Holdings Inc (NYSE:CPS) was held by Silver Point Capital, followed by Park West Asset Management with a $23.2 million position. Other investors bullish on the company included Arrowstreet Capital, Two Sigma Advisors, and Renaissance Technologies.

Follow Cooper-Standard Holdings Inc. (NYSE:CPS)

Follow Cooper-Standard Holdings Inc. (NYSE:CPS)

Receive real-time insider trading and news alerts

Next up is American International Group Inc (NYSE:AIG), a position initiated back in the beginning of 2011. During the previous quarter, Mulé and his team managed to lock in some profits, having sold out of 27% of their stake. According to the fund’s latest 13F filing, it held 1.55 million shares valued at $92.2 million at the end of September. The stock returned 12.8% during the third quarter.

During the second quarter, the number of hedge funds tracked by Insider Monkey that were invested in this stock fell by 10% to 85. Among those that kept their positions, Icahn Capital was the largest shareholder of American International Group Inc (NYSE:AIG), with a stake worth $2.41 billion reported as of the end of June. Trailing Icahn Capital was First Pacific Advisors, which amassed a stake valued at $658.1 million. Paulson & Co, Kensico Capital, and First Eagle Investment Management also held valuable positions in the company.

Follow American International Group Inc. (NYSE:AIG)

Follow American International Group Inc. (NYSE:AIG)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

EnPro Industries, Inc. (NYSE:NPO) is also one of Silver Point Capital’s major investments. According to regulatory filings, the fund held 1.61 million shares of it at the end of September, unchanged from the previous quarter. The stock rose by roughly 28% from July to September, thus pushing the value of the fund’s stake to $91.5 million.

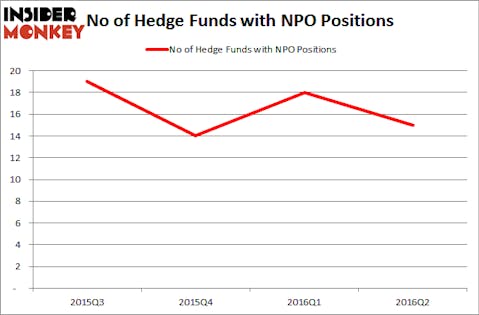

We’re going to take a glance at the recent hedge fund action surrounding EnPro Industries, Inc. (NYSE:NPO) now. Heading into the third quarter of 2016, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a drop of 17% from the previous quarter. At the end of June, Silver Point Capital had the largest position in EnPro Industries, followed closely by Greywolf Capital Management, led by Jonathan Savitz, with a $60.1 million position. Some other professional money managers that are bullish comprise Steve Ketchum’s Sound Point Capital, Bart Baum’s Ionic Capital Management, and Peter S. Park’s Park West Asset Management.

Follow Enpro Inc. (NYSE:NPO)

Follow Enpro Inc. (NYSE:NPO)

Receive real-time insider trading and news alerts

Last but not least is Nortek Inc (NASDAQ:NTK), a manufacturer of household electronics. Over the course of the third quarter, Silver Point’s management decided to liquidate its entire stake in this company. According to regulatory filings, the fund previously held 885,000 shares of Nortek, one of the largest positions among the funds in our database. Looking at the stock’s performance, it seems Silver Point might have rushed its decision to dump the stock, which returned approximately 45% during the third quarter, though we don’t know when during the quarter it sold off the stake, so it may have enjoyed most of those gains.

Hedge fund interest in Nortek Inc (NASDAQ:NTK) was flat during the second quarter, which we see as a negative indicator. At the end of June, 10 of the funds followed by Insider Monkey were invested in this stock, having together amassed roughly 36% of its common stock. More specifically, Gates Capital Management was the largest shareholder of Nortek, with a stake worth $193.4 million reported as of the end of June. Trailing Gates Capital Management was Anchorage Advisors, which amassed a stake valued at $90.4 million. Millennium Management and Balyasny Asset Management also held valuable positions in the company.

Follow Nortek Inc (NASDAQ:NTK)

Follow Nortek Inc (NASDAQ:NTK)

Receive real-time insider trading and news alerts

Disclosure: None