Why do investors care so much about REITs?

Investors looking for dividend yields and a hedge against inflation often look at the REIT sector. REITs are required by law to distribute at least 90% of their taxable income to shareholders, and because of this, earnings, for the most part, are not taxed at the corporate level. That is the “secret sauce” about being approved for REIT status. This combination allows for attractive dividend yields paid from funds from operations, or FFO. This is a major reason many investors consider REITs.

FFO differs from net income due to depreciation (a non-cash expense) being added back, and excluding gains or losses from property sales. It is considered a good approximation of cash flow, and is commonly used to evaluate a REIT’s operating performance. A well managed REIT will also see growth in its net asset value, or NAV. NAV is simply a measure of the “net market value” of the properties and other assets owned by a REIT.

This “new kid” actually brings a lot of experience to the table

Rexford Industrial knows just how difficult it is to do business in Southern California; in fact, that is a key component of its strategy, or investment thesis. Although the company just recently went public, Co-Founders Mr. Richard Ziman and Mr. Howard Schwimmer are deeply rooted in Los Angeles and have a history of successfully managing publicly traded REITs. This includes Mr. Ziman serving as Chairman of the Board and CEO of Arden Realty from its inception in 1990 until its sale in mid-2006 to General Electric in a $4.8 billion transaction involving Arden’s portfolio of twenty million square feet in more than 200 office buildings.

This experience with “infill” Southern California office real estate is now being leveraged in Rexford Realty’s approach to the “infill” industrial market in Los Angeles, Orange, Ventura, and San Diego Counties — as well as the West Inland Empire (parts of Bakersfield and Riverside Counties). Mr. Schwimmer has actively worked in this “infill” industrial market for the past 35 years.

Rexford Industrial portfolio and tenants

Rexford is starting out with 61 properties totaling 6.7 million square feet. It also manages another 20 properties containing 1.2 million square feet. The entire Southern California industrial market contains almost 2 billion square feet – the largest single market in the U.S. The “infill” market is for the most part completely built out, and this helps to provide a competitive “moat” for Rexford.

Source: Rexford Prospectus

Legendary “SoCal” traffic problems make these “infill” locations highly desirable, and they can often command premium rents. In general, industrial rents in Southern California are some of the highest in the country. Likewise occupancy rates for the overall market have been strong, 90% or above, even during this last recession.

An average building size of just less than 110,000 square feet tends to yield higher overall lease rates than huge bulk warehouses. Rexford has a broad mix of 693 tenants. Approximately 60% are multi-tenant and 40% are single tenant. The risk profile is reduced by the fact that there is no one tenant who occupies a significant percentage of the Rexford portfolio. No single tenant accounts for more than 2.3% of Rexford’s lease income, and no single industry accounts for more than 11.6% of total annualized rents.

Rexford Industrial does have all of its eggs in one basket. Parts of this basket are located in active seismic zones in Southern California. Barriers to competition will help keep rents and occupancy high. Stay tuned regarding the dividend.

Compare and contrast overview

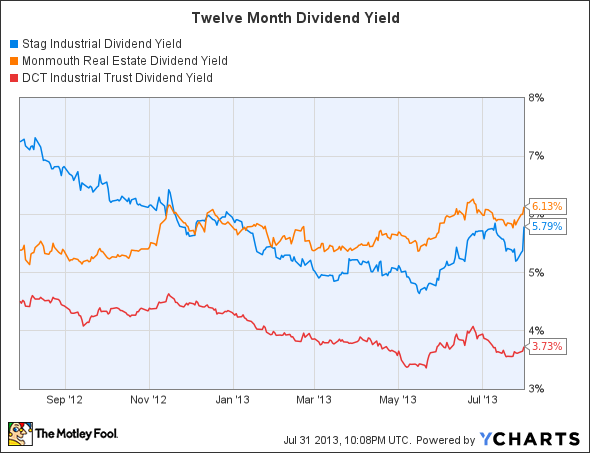

STAG Industrial: Market cap $852 million. A publicly traded REIT since April, 2011. Geographically diverse with 194 properties in 33 states. Stag Industrial Inc (NYSE:STAG) has a diverse tenant mix with no heavy concentration in one industry or one tenant. Single Tenant Class B properties in secondary markets is the main focus. This strategy has resulted in better than average earnings and growth. Stag Industrial Inc (NYSE:STAG) management is experienced. Its dividend yield is 5.79%

STAG Industrial continues to grow at a fast pace while rewarding shareholders with a high yield. From January through June, Stag Industrial Inc (NYSE:STAG) acquired 23 properties containing four million square feet for $170 million. As of July 1, it has an additional 11 properties under contract for an additional $75 million. Stag Industrial Inc (NYSE:STAG) has few competitors of scale in the markets where it operates.

Monmouth Real Estate: Market cap $416 million. A publicly traded REIT since 1968. Experienced and fiscally conservative management. Geographically diverse with 73 properties in 26 states. Its tenant mix is highly concentrated, with 41% in FedEx/FedEx Ground. Historically a slow growth REIT; now, Monmouth R.E. Inv. Corp. (NYSE:MNR) is poised for much faster growth in the near term. Monmouth R.E. Inv. Corp. (NYSE:MNR) has consistently paid a dividend for 21 straight years and yields 6.13%

Monmouth Real Estate acquired one million square feet of properties in 2012, and has two million square feet of Class A build to suit properties under contract for 2013. It is experiencing unprecedented growth opportunities from e-commerce; however, FedEx expansions will continue to concentrate its portfolio.

DCT Industrial: Market cap $2.1 billion. A publicly traded REIT since 2002. Geographically diverse with 75 million square feet spread over 21 distribution markets located in 14 states. A diverse tenant mix, as of Dec 31, 2012 no customer occupied more than 1.6% of its portfolio. National and regional distribution markets are the company’s main focus. Development is the story. During 2012, there were nine buildings under construction, totaling 2.3 million square feet. Regional offices provide local development and leasing expertise. Its dividend yield is 3.73%

On Aug 2, DCT reported results for the quarter ending June 30, including a note that it “Acquired 13 Buildings for $157.2 million and sold 15 Buildings for $51.7 million; Sold Remaining San Antonio Assets; Under Contract to Sell All Mexico Assets.” This is a very dynamic company.

My takeaway

Investors may want to wait and see how Rexford Industrial will balance future growth with dividend yield for shareholders. DCT Industrial Trust Inc. (NYSE:DCT) is busy “recycling capital,” for acquisition and development in targeted bulk distribution markets. I view them both as industrial REITs to watch for now.

Stag Industrial Inc (NYSE:STAG) common stock pays a hefty dividend while growing at a fast pace. It’s still small enough for this growth to be meaningful to shareholders moving forward. I believe in the business model for the long term. These shares could fit well in many portfolios.

Monmouth R.E. Inv. Corp. (NYSE:MNR) is a dividend rock. It could be an e-commerce growth sleeper as well. Additionally, it has two classes of preferred stock that both yield over 7.5%. Management views these shares as “permanent capital.” In a world busy chasing yield, these shares should be on your radar screen if you believe FedEx will continue to be a thriving enterprise.

The article How Can an “All in” Bet Pay You Dividends? originally appeared on Fool.com and is written by Bill Stoller.

Bill Stoller has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Bill is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.